What Is A Tax Warrant In Wisconsin - The different types of warrants filed include: What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. All delinquent debt is subject to having. What is a tax warrant? Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. This legal action allows the state.

Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant? All delinquent debt is subject to having. You may have heard the term tax warrant, but do you know what it means for your financial future if you. What is a tax warrant? A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. The different types of warrants filed include: A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. This legal action allows the state.

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant? What is a tax warrant? What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? This legal action allows the state. All delinquent debt is subject to having. The different types of warrants filed include: You may have heard the term tax warrant, but do you know what it means for your financial future if you. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant.

Verify a Refund Check

This legal action allows the state. All delinquent debt is subject to having. The different types of warrants filed include: A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant?

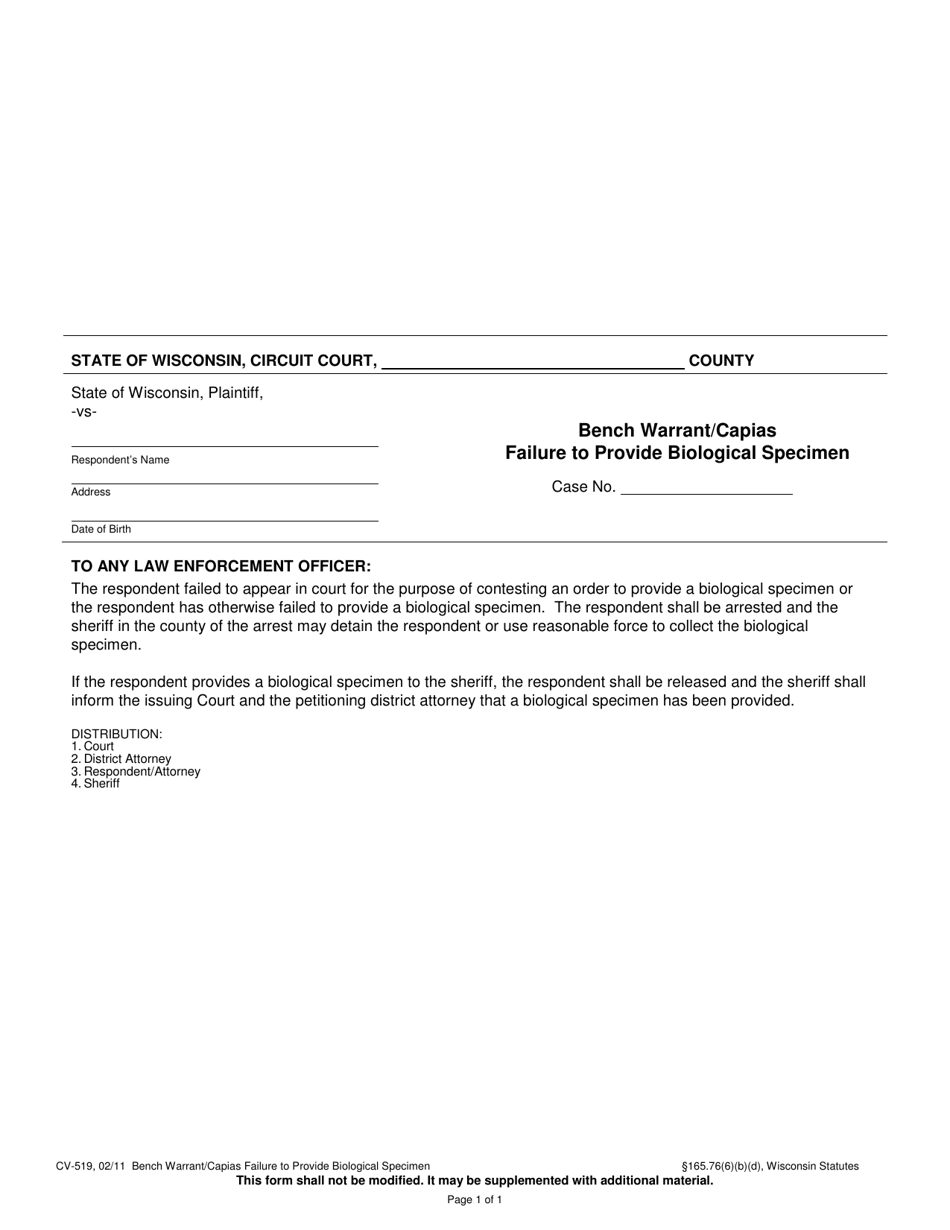

Form CV519 Fill Out, Sign Online and Download Printable PDF

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? All delinquent debt is subject to having. A tax warrant in wisconsin is a legal document issued by the dor authorizing.

