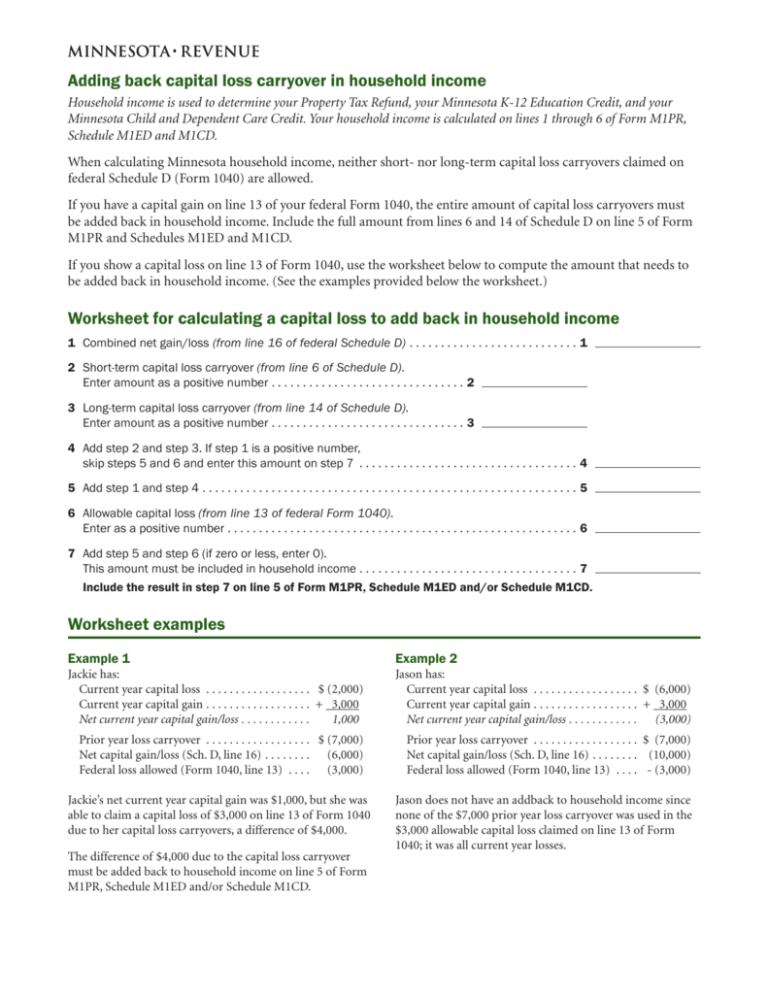

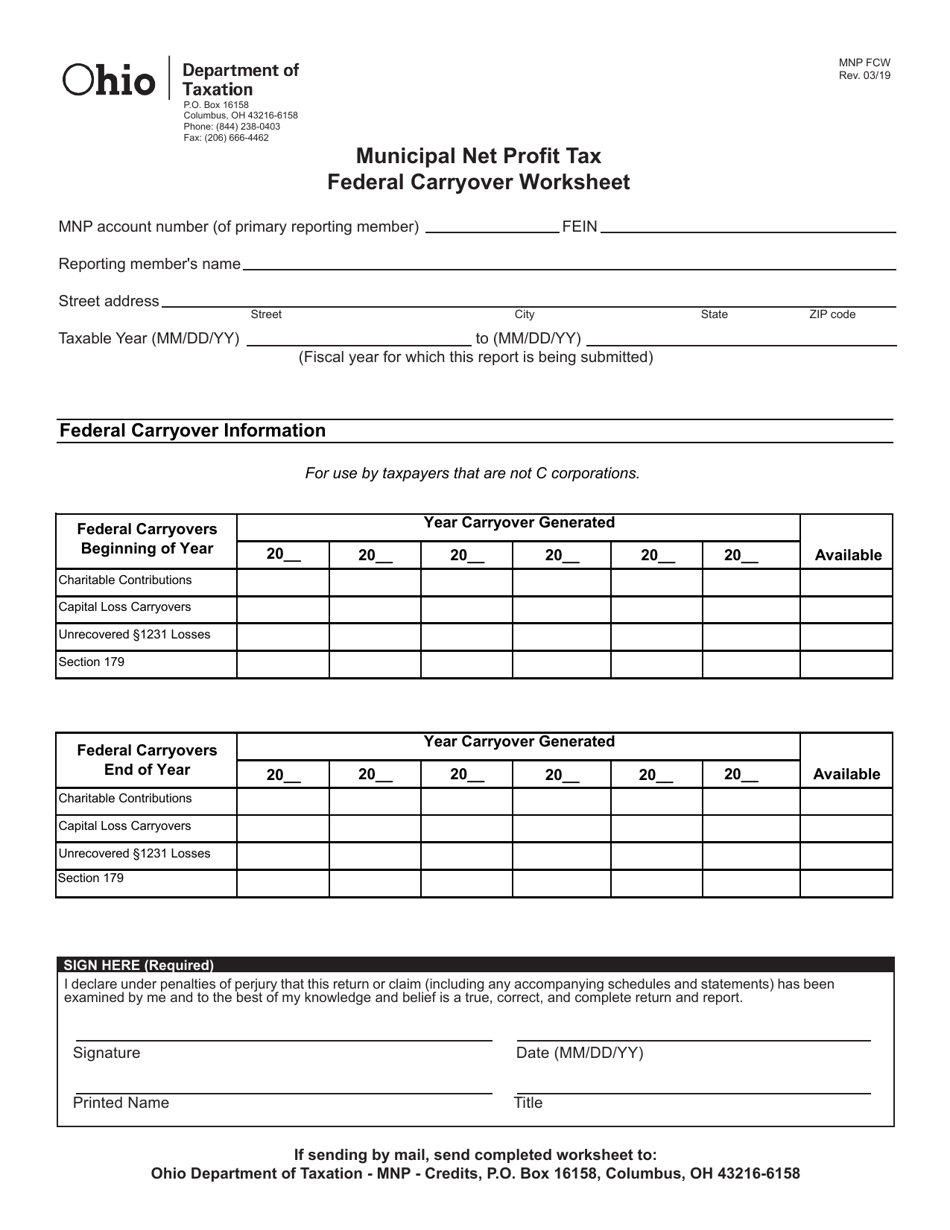

What Is A Federal Carryover Worksheet - Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary conversions, capital gain distributions, and. This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to put anything in there. What is the federal carryover worksheet in turbotax? You would not carry over your 2019 income to this worksheet. Turbotax fills it out for you based on your 2019 return. Turbotax does not keep track of your nol nor does it automatically. These instructions explain how to complete schedule d (form 1040). Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. You can use this carryover. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of.

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. What is the federal carryover worksheet in turbotax? You can use this carryover. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. These instructions explain how to complete schedule d (form 1040). This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to put anything in there. Turbotax fills it out for you based on your 2019 return. You would not carry over your 2019 income to this worksheet. Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary conversions, capital gain distributions, and. This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year.

Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Turbotax fills it out for you based on your 2019 return. Turbotax does not keep track of your nol nor does it automatically. What is the federal carryover worksheet in turbotax? Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary conversions, capital gain distributions, and. You would not carry over your 2019 income to this worksheet. This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. These instructions explain how to complete schedule d (form 1040). You can use this carryover. This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to put anything in there.

Carryover Worksheet Total Withheld Pmts Printable And Enjoyable Learning

These instructions explain how to complete schedule d (form 1040). You would not carry over your 2019 income to this worksheet. Turbotax does not keep track of your nol nor does it automatically. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Turbotax fills it out for you based on your 2019 return.

What Is A Federal Carryover Worksheet Printable Word Searches

You can use this carryover. These instructions explain how to complete schedule d (form 1040). Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. You would not carry over your 2019 income to.

Free federal carryover worksheet, Download Free federal carryover

