Option Calendar Spread - A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Calendar Call Spread Option Strategy Heida Kristan

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

Option Calendar Spreads

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Calendar Spread Options Trading Strategy In Python

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

Options Strategy Calendar Spread (Setting Up the Calendar) Tradersfly

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

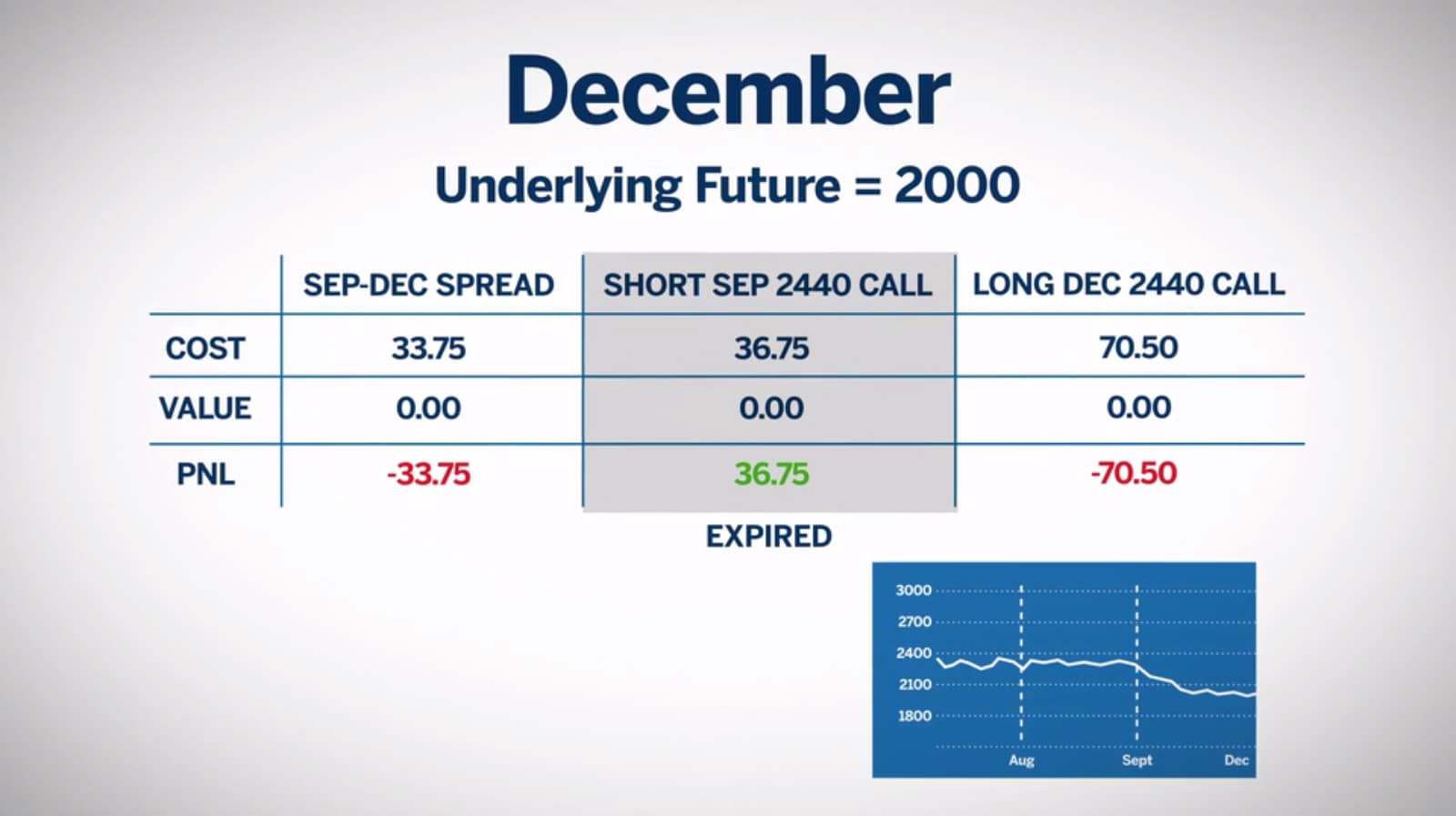

How to Trade Options Calendar Spreads (Visuals and Examples)