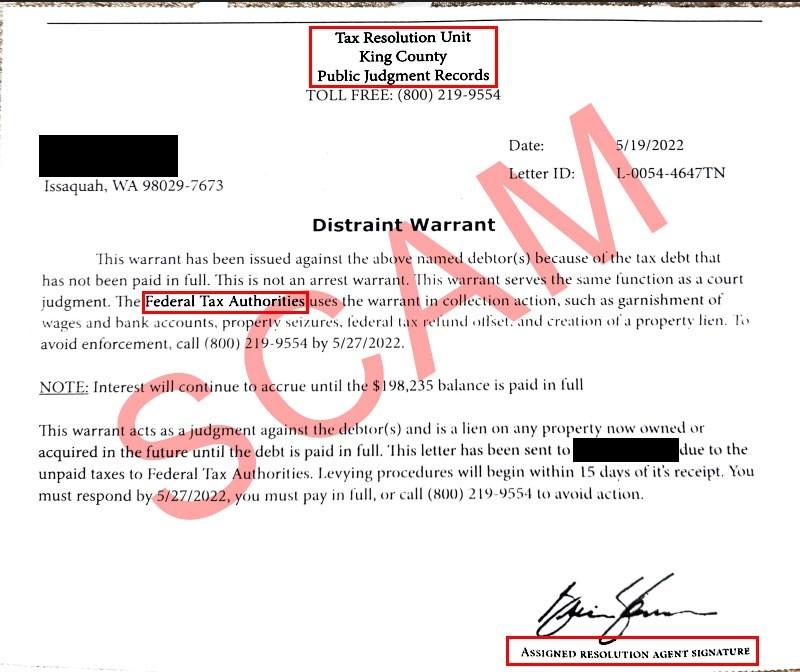

Judgement Records Search

The different types of warrants filed include: What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. This legal action allows the state. A tax warrant acts as a lien against real and personal property you own in the county in which it is.