What is the federal carryover worksheet in turbotax? Turbotax does not keep track of your nol nor does it automatically. You would not carry over your 2019 income to this worksheet. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. Schedule d (form 1040) is used to report the sale or exchange of capital.

What Is A Federal Carryover Worksheet Printable Word Searches

This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. What is the federal carryover worksheet in turbotax? Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. What is the federal carryover worksheet in turbotax? Turbotax does not keep track of your nol nor does it automatically. Turbotax fills it out for you based on your 2019 return. You can use this carryover.

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. Turbotax does not keep track of your nol nor does it automatically. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of. What is the federal carryover worksheet in turbotax? Schedule d (form 1040) is used to report the sale.

What Is A Federal Carryover Worksheet Printable Word Searches

Turbotax does not keep track of your nol nor does it automatically. You would not carry over your 2019 income to this worksheet. You can use this carryover. These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax?

6 6 Shortterm capital loss carryover. Enter the

Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. You can use this carryover. This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. These instructions explain how to complete schedule d (form 1040). What is the federal carryover worksheet in turbotax?

1040 (2023) Internal Revenue Service Worksheets Library

What is the federal carryover worksheet in turbotax? You can use this carryover. This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to put anything in there. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting. These instructions explain how.

Complete Form 8949 Before You Complete Line 1B, 2, 3, 8B, 9, Or 10 Of.

These instructions explain how to complete schedule d (form 1040). This is my first time doing my taxes and i am getting stuck on the federal carryover worksheet on turbotax do i need to put anything in there. Turbotax does not keep track of your nol nor does it automatically. You would not carry over your 2019 income to this worksheet.

Turbotax Fills It Out For You Based On Your 2019 Return.

This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year. What is the federal carryover worksheet in turbotax? Schedule d (form 1040) is used to report the sale or exchange of capital assets, involuntary conversions, capital gain distributions, and. Learn how to generate a federal carryover worksheet, including key qualifications, necessary documents, and reporting.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)