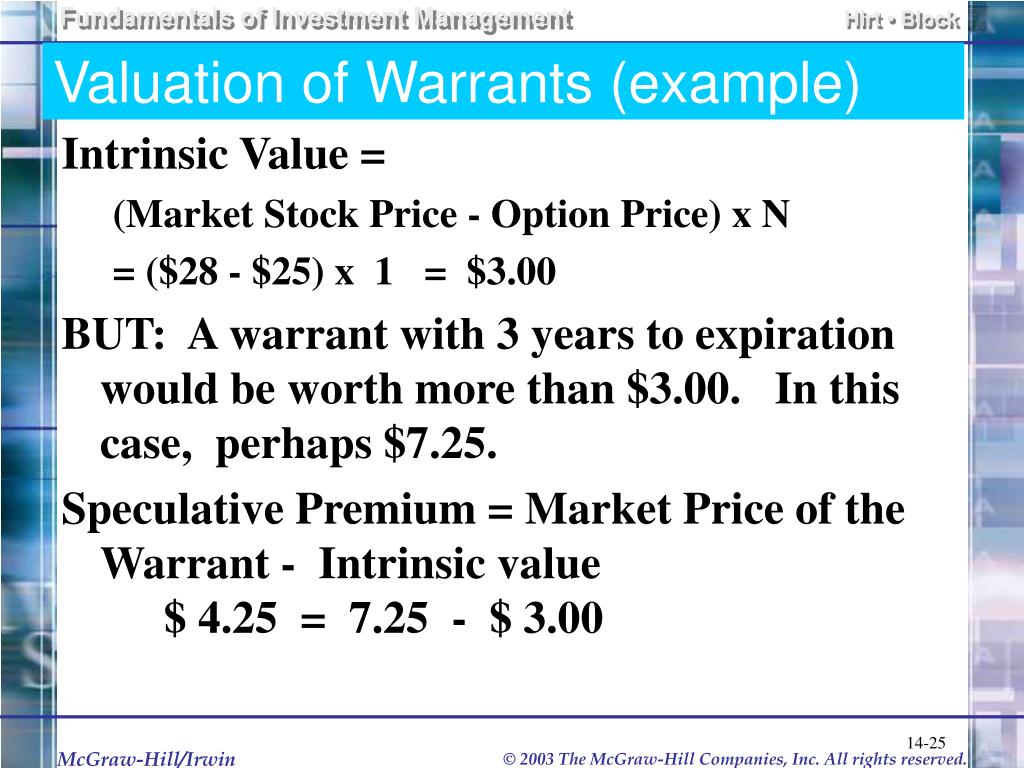

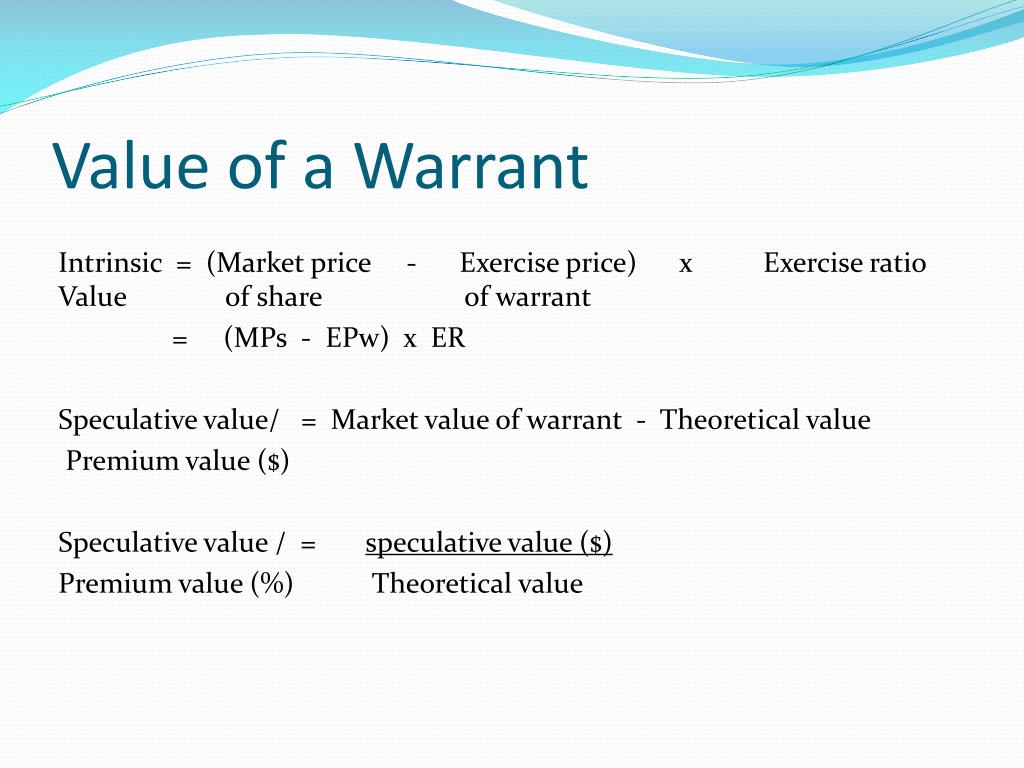

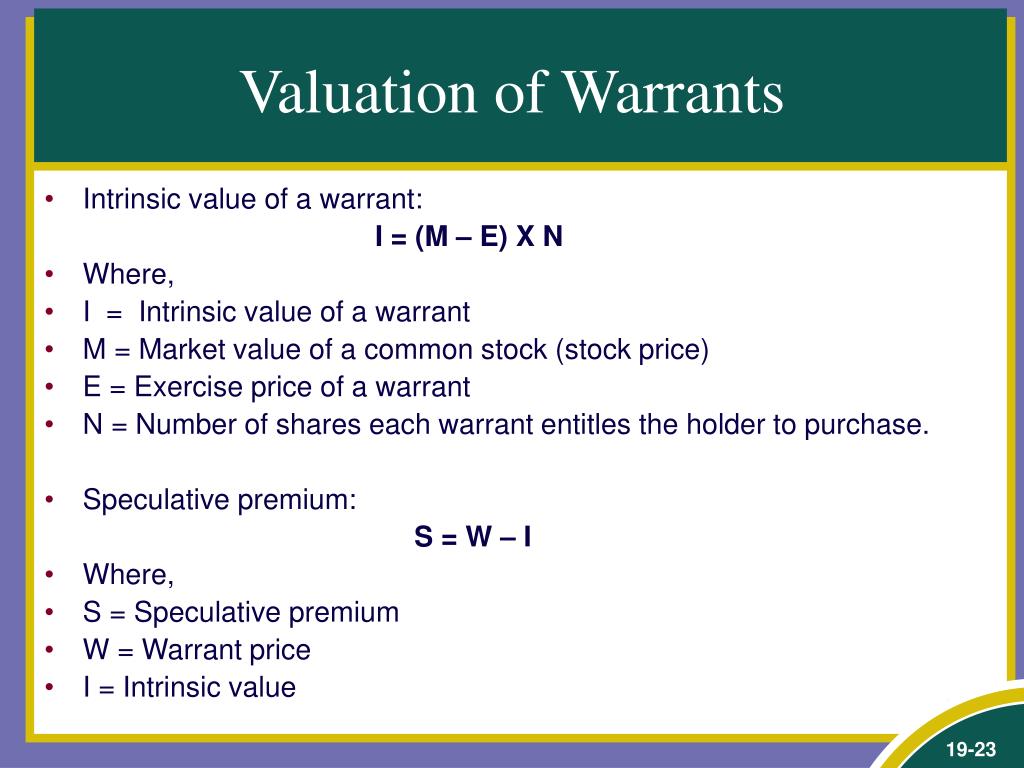

Value Of A Warrant - To determine the value of a warrant, you must. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The market value of a warrant is generally higher than its minimum theoretical value. A stock warrant grants you the right to buy stock at a certain price on a specific date. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. First, warrants have intrinsic value. The difference between the market value of a warrant over the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting.

Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. First, warrants have intrinsic value. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. A stock warrant grants you the right to buy stock at a certain price on a specific date. The difference between the market value of a warrant over the. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. The market value of a warrant is generally higher than its minimum theoretical value. To determine the value of a warrant, you must.

A stock warrant grants you the right to buy stock at a certain price on a specific date. The difference between the market value of a warrant over the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. To determine the value of a warrant, you must. The market value of a warrant is generally higher than its minimum theoretical value. First, warrants have intrinsic value.

