What Is A State Tax Warrant - State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. What is a state tax warrant? If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your.

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. What is a state tax warrant?

A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. What is a state tax warrant? State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your.

Tax Warrants — DeKalb County Sheriff's Office

If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is equivalent to a civil judgment against you, and protects new york.

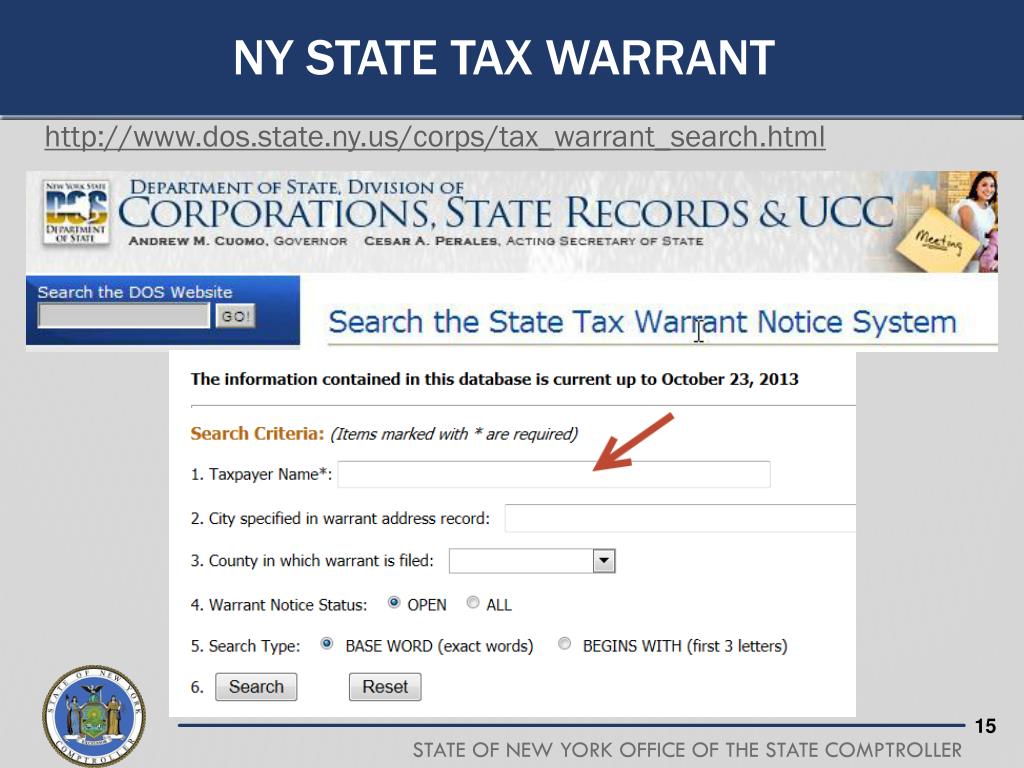

New York State Tax Warrant Search How To Find Info YouTube

What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is equivalent to a civil judgment against you, and protects.

How to redeem California tax return warrants? Personal Finance

State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the.

Consumer Corner How To Avoid The Bucks County Distraint Warrant Scam

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. What is a state tax warrant? A tax warrant is equivalent to a civil judgment against.

New York State Tax Collections When NYS Wants Back Due Tax Debt

What is a state tax warrant? If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. A tax warrant is equivalent to a civil judgment.

PPT State Authorities Vendor Responsibility PowerPoint Presentation

What is a state tax warrant? A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. State tax warrants are legal documents issued by.

