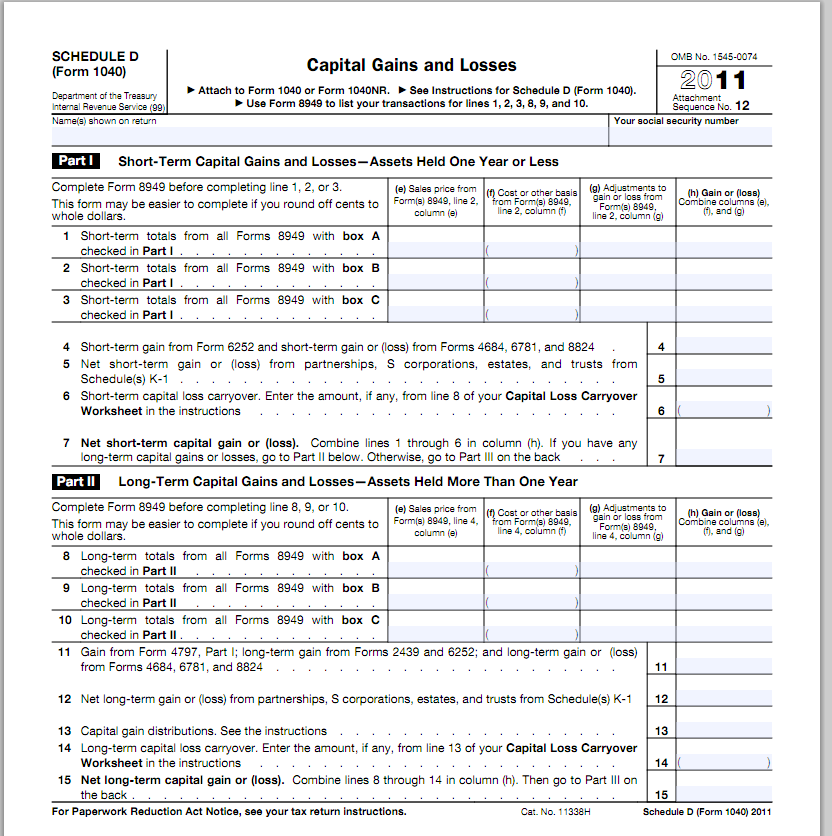

What Is A Carryover Worksheet - Total withheld/pmts must be entered. Turbotax fills it out for you based on your 2019 return. We still need to know your total payments and withholding for. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. What is a capital loss carryover? You would not carry over your 2019 income to this worksheet. Capital loss carryover is the net amount of capital losses eligible to be carried forward into future. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d.

Total withheld/pmts must be entered. We still need to know your total payments and withholding for. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. Capital loss carryover is the net amount of capital losses eligible to be carried forward into future. Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. Turbotax fills it out for you based on your 2019 return. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. What is a capital loss carryover? You would not carry over your 2019 income to this worksheet.

You would not carry over your 2019 income to this worksheet. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. Turbotax fills it out for you based on your 2019 return. Capital loss carryover is the net amount of capital losses eligible to be carried forward into future. We still need to know your total payments and withholding for. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. What is a capital loss carryover? Total withheld/pmts must be entered.

