What Is A Tax Warrant In Indiana - If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a. A tax warrant in indiana is essentially a court order. It is a warrant for amounts due,. A tax warrant that comes from your county sheriff is not a warrant for your arrest. What is a sheriff warrant? A comprehensive guide for indiana residents. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Tax warrant for collection of tax. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes.

A comprehensive guide for indiana residents. If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. It is a warrant for amounts due,. What is a sheriff warrant? Tax warrant for collection of tax. A tax warrant that comes from your county sheriff is not a warrant for your arrest. A tax warrant in indiana is essentially a court order. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a.

A tax warrant that comes from your county sheriff is not a warrant for your arrest. What is a sheriff warrant? If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. A comprehensive guide for indiana residents. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes. A tax warrant in indiana is essentially a court order. Tax warrant for collection of tax. It is a warrant for amounts due,. A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a.

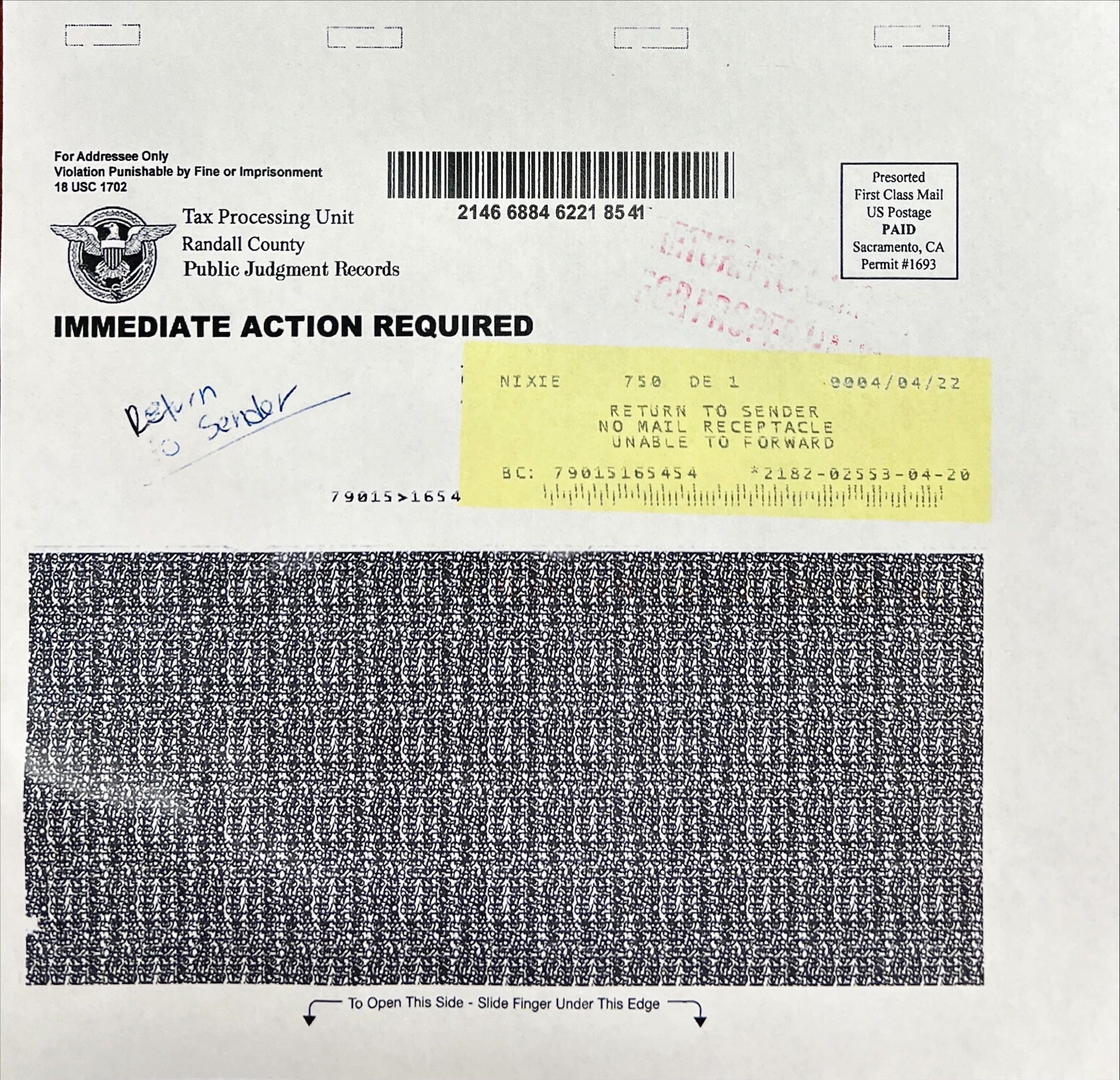

pay indiana tax warrant online Reyes Ralph

A tax warrant that comes from your county sheriff is not a warrant for your arrest. A tax warrant in indiana is essentially a court order. What is a sheriff warrant? Tax warrant for collection of tax. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes.

Doxpop Tools for Attorneys and Public Information Researchers NEW

A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a. Tax warrant for collection of tax. It is a warrant for amounts due,. A comprehensive guide for indiana residents. If a taxpayer does not pay the amount due or.

pay indiana tax warrant online Reyes Ralph

A tax warrant that comes from your county sheriff is not a warrant for your arrest. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes. A comprehensive guide for.

pay indiana tax warrant online Reyes Ralph

Tax warrant for collection of tax. A comprehensive guide for indiana residents. What is a sheriff warrant? A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a. If your account reaches the tax warrant stage, you must pay the.