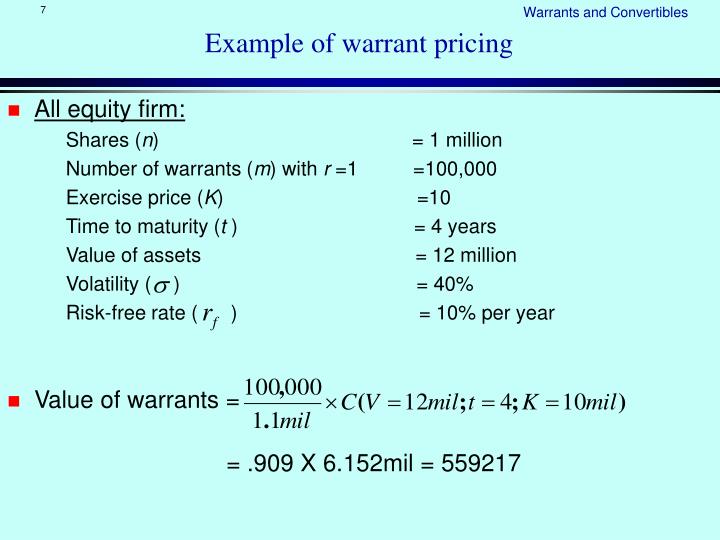

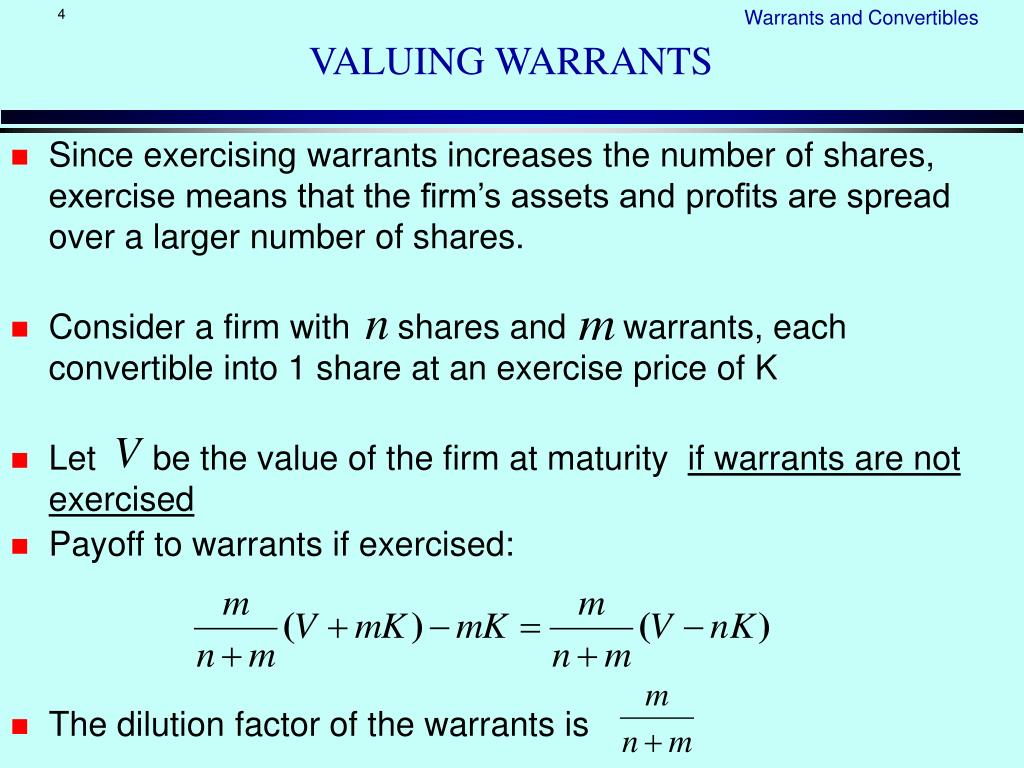

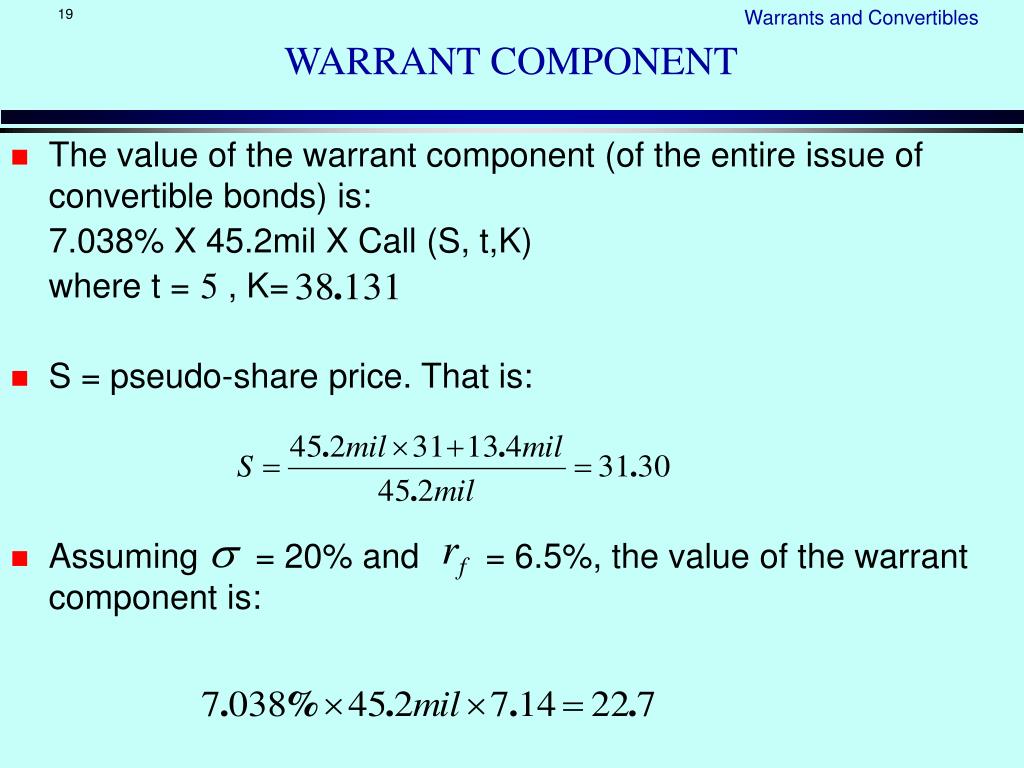

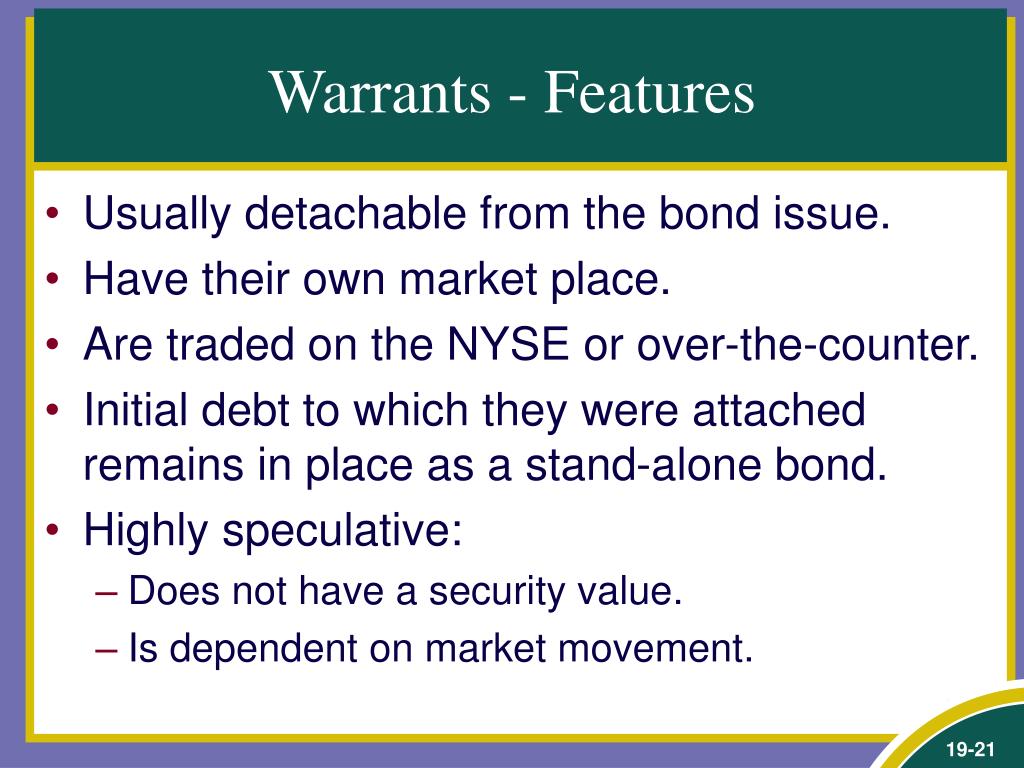

PPT Warrants and Convertibles PowerPoint Presentation, free download

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. To determine the value of a warrant, you must. First, warrants have intrinsic value. The market value of a warrant is.

