Short Calendar Spread - Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade.

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade.

Calendar Spread Options Strategy Definedge Securities Shelf

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

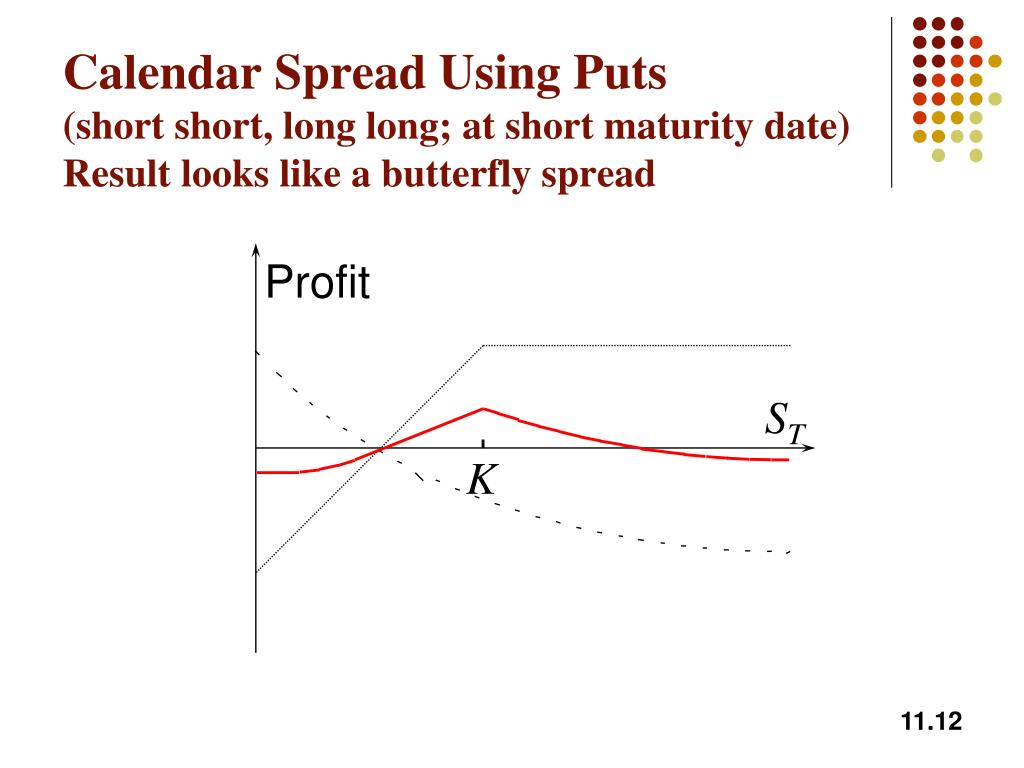

PPT Trading Strategies Involving Options PowerPoint Presentation

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

Everything You Need to Know about Calendar Spreads

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position.

Calendar Spreads 101 Everything You Need To Know

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position.

What Is A Calendar Spread Option Strategy Mab Millicent

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

Calendar Call Spread Option Strategy Heida Kristan

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

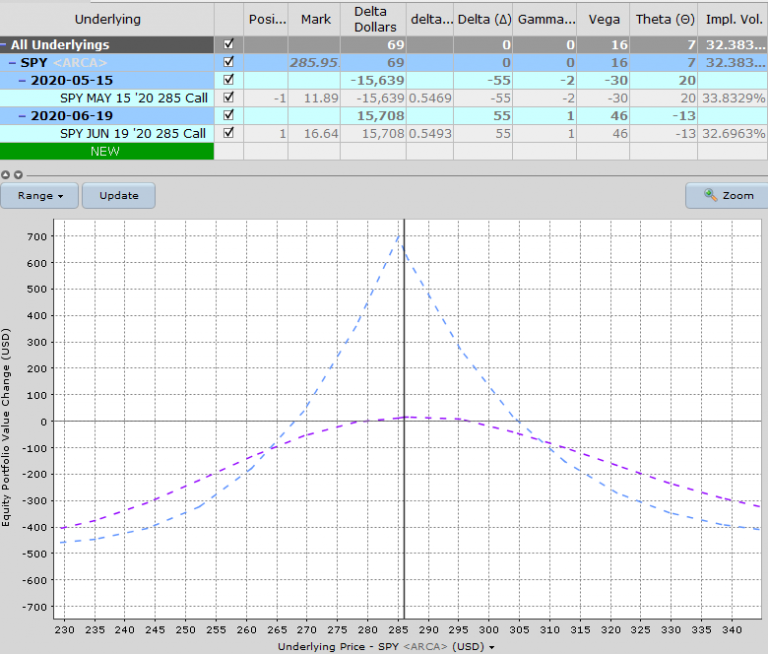

Pin on Double Calendar Spreads and Adjustments

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

What is a Calendar Spread?

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade.

Calendar Spreads in Futures and Options Trading Explained

Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Learn How To Use A Short Calendar Call Spread To Profit From A Volatile Market When You Are Unsure Of The Direction Of Price Movement.

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position.

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)