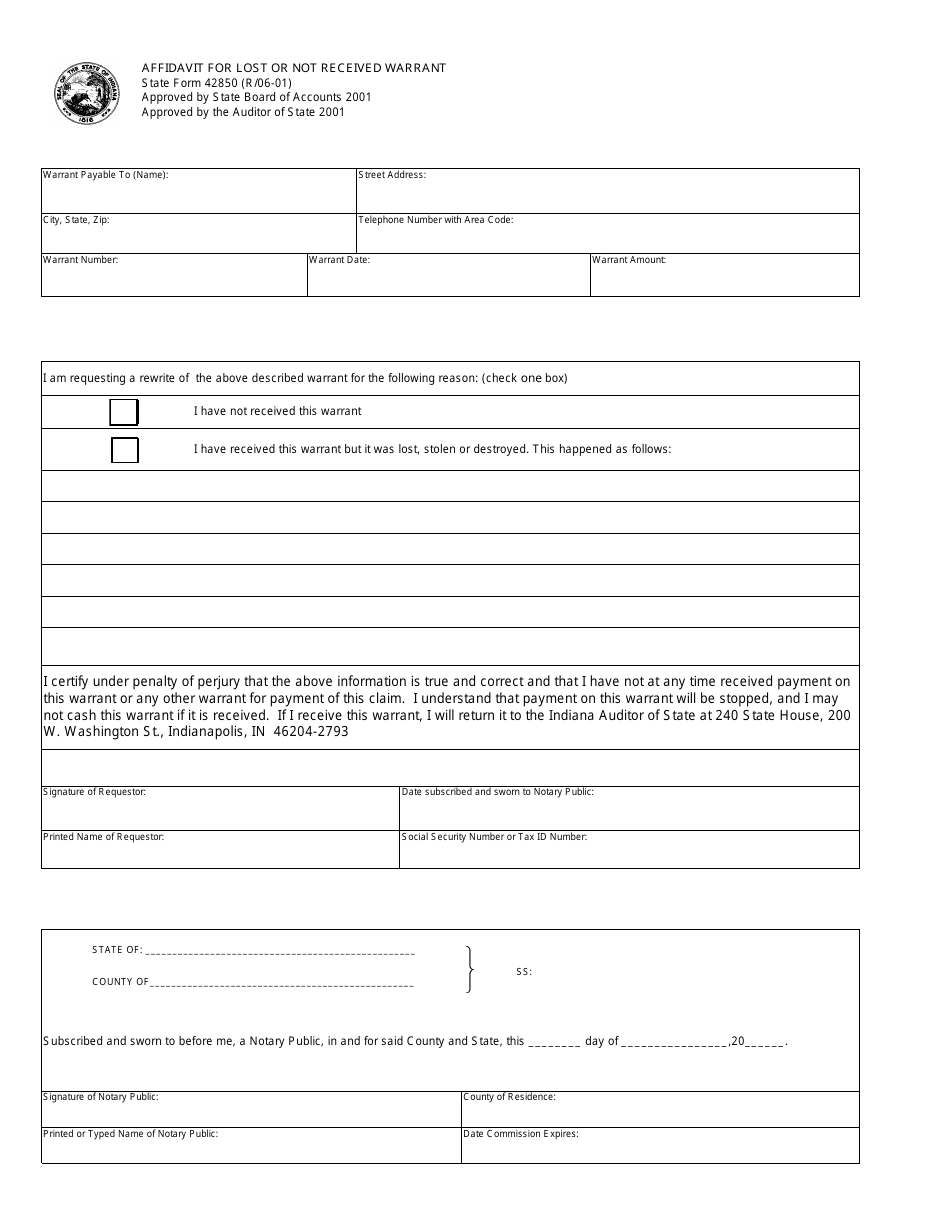

Indiana Department Of Revenue Tax Warrants

A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a. A tax warrant in indiana is essentially a court order. A tax warrant that comes from your county sheriff is not a warrant for your arrest. The issuance of.

Tax Warrants — DeKalb County Sheriff's Office

If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. A comprehensive guide for indiana residents. A tax warrant in indiana is essentially a court order. A tax warrant that comes from your county sheriff is not a warrant for your arrest. The issuance of a tax warrant.

pay indiana tax warrant online Reyes Ralph

What is a sheriff warrant? It is a warrant for amounts due,. A tax warrant in indiana is essentially a court order. If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. A tax warrant is a notification to the county clerk's office that a taxpayer owes a.

Indiana Department Of Revenue Tax Warrants

Tax warrant for collection of tax. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. A comprehensive guide for indiana residents. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes. If a taxpayer does not pay the amount.

indiana department of revenue tax warrants Sanda Gerald

A comprehensive guide for indiana residents. A tax warrant in indiana is essentially a court order. What is a sheriff warrant? The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes. If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20).

Indiana Department Of Revenue Tax Warrants

A comprehensive guide for indiana residents. If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department. What is a sheriff warrant? If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. It is a warrant for amounts due,.

If Your Account Reaches The Tax Warrant Stage, You Must Pay The Total Amount Due Or Accept The Expense And.

What is a sheriff warrant? A tax warrant is a notification to the county clerk's office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a. A tax warrant that comes from your county sheriff is not a warrant for your arrest. If a taxpayer does not pay the amount due or show reasonable cause for not paying within twenty (20) days, the department.

A Comprehensive Guide For Indiana Residents.

It is a warrant for amounts due,. A tax warrant in indiana is essentially a court order. Tax warrant for collection of tax. The issuance of a tax warrant in indiana is a structured process initiated by the dor to collect delinquent taxes.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)