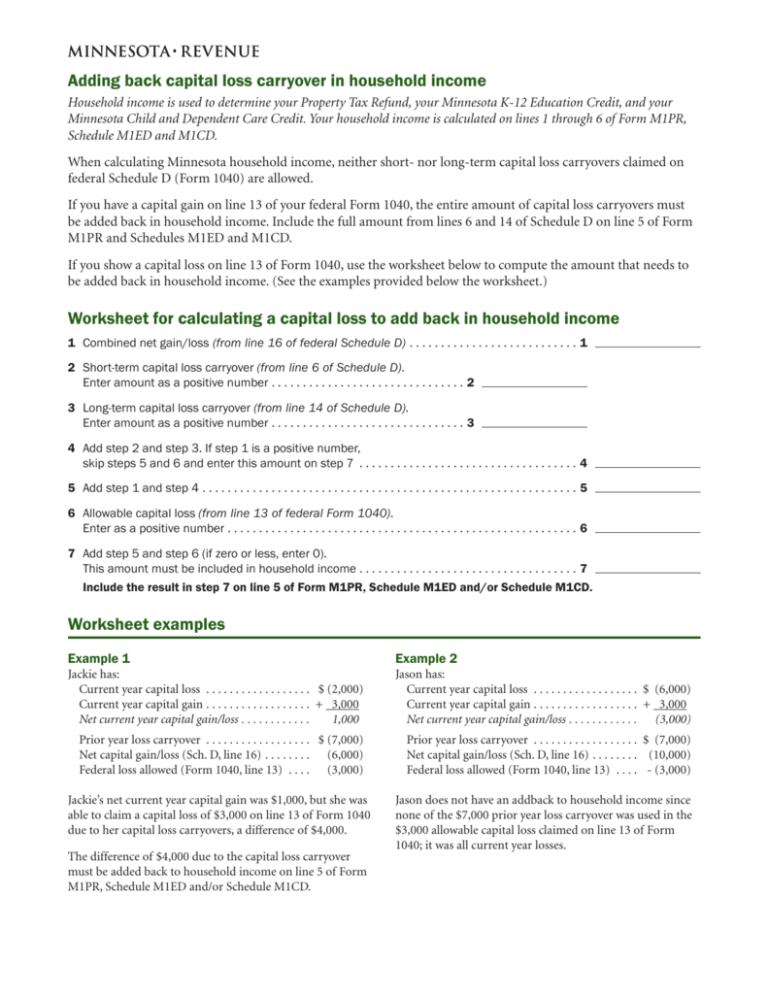

2024 Capital Loss Carryover Worksheet Nelly Yevette

The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. We still need to know your total payments and withholding for. Total withheld/pmts must be entered. Turbotax fills it out for you based on your 2019 return. What is a capital loss carryover?

Carryover Worksheet Total Withheld Pmts Printable And Enjoyable Learning

Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. Turbotax fills it out for you based on your 2019 return. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. We still need to know your total payments and withholding for. You.

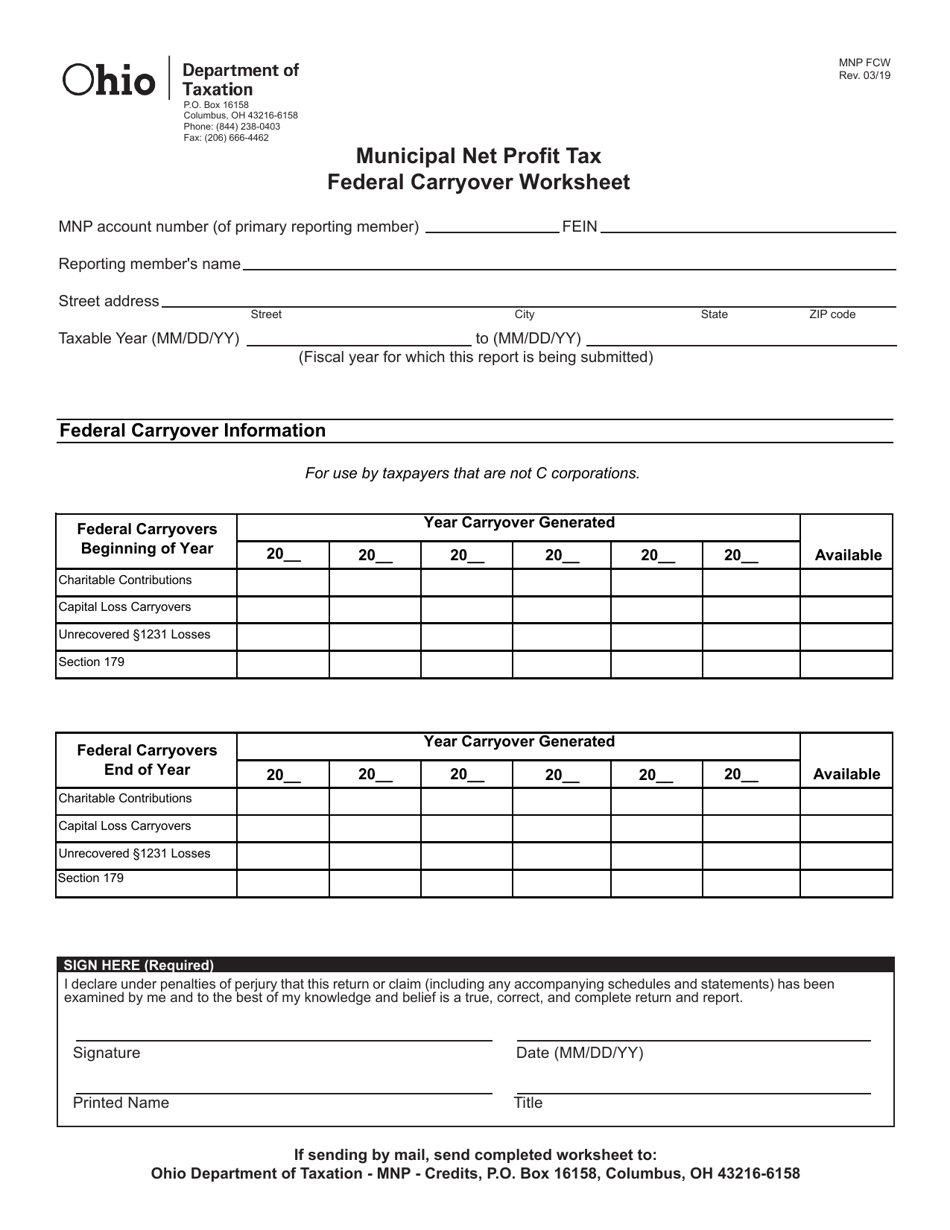

Carryover Worksheet Total Withheld/pmts Federal Carryover Wo

We still need to know your total payments and withholding for. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. Capital loss carryover.