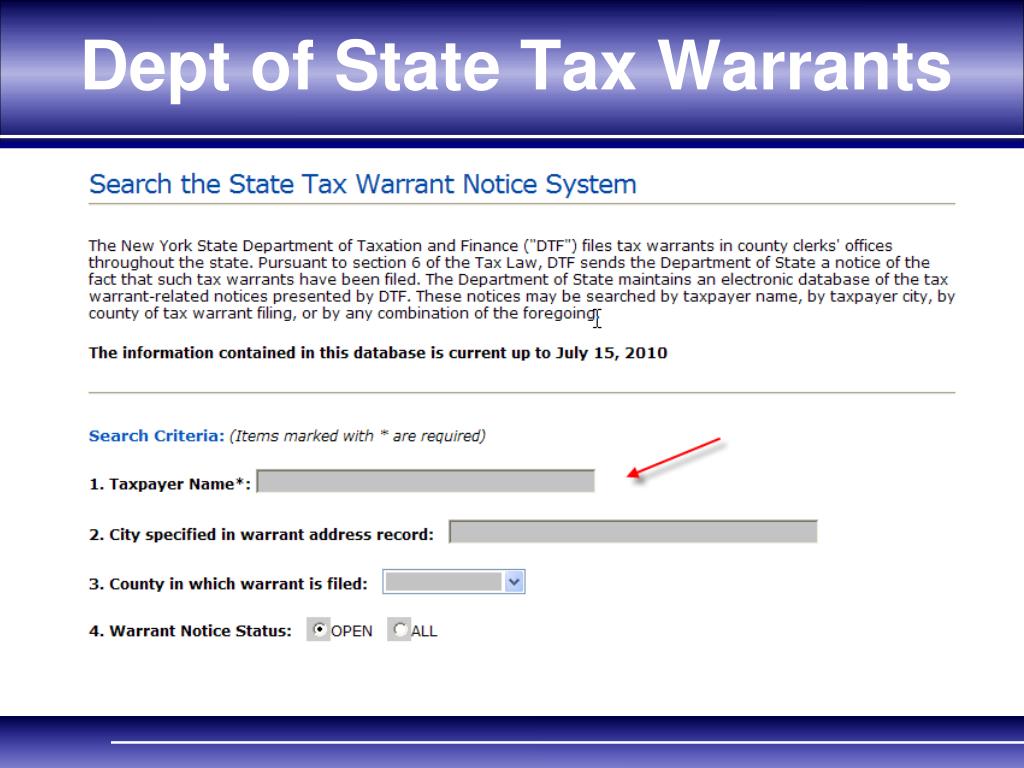

Stranger Things Owner Anomalies in Revenue & Billing ppt download

A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. What is a state tax warrant? State tax warrants are legal documents issued by a state.

PPT Vendor Responsibility 101 PowerPoint Presentation, free download

What is a state tax warrant? State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a. A tax warrant is equivalent to a civil judgment against you, and protects new york.

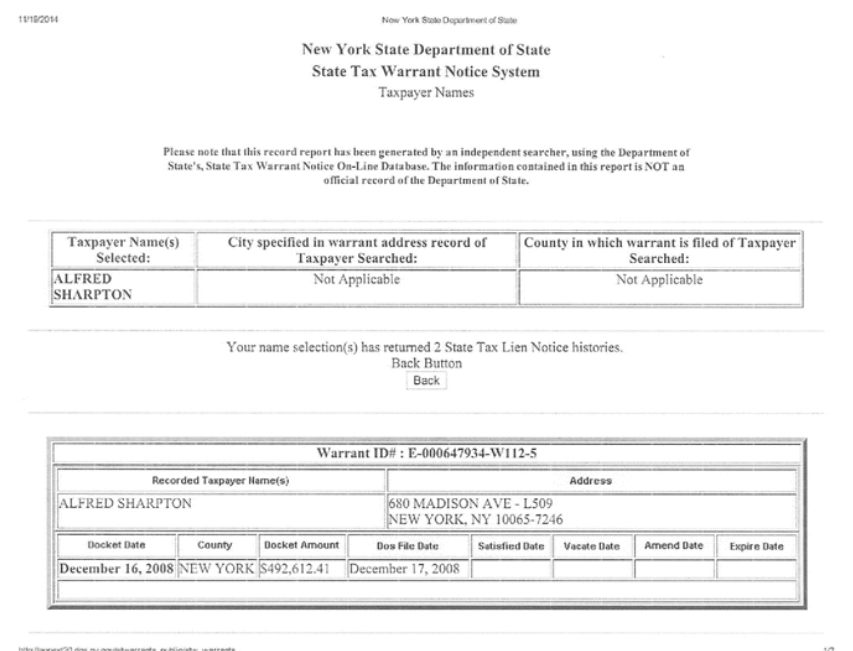

Warrant Taxpayer Taxes

If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. State tax warrants are legal documents issued by a state tax agency to enforce collection of unpaid taxes. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority.

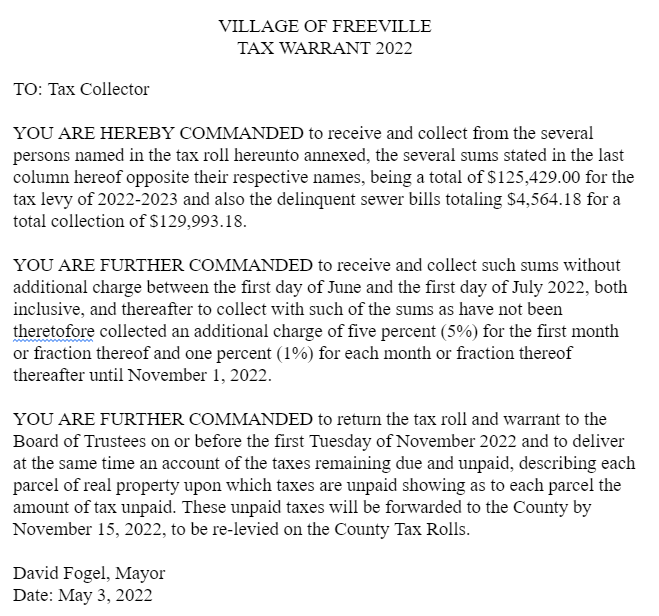

Legal Notice Tax Warrant Freeville NY

What is a state tax warrant? If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. State tax warrants are legal documents issued by a.

State Tax Warrants Are Legal Documents Issued By A State Tax Agency To Enforce Collection Of Unpaid Taxes.

If you have a state of kansas tax warrant that means the kansas department of revenue (kdor) believes you owe delinquent taxes. A tax warrant is equivalent to a civil judgment against you, and protects new york state's interests and priority in the collection of. If you fail to pay your state taxes or resolve the past due balance within a reasonable time, the tax bureau in your. A tax warrant is essentially a legal order issued by a state or local government authorizing law enforcement to seize a.