PPT Warrants and Convertibles PowerPoint Presentation, free download

The market value of a warrant is generally higher than its minimum theoretical value. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. To determine the value of a warrant, you must. A stock warrant.

PPT Chapter 11 PowerPoint Presentation, free download ID3790721

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. First, warrants have intrinsic value. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The difference between the market value of a warrant over the. If the stock price is.

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

To determine the value of a warrant, you must. First, warrants have intrinsic value. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. The difference between the market value of a warrant over the. The market value of a warrant is generally higher than its minimum theoretical value.

Warrants and Convertibles ppt download

The market value of a warrant is generally higher than its minimum theoretical value. To determine the value of a warrant, you must. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. The difference between the market value of a warrant over the. First, warrants have intrinsic value.

PPT Convertibles, Warrants, and Derivatives PowerPoint Presentation

The market value of a warrant is generally higher than its minimum theoretical value. First, warrants have intrinsic value. A stock warrant grants you the right to buy stock at a certain price on a specific date. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add.

Learning Objectives Calculate the conversion value of a convertible

The difference between the market value of a warrant over the. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. The market value of a warrant is generally higher than its minimum theoretical value. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. First,.

PPT Understanding Convertible Securities and Warrants PowerPoint

First, warrants have intrinsic value. A stock warrant grants you the right to buy stock at a certain price on a specific date. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. To determine the value of a warrant, you must. To calculate the warrant value, subtract the strike price.

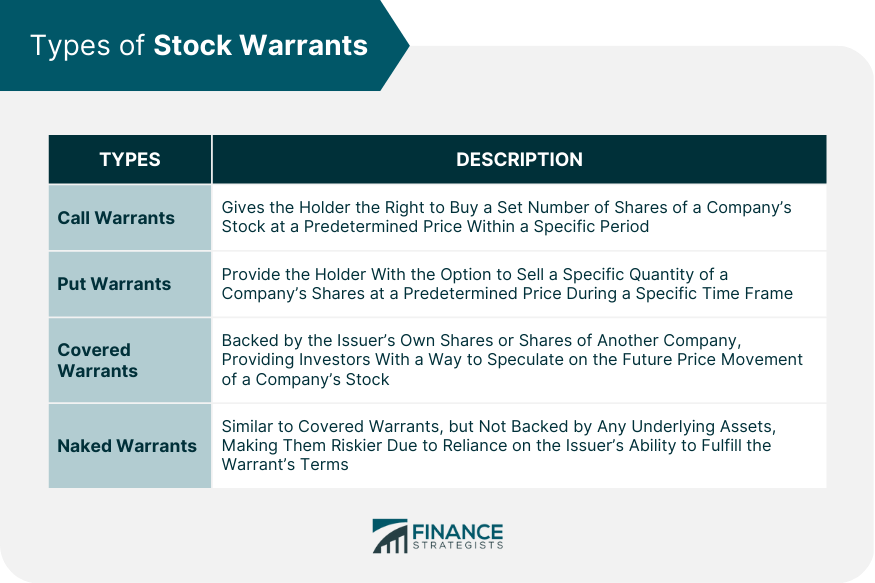

Stock Warrants Definition, How They Work, Types, Pros & Cons

To determine the value of a warrant, you must. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. Explore the essentials of warrant accounting and valuation, including key components, methods, and financial reporting. The difference between the market value of a warrant over the. The market value of a warrant.

PPT Warrants and Convertibles PowerPoint Presentation ID5767334

To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. The market value of a warrant is generally higher than its minimum theoretical value. A stock warrant.

Explore The Essentials Of Warrant Accounting And Valuation, Including Key Components, Methods, And Financial Reporting.

The market value of a warrant is generally higher than its minimum theoretical value. To calculate the warrant value, subtract the strike price from the current market price to determine the intrinsic value (if positive), then add the. If the stock price is above the exercise price of the warrant, then the warrant's intrinsic value equals the. A stock warrant grants you the right to buy stock at a certain price on a specific date.

The Difference Between The Market Value Of A Warrant Over The.

To determine the value of a warrant, you must. First, warrants have intrinsic value.

+x+N.jpg)