Pay Tax Warrant - If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of a payment plan. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Penalties and interest will continue to grow until you pay the. If you can’t pay your tax debt in full, you may be able. You must pay your total warranted balance in full to satisfy your tax warrant.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Penalties and interest will continue to grow until you pay the. If you can’t pay your tax debt in full, you may be able. Pay your tax balance due, estimated payments or part of a payment plan. You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Tax warrant for collection of tax.

If you can’t pay your tax debt in full, you may be able. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. You must pay your total warranted balance in full to satisfy your tax warrant. Penalties and interest will continue to grow until you pay the. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of a payment plan. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes.

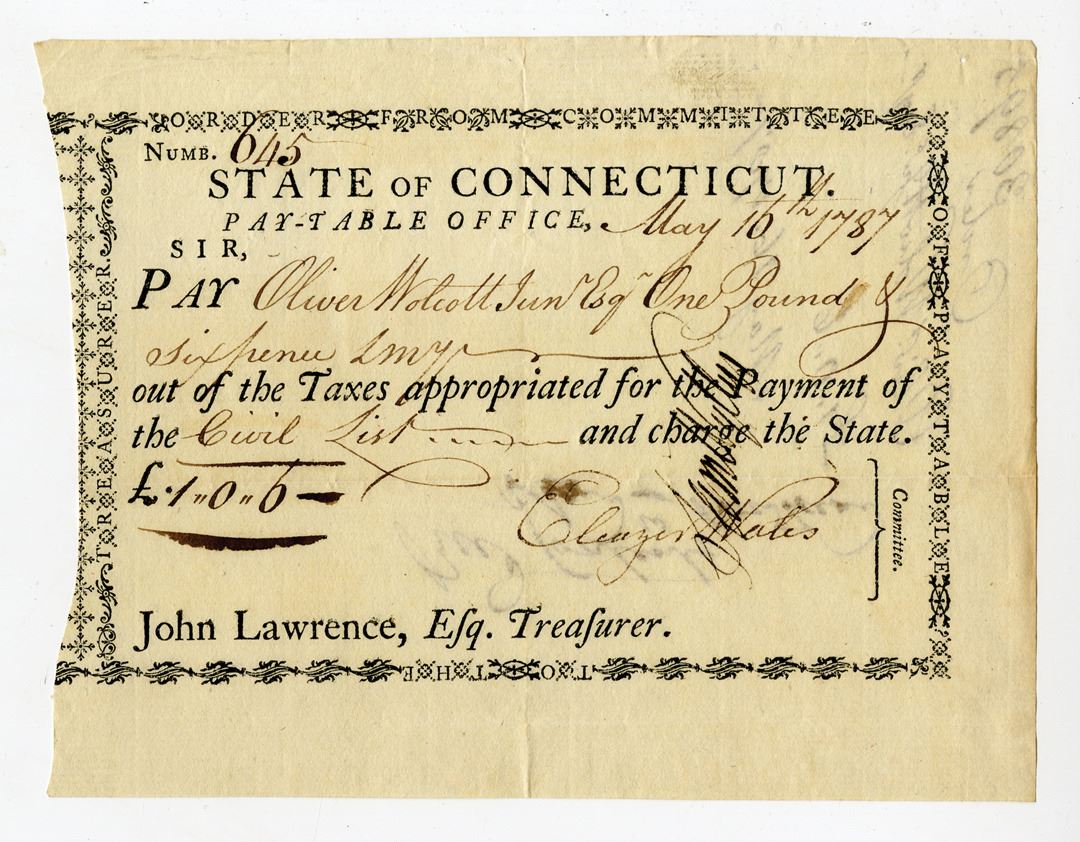

State of Connecticut, PayTable Office, 1787, Tax Warrant, Signed by

Penalties and interest will continue to grow until you pay the. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Tax warrant for collection of tax. You must pay your total warranted balance in full to satisfy your tax warrant. If your account.

pay indiana tax warrant online Reyes Ralph

Penalties and interest will continue to grow until you pay the. Tax warrant for collection of tax. You must pay your total warranted balance in full to satisfy your tax warrant. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. If you can’t.

pay indiana tax warrant online Reyes Ralph

You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes..

pay indiana tax warrant online Reyes Ralph

You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. If you can’t pay your tax debt in full, you may be able. Penalties and interest will continue to grow until you pay the. Tax warrant.

New York State Tax Collections When NYS Wants Back Due Tax Debt

If you can’t pay your tax debt in full, you may be able. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of a payment plan. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. You must pay your total warranted balance in.

pay indiana tax warrant online Reyes Ralph

Tax warrant for collection of tax. If you can’t pay your tax debt in full, you may be able. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. If your account reaches the tax warrant stage, you must pay the total amount due.

pay indiana tax warrant online Reyes Ralph

Pay your tax balance due, estimated payments or part of a payment plan. You must pay your total warranted balance in full to satisfy your tax warrant. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. A tax warrant is a legal action that can be brought against you.

