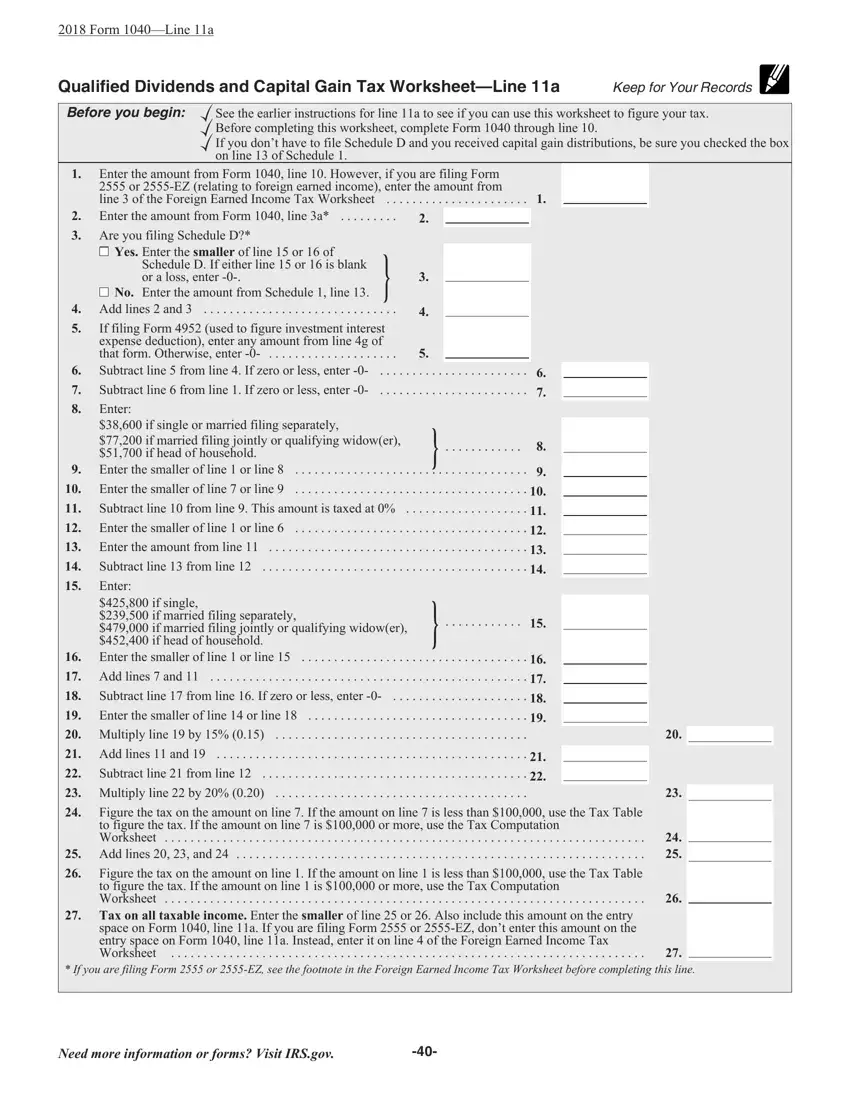

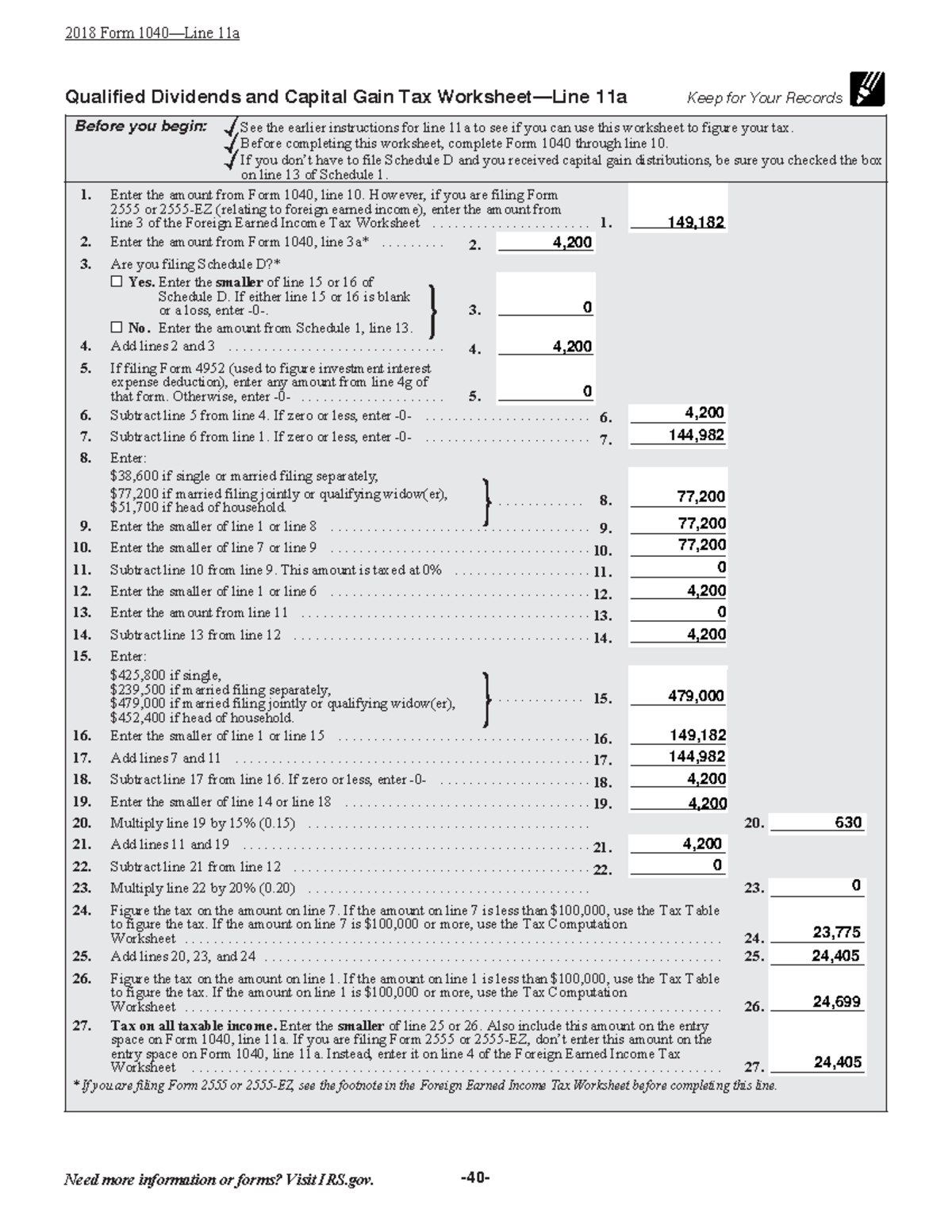

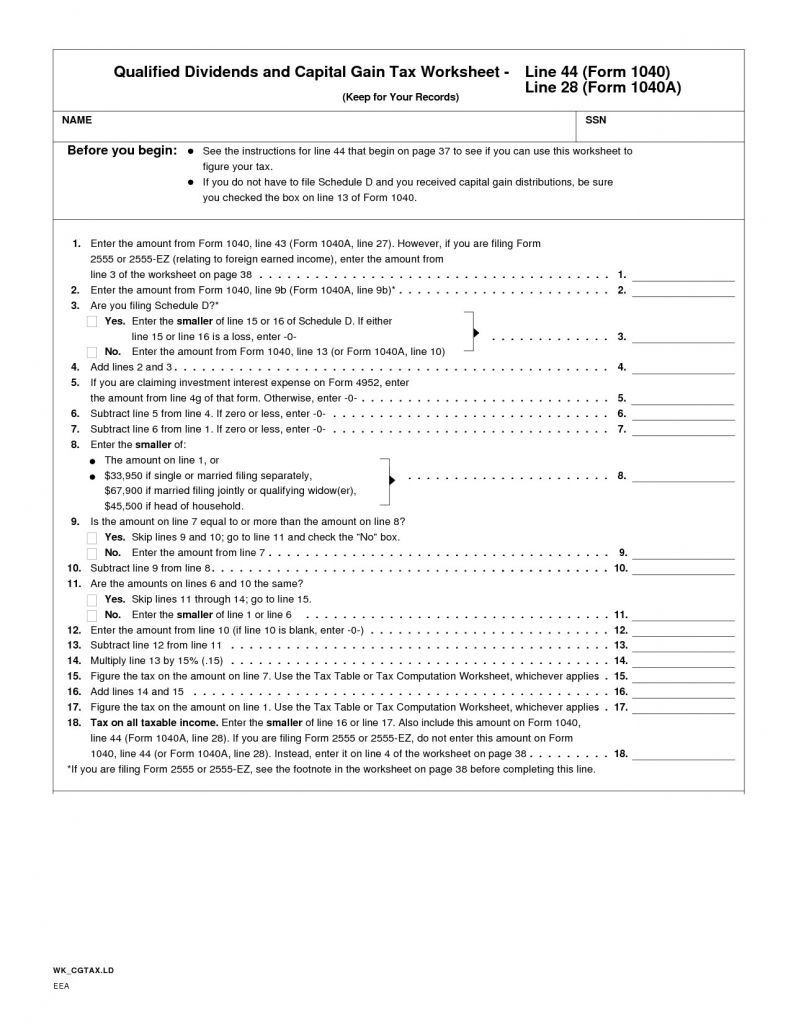

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2021 - Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. However, some dividends are special. Dividends are generally taxed at your ordinary income tax rates. Use the tax tables in the form 1040 instructions.

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. However, some dividends are special. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the tax tables in the form 1040 instructions. Dividends are generally taxed at your ordinary income tax rates.

Dividends are generally taxed at your ordinary income tax rates. However, some dividends are special. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form.

Social Security Benefits Worksheet 2021 Pdf

Use the tax tables in the form 1040 instructions. Dividends are generally taxed at your ordinary income tax rates. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d.

Qualified Dividends And Capital Gain Tax Form

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. Dividends are generally taxed at your ordinary income tax rates. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have.

Free capital gains tax worksheet, Download Free capital gains tax

Dividends are generally taxed at your ordinary income tax rates. Use the tax tables in the form 1040 instructions. Use 1 of the following methods to calculate the tax for line 16 of form 1040. However, some dividends are special. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. Use 1 of the following methods to calculate the tax for line 16 of form 1040. However, some dividends are special. Use the tax tables in the form.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. However, some dividends are special. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file.

Qualified Dividends Worksheet 2024

Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Dividends are generally taxed at your ordinary income tax rates. Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are.

Qualified Dividend And Capital Gain Worksheet 2023 Qualified

Use 1 of the following methods to calculate the tax for line 16 of form 1040. Dividends are generally taxed at your ordinary income tax rates. However, some dividends are special. Use the tax tables in the form 1040 instructions. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 Q

Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form. Use 1 of the following methods to calculate the tax for line 16 of form 1040. However, some dividends are special. Dividends are generally taxed at your ordinary.

Qualified Dividends And Capital Gains Tax Worksheet Qualifie

Use the tax tables in the form 1040 instructions. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Dividends are generally taxed at your ordinary income tax rates. Complete.

