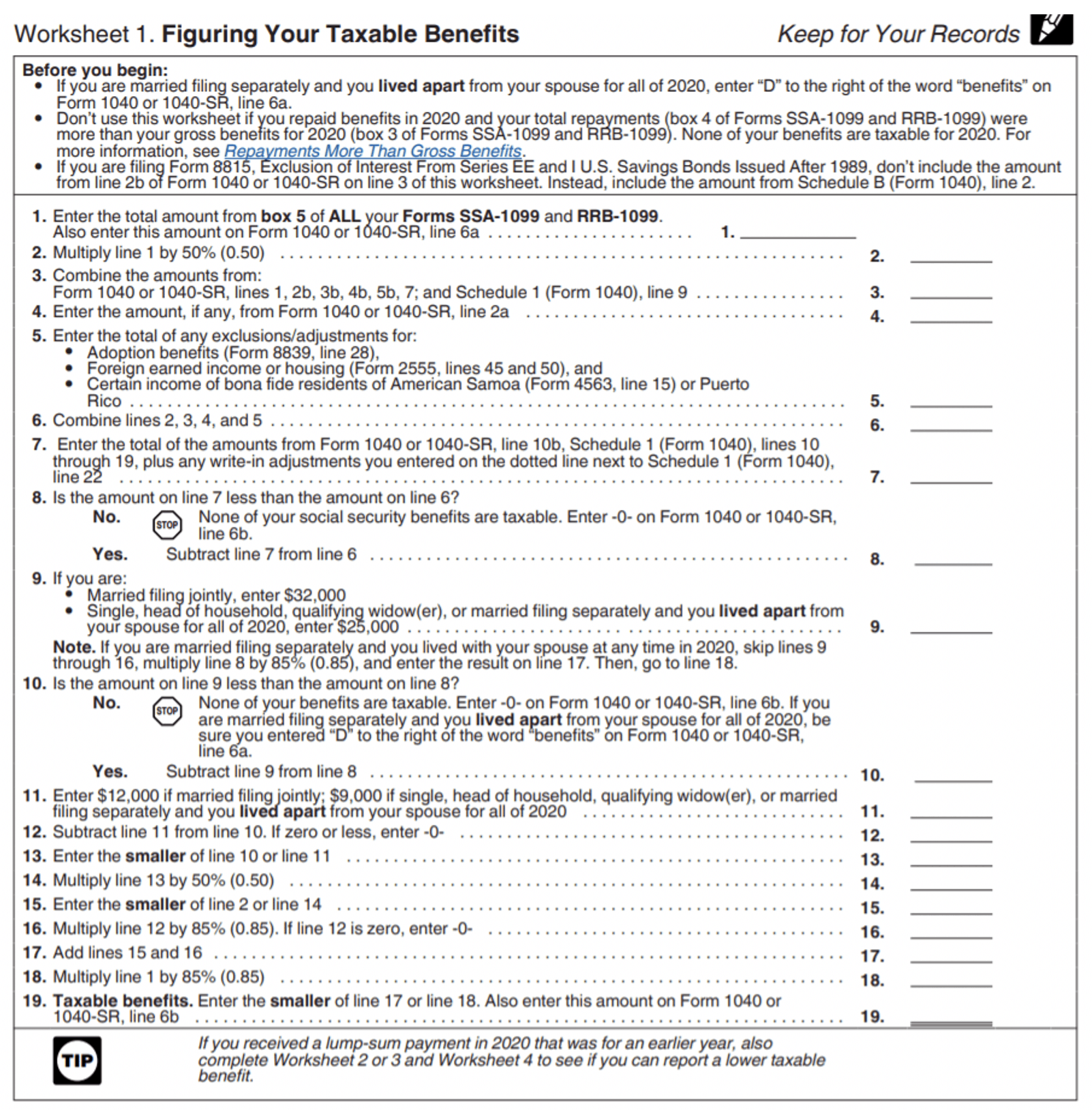

Social Security Taxable Benefits Worksheet - Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. How to report taxable benefits. The worksheet provided can be used to determine the exact amount. Deductions related to your benefits, including a. The taxable portion can range from 50 to 85 percent of your benefits.

The worksheet provided can be used to determine the exact amount. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. The taxable portion can range from 50 to 85 percent of your benefits. Deductions related to your benefits, including a. How to report taxable benefits.