Tax Warrants — DeKalb County Sheriff's Office

Pay your tax balance due, estimated payments or part of a payment plan. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. You must pay your total warranted balance in full to satisfy your tax warrant. A tax warrant is a legal action that can be brought against you.

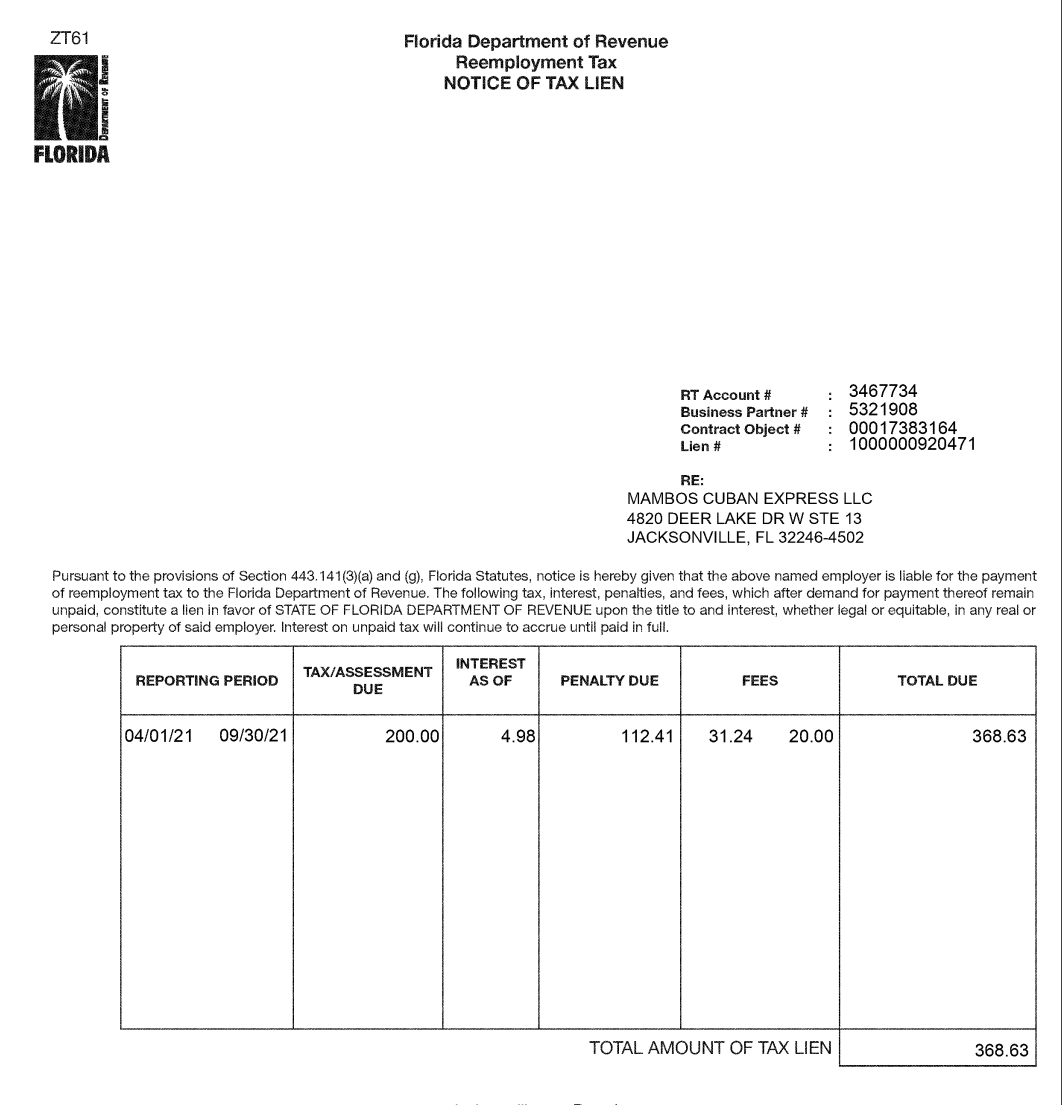

Jacksonville City Council Candidate Raul Arias Struggles to pay his

Penalties and interest will continue to grow until you pay the. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes. Tax warrant for.

What Happens When the IRS Issues a Tax Warrant Against Me?

Penalties and interest will continue to grow until you pay the. If you can’t pay your tax debt in full, you may be able. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Tax warrant for collection of tax. Pay your tax balance due, estimated payments or part of.

Tax Warrant For Collection Of Tax.

You must pay your total warranted balance in full to satisfy your tax warrant. Penalties and interest will continue to grow until you pay the. If your account reaches the tax warrant stage, you must pay the total amount due or accept the expense and. Pay your tax balance due, estimated payments or part of a payment plan.

If You Can’t Pay Your Tax Debt In Full, You May Be Able.

A tax warrant is a legal action that can be brought against you by the state or federal government if you fail to pay your taxes.

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)