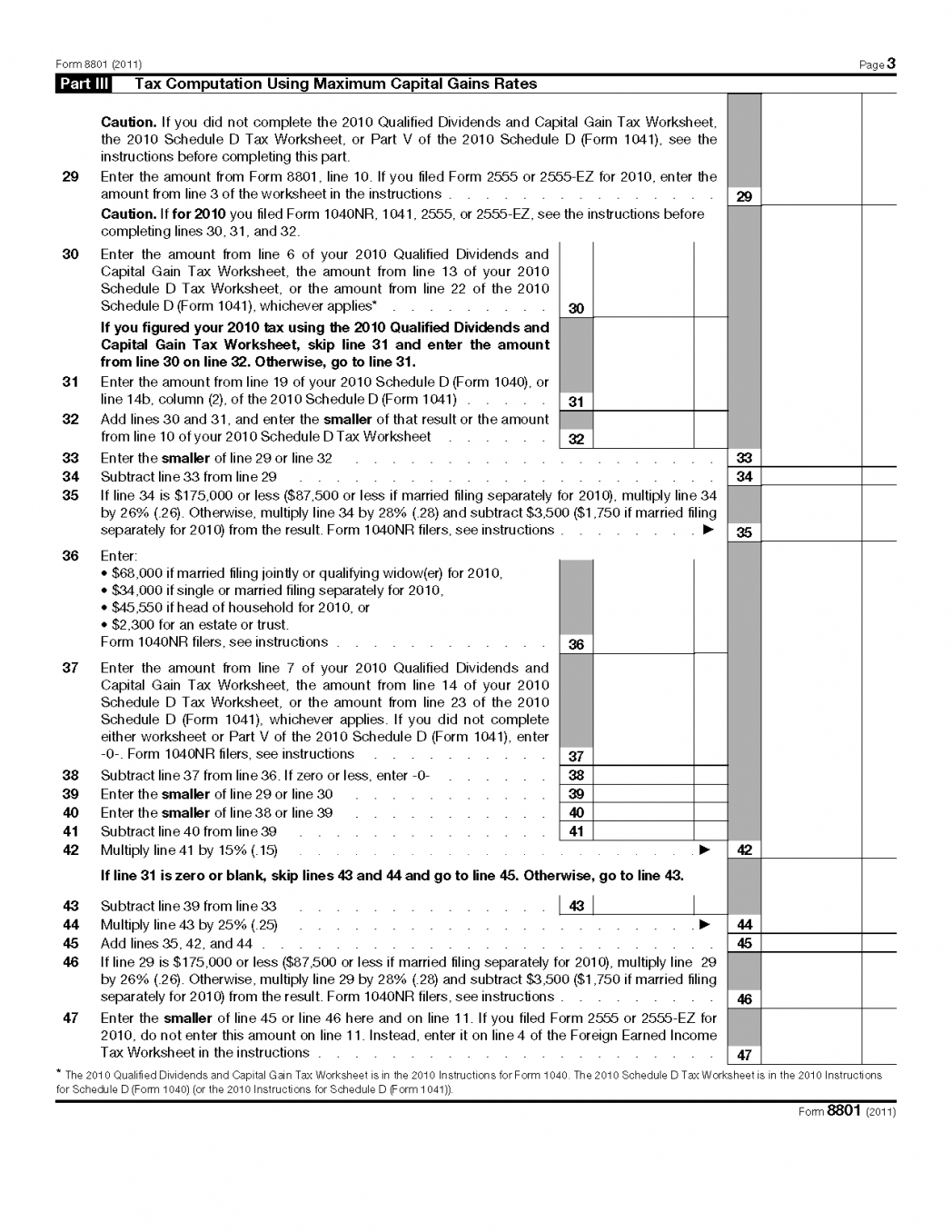

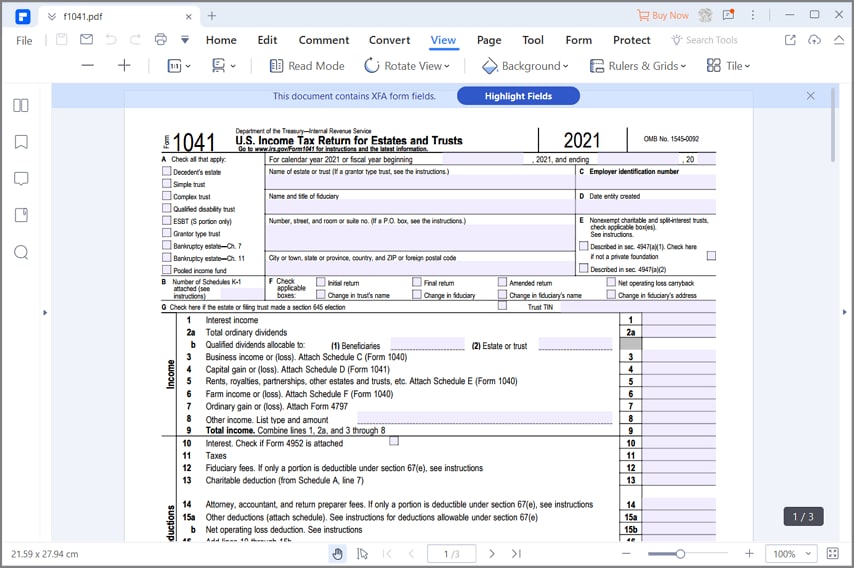

Form 1041 Schedule G 2025 Sebastian Naylor

Use the tax tables in the form 1040 instructions. Dividends are generally taxed at your ordinary income tax rates. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. However,.

Use 1 Of The Following Methods To Calculate The Tax For Line 16 Of Form 1040.

Dividends are generally taxed at your ordinary income tax rates. However, some dividends are special. Use the qualified dividends and capital gain tax worksheet to figure your tax if you do not have to use the schedule d tax. Use the tax tables in the form 1040 instructions.