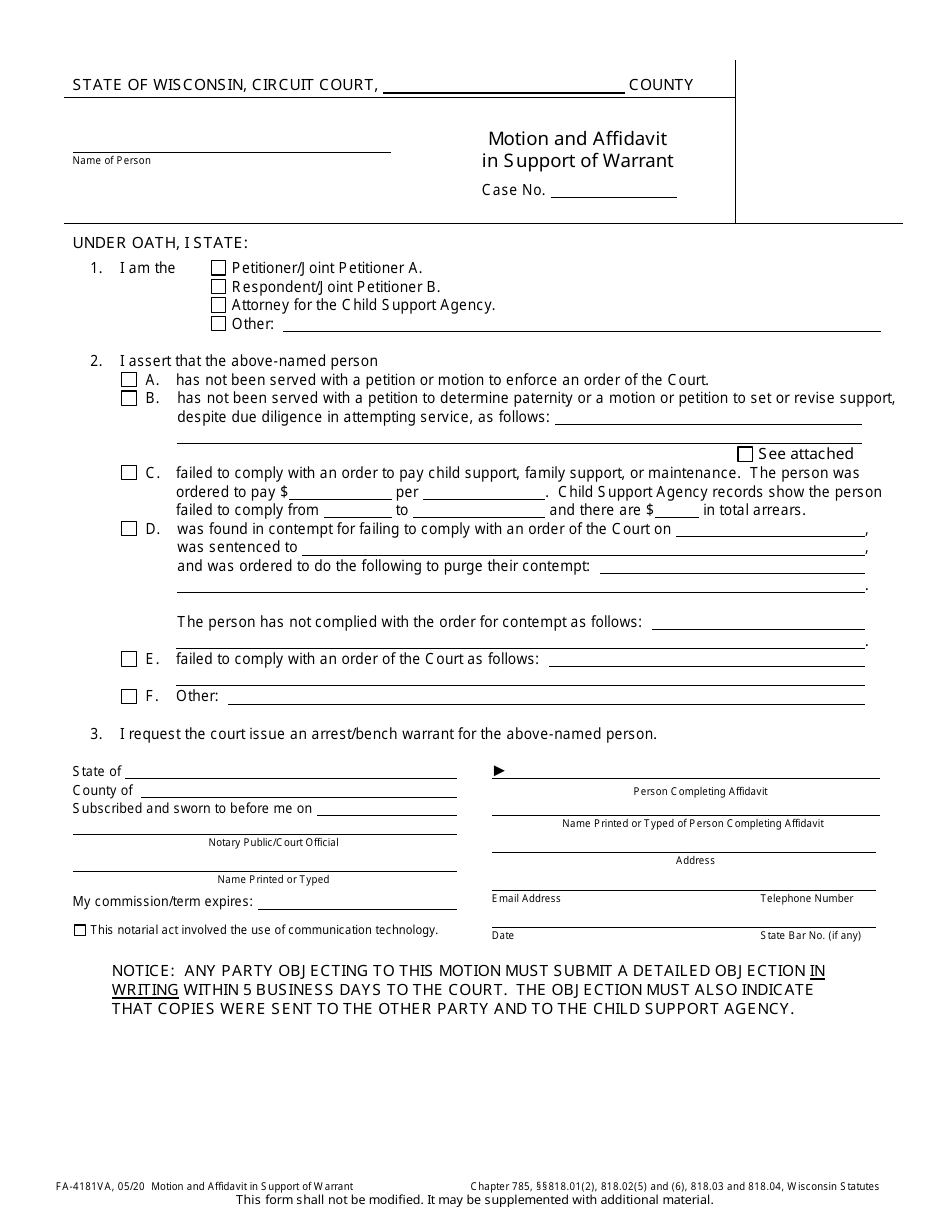

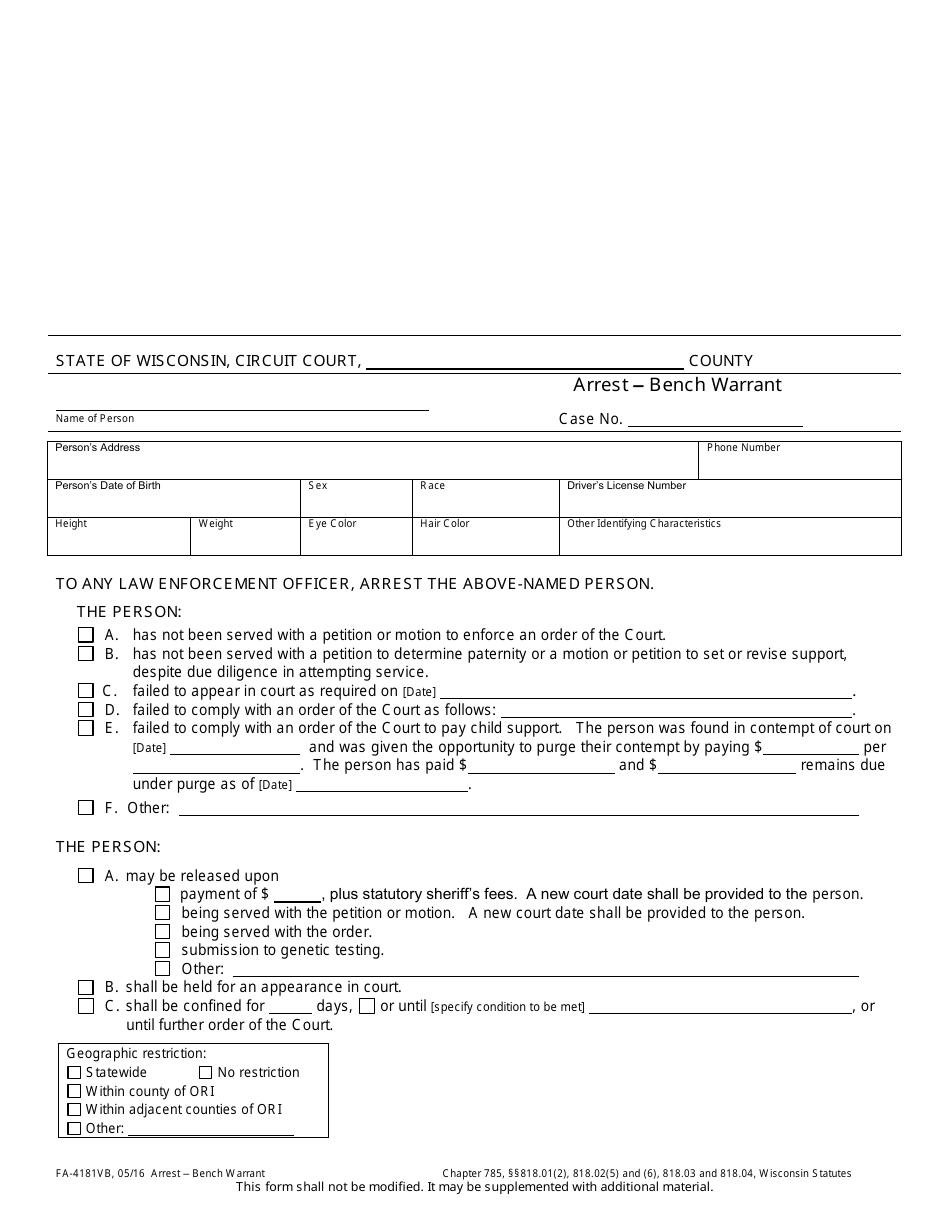

Form FA4181VA Fill Out, Sign Online and Download Printable PDF

The different types of warrants filed include: Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you. Unpaid taxes in wisconsin can lead to serious consequences, including.