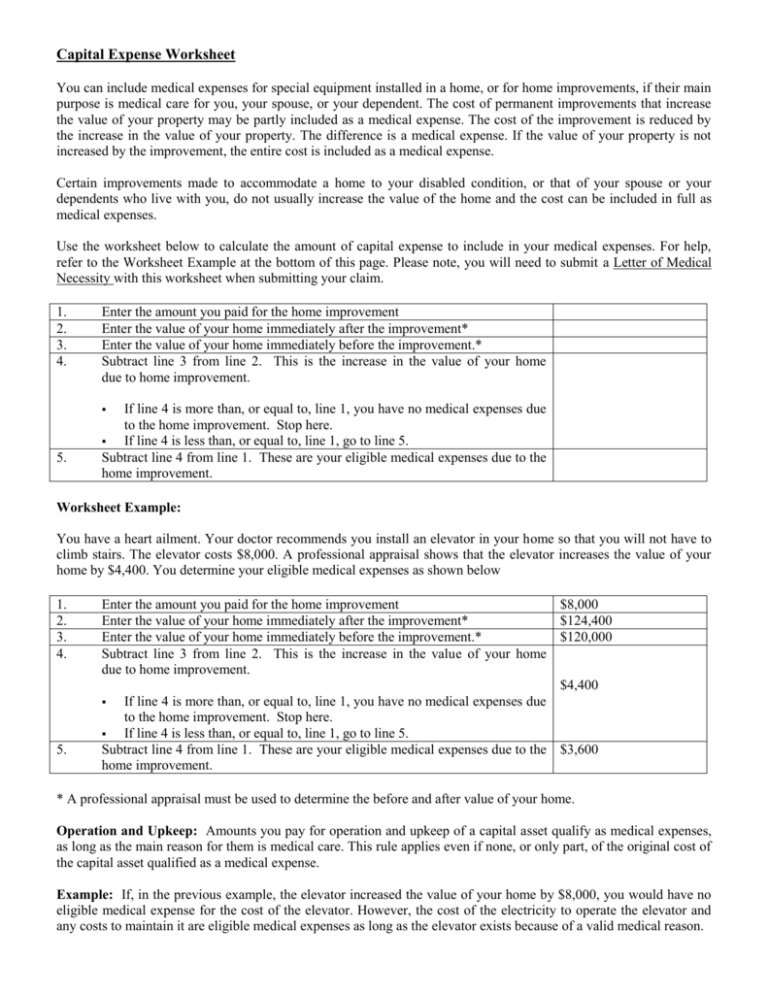

What Is A Federal Carryover Worksheet Printable Word Searches

We still need to know your total payments and withholding for. Turbotax fills it out for you based on your 2019 return. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. Generating a federal carryover worksheet requires a solid understanding of.

Irs Capital Loss Carryover Worksheet 2023

Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. Total withheld/pmts must be entered. Turbotax fills it out for you based on your.

What Is A Federal Carryover Worksheet Printable Word Searches

You would not carry over your 2019 income to this worksheet. Total withheld/pmts must be entered. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. Turbotax fills it out for you based.

What Is A Federal Carryover Worksheet Printable Word Searches

You would not carry over your 2019 income to this worksheet. Total withheld/pmts must be entered. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. Generating a federal carryover worksheet requires a.

What Is A Carryover Worksheet

A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. Turbotax fills it out for you based on your 2019 return. We still need to know your total payments and withholding for. Use.

What Is A Carryover Worksheet

Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. What is a capital loss carryover? Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. A carryover worksheet is a critical tool in.

1041 Capital Loss Carryover Worksheet

Total withheld/pmts must be entered. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d. Capital loss carryover is the net amount of capital losses eligible to be carried forward into future. We still need to know your total payments and withholding for. You would not carry over your 2019 income to.

What Is A Capital Loss Carryover?

Generating a federal carryover worksheet requires a solid understanding of the tax code, particularly sections of the internal. We still need to know your total payments and withholding for. A carryover worksheet is a critical tool in this process, helping individuals track withheld taxes and extra payments made. The carryover amount is calculated using the capital loss carryover worksheet found in the instructions for schedule d.

Turbotax Fills It Out For You Based On Your 2019 Return.

Use this worksheet to figure your capital loss carryovers from 2023 to 2024 if your 2023 schedule d, line 21, is a loss and (a) that loss is. Capital loss carryover is the net amount of capital losses eligible to be carried forward into future. You would not carry over your 2019 income to this worksheet. Total withheld/pmts must be entered.

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)