How to report taxable benefits. Deductions related to your benefits, including a. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

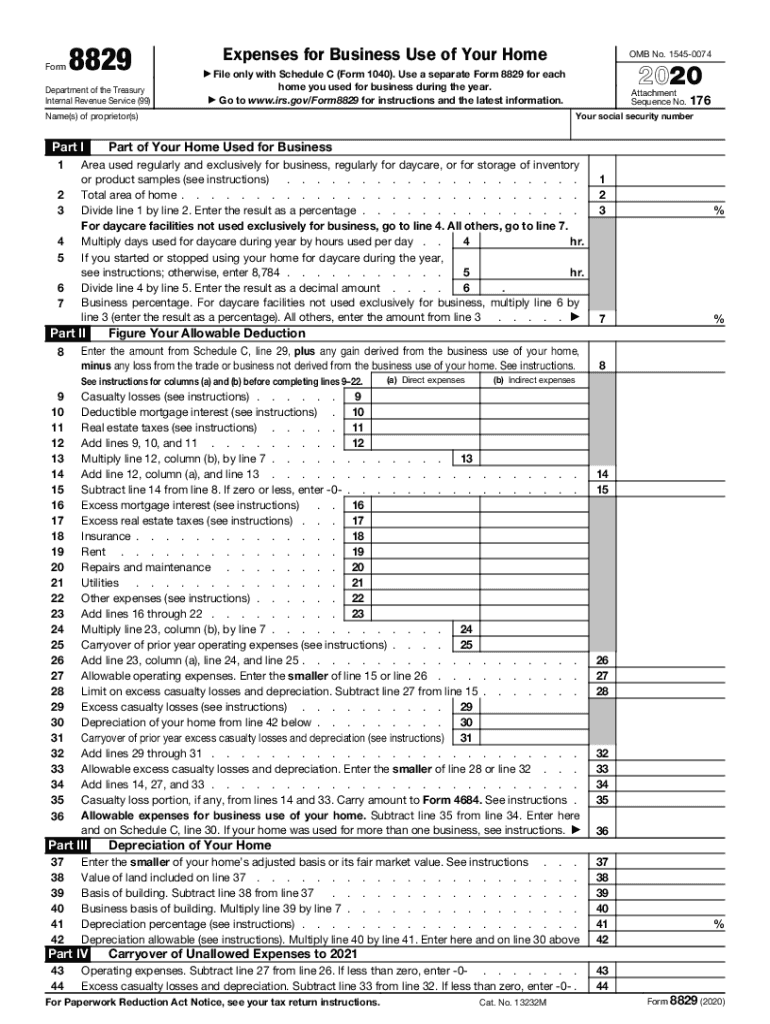

Taxable Social Security Worksheet Printable Computer Tools

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. Deductions related to your benefits, including a. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. How to report taxable benefits.

1040 Worksheet For Social Security Benefits Taxable Social S

The worksheet provided can be used to determine the exact amount. How to report taxable benefits. The taxable portion can range from 50 to 85 percent of your benefits. Deductions related to your benefits, including a. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may.

Is Social Security Taxable In 2025 In Texas Paule Magdaia

How to report taxable benefits. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. Deductions related to your benefits, including a.

Taxation of Social Security Benefits KLRD Worksheets Library

Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. Deductions related to your benefits, including a. How to report taxable benefits.

Worksheet Taxable Social Security Benefits Taxable Social Se

Deductions related to your benefits, including a. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. How to report taxable benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may.

Worksheet 1 Figuring Your Taxable Benefits

The worksheet provided can be used to determine the exact amount. How to report taxable benefits. The taxable portion can range from 50 to 85 percent of your benefits. Deductions related to your benefits, including a. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may.

Taxable Social Security Worksheet 2024

How to report taxable benefits. The worksheet provided can be used to determine the exact amount. Deductions related to your benefits, including a. The taxable portion can range from 50 to 85 percent of your benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may.

Social Security Benefits Worksheet 1040a. Worksheets. Kristawiltbank

The taxable portion can range from 50 to 85 percent of your benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. Deductions related to your benefits, including a. The worksheet provided can be used to determine the exact amount. How to report taxable benefits.

Social Security Tax Worksheet 2023 Social Security Taxable B

The taxable portion can range from 50 to 85 percent of your benefits. The worksheet provided can be used to determine the exact amount. How to report taxable benefits. Deductions related to your benefits, including a. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may.

Federal Tax Worksheet 2023

The taxable portion can range from 50 to 85 percent of your benefits. How to report taxable benefits. The worksheet provided can be used to determine the exact amount. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. Deductions related to your benefits, including a.

The Worksheet Provided Can Be Used To Determine The Exact Amount.

The taxable portion can range from 50 to 85 percent of your benefits. How to report taxable benefits. Complete this worksheet to see if any of your social security and/or ssi (supplemental security income) benefits may. Deductions related to your benefits, including a.