Fake tax letter sent to Winnebago County residents, officials warn

You may have heard the term tax warrant, but do you know what it means for your financial future if you. All delinquent debt is subject to having. What is a tax warrant? The different types of warrants filed include: Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant.

Tax Warrants — DeKalb County Sheriff's Office

The different types of warrants filed include: Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant? A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. All delinquent debt is subject to having.

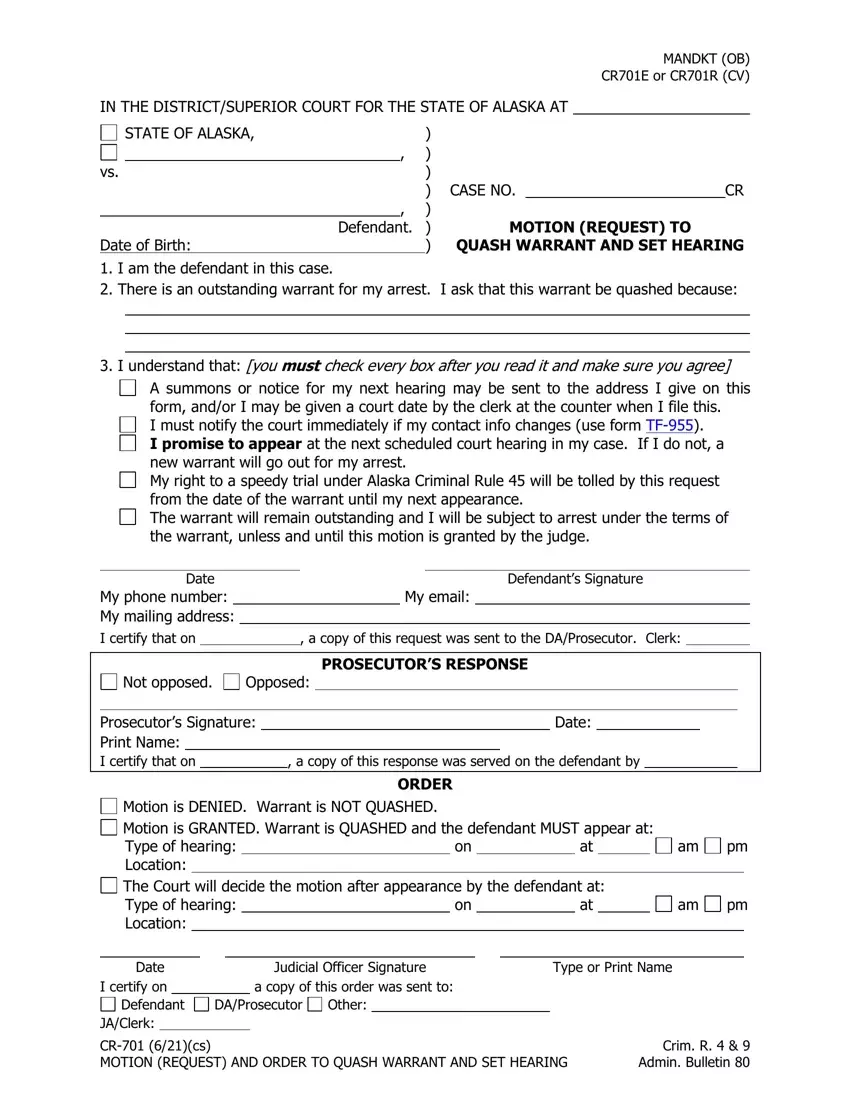

Warrant Taxpayer Taxes

What is a tax warrant? Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. What is a tax warrant and when does the wisconsin department of revenue file a tax warrant? This legal action allows the state. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale.

Wisconsin Warrant Template Fill Out And Sign Printabl vrogue.co

A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. All delinquent debt is subject to having. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. Wisconsin department of revenue division of income, sales,.

Form FA4181VB Fill Out, Sign Online and Download Printable PDF

All delinquent debt is subject to having. The different types of warrants filed include: A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. Unpaid taxes in wisconsin can lead to.