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

Calendar Spread Options Strategy VantagePoint

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

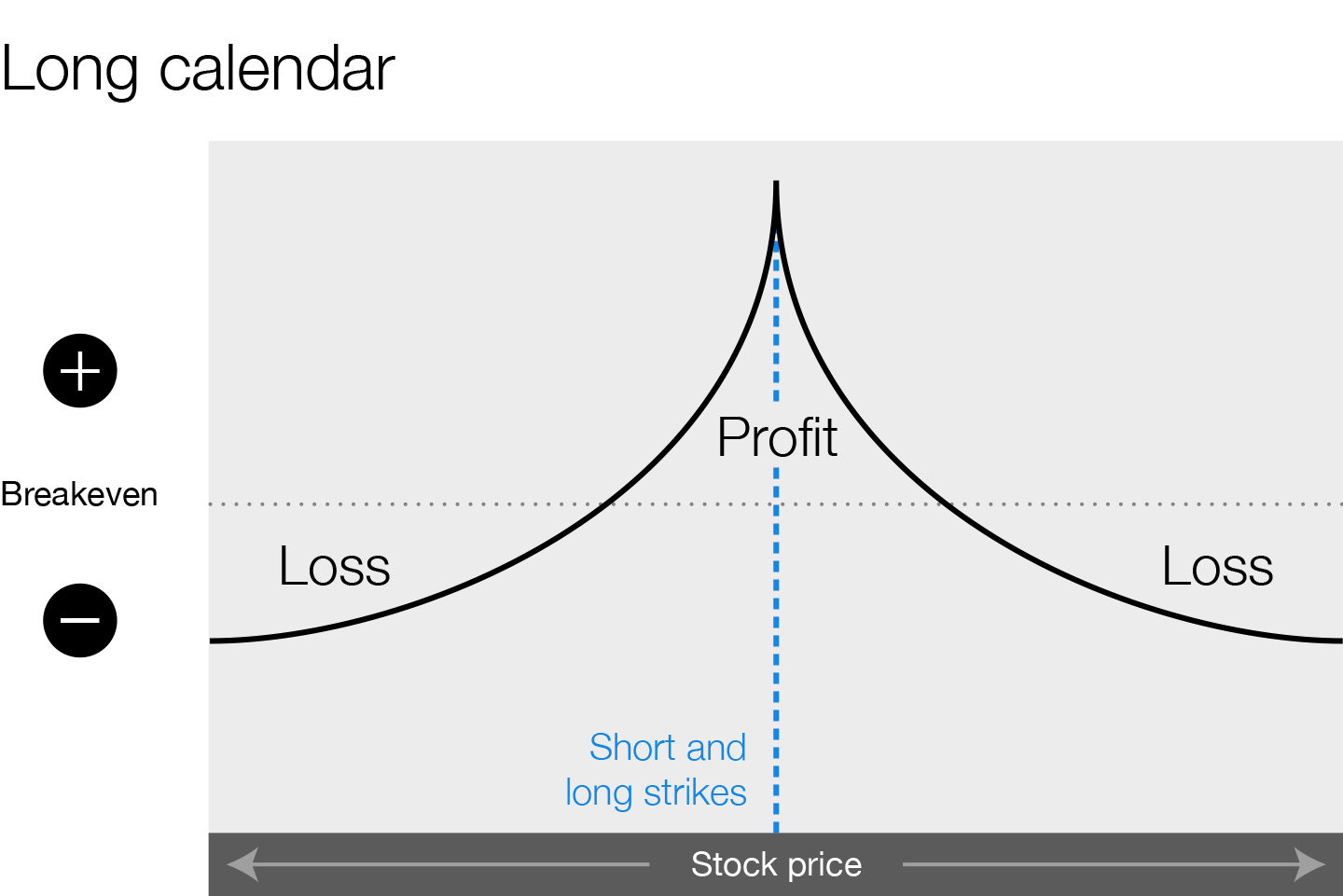

Calendar Spread and Long Calendar Option Strategies Market Taker

A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the. A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias. A calendar spread, also known as a time spread, is an options trading strategy that involves buying and selling two options of the.

A Calendar Spread, Also Known As A Time Spread, Is An Options Trading Strategy That Involves Buying And Selling Two Options Of The.

A calendar spread allows option traders to take advantage of elevated premium in near term options with a neutral market bias.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)