Partnership Basis Worksheet - Was there a new requirement that all partners need to have a basis statement before filing their tax returns? Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Partnership basis worksheet specific instructions. There may be some transactions or certain distributions that require you to. To help you track basis,. It includes topics such as withholding. This publication provides supplemental federal income tax information for partnerships and partners.

There may be some transactions or certain distributions that require you to. To help you track basis,. Partnership basis worksheet specific instructions. This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? It includes topics such as withholding.

It includes topics such as withholding. Partnership basis worksheet specific instructions. There may be some transactions or certain distributions that require you to. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. To help you track basis,. This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Was there a new requirement that all partners need to have a basis statement before filing their tax returns?

Partnership Adjusted Basis Worksheet Fillable

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. This publication provides supplemental federal income tax information for partnerships and partners. Was there a new requirement that.

Partnership Adjusted Basis Worksheet Fillable

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership.

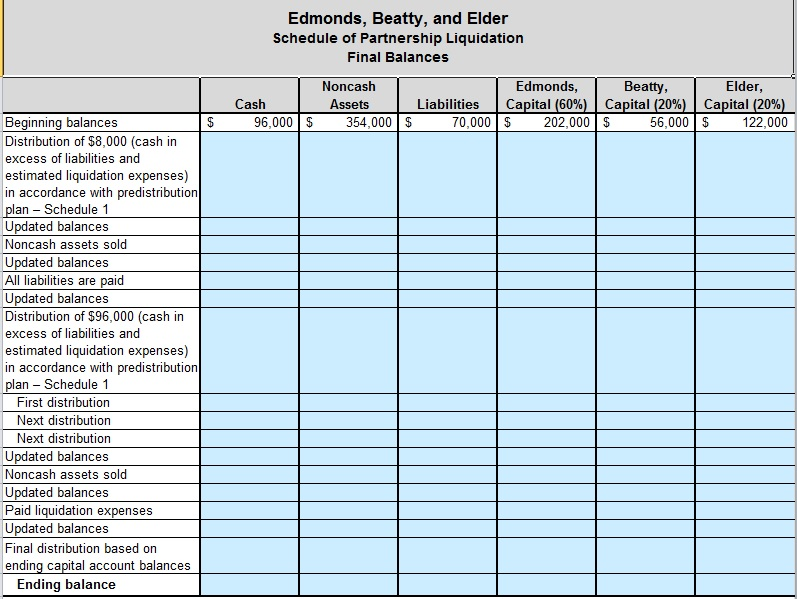

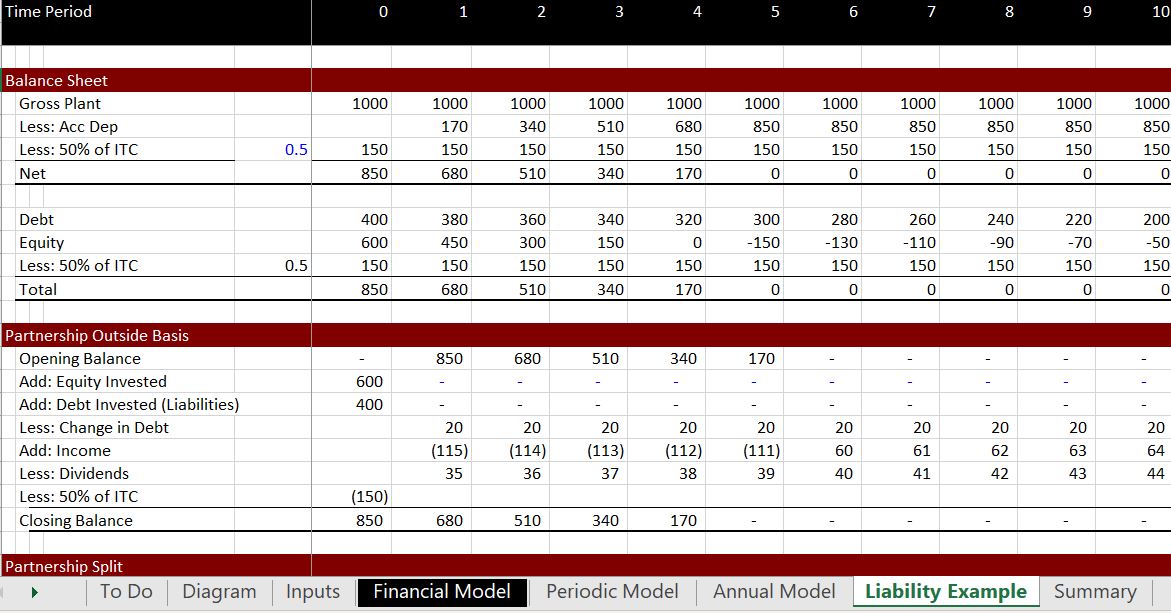

Partner Basis Worksheet Template Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. This publication provides supplemental federal income tax information for partnerships and partners. It includes topics such as withholding..

Partnership Basis Worksheets

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. It includes topics such as withholding. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Was there a new requirement that all partners need to have a.

Partnership Adjusted Basis Worksheet

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. It includes topics such as withholding. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? Partnership basis worksheet specific instructions. To help you track basis,.

Partnership Basis Worksheet Excel

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. There may be some transactions or certain distributions that require you to. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? The adjusted partnership basis will be used to.

Partnership Basis Calculation Worksheet Printable And Enjoyable Learning

Was there a new requirement that all partners need to have a basis statement before filing their tax returns? This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Partnership basis worksheet specific instructions. There may be.

Partner Basis Worksheet Template Excel

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? There may be some transactions or certain distributions that require you to. This publication provides supplemental federal income tax information.

Free Partnership Worksheet Free to Print, Save & Download

This publication provides supplemental federal income tax information for partnerships and partners. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. Partnership basis worksheet specific instructions. It.

Using the information below, complete the Excel

To help you track basis,. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? Partnership basis worksheet specific instructions. It includes topics such as withholding. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest.

It Includes Topics Such As Withholding.

To help you track basis,. The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. Was there a new requirement that all partners need to have a basis statement before filing their tax returns? There may be some transactions or certain distributions that require you to.

Partnership Basis Worksheet Specific Instructions.

Use the basis wks screen to calculate a partner’s new basis after increases and/or decreases are made to basis during the. This publication provides supplemental federal income tax information for partnerships and partners.