Income Tax Calendar 2024 Pdf - The effect of saturdays, sundays, and holidays has been. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any tax due. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you receive any income not shown in this organizer such as gambling.

Did you receive any income not shown in this organizer such as gambling. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any tax due. The effect of saturdays, sundays, and holidays has been. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income.

The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any tax due. The effect of saturdays, sundays, and holidays has been. Did you receive any income not shown in this organizer such as gambling.

2024 tax calendar Miller Kaplan

The effect of saturdays, sundays, and holidays has been. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any.

2024birtaxcalendar.pdf

The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you receive any income not shown in this organizer such as gambling. File a 2023 calendar year income tax return (form 1120) and pay any tax due. Did you take your first rmd in.

Tax Calendar Important Dates for F.Y. 20242025 PDF

File a 2023 calendar year income tax return (form 1120) and pay any tax due. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. The effect of saturdays, sundays, and holidays has been. Did you receive any income not shown in this organizer such.

Tax Calendar Important Dates for F.Y. 20242025

Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? The effect of saturdays, sundays, and holidays has been. File a 2023 calendar year income tax return (form 1120) and pay any tax due. Did you receive any income not shown in this organizer such as gambling. The amounts in column (1) are to be included as.

Tax Calendar Important Dates for F.Y. 20242025

File a 2023 calendar year income tax return (form 1120) and pay any tax due. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? The effect of saturdays, sundays, and holidays.

2024 Tax Brackets Chart Pdf Uriel Holden

Did you receive any income not shown in this organizer such as gambling. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. File a 2023 calendar year income tax return (form 1120) and pay any tax due. The effect of saturdays, sundays, and holidays.