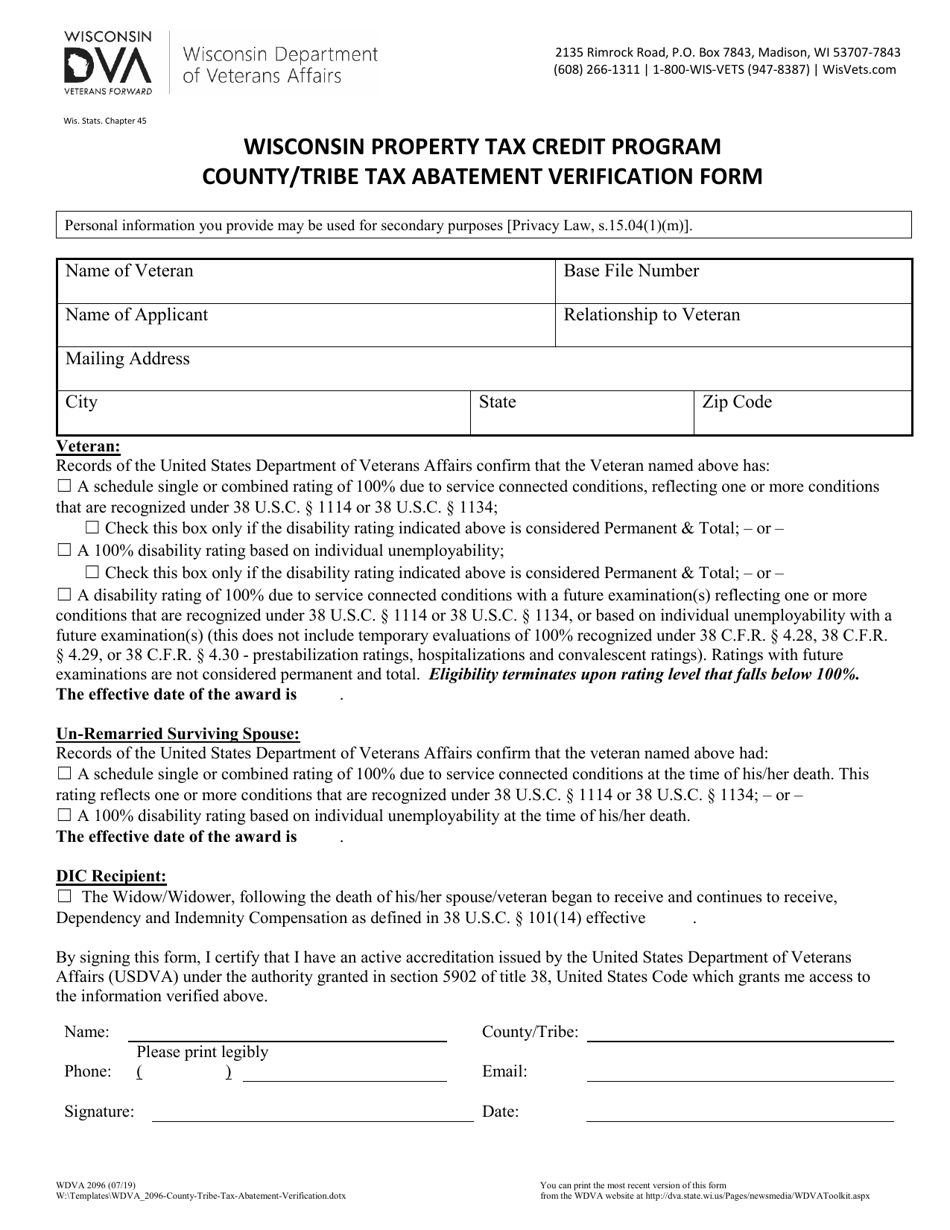

Form WDVA2096 Fill Out, Sign Online and Download Fillable PDF

A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. Unpaid taxes in wisconsin can lead to serious consequences, including a delinquent tax warrant. You may have heard the term tax warrant, but do you know what it means for your financial future if you. What is.

What Is A Tax Warrant And When Does The Wisconsin Department Of Revenue File A Tax Warrant?

All delinquent debt is subject to having. A tax warrant in wisconsin is a legal document issued by the dor authorizing the seizure and sale of a taxpayer's property to. What is a tax warrant? You may have heard the term tax warrant, but do you know what it means for your financial future if you.

The Different Types Of Warrants Filed Include:

Wisconsin department of revenue division of income, sales, and excise tax notice of proposed guidance documents pursuant. This legal action allows the state. A tax warrant acts as a lien against real and personal property you own in the county in which it is filed. What is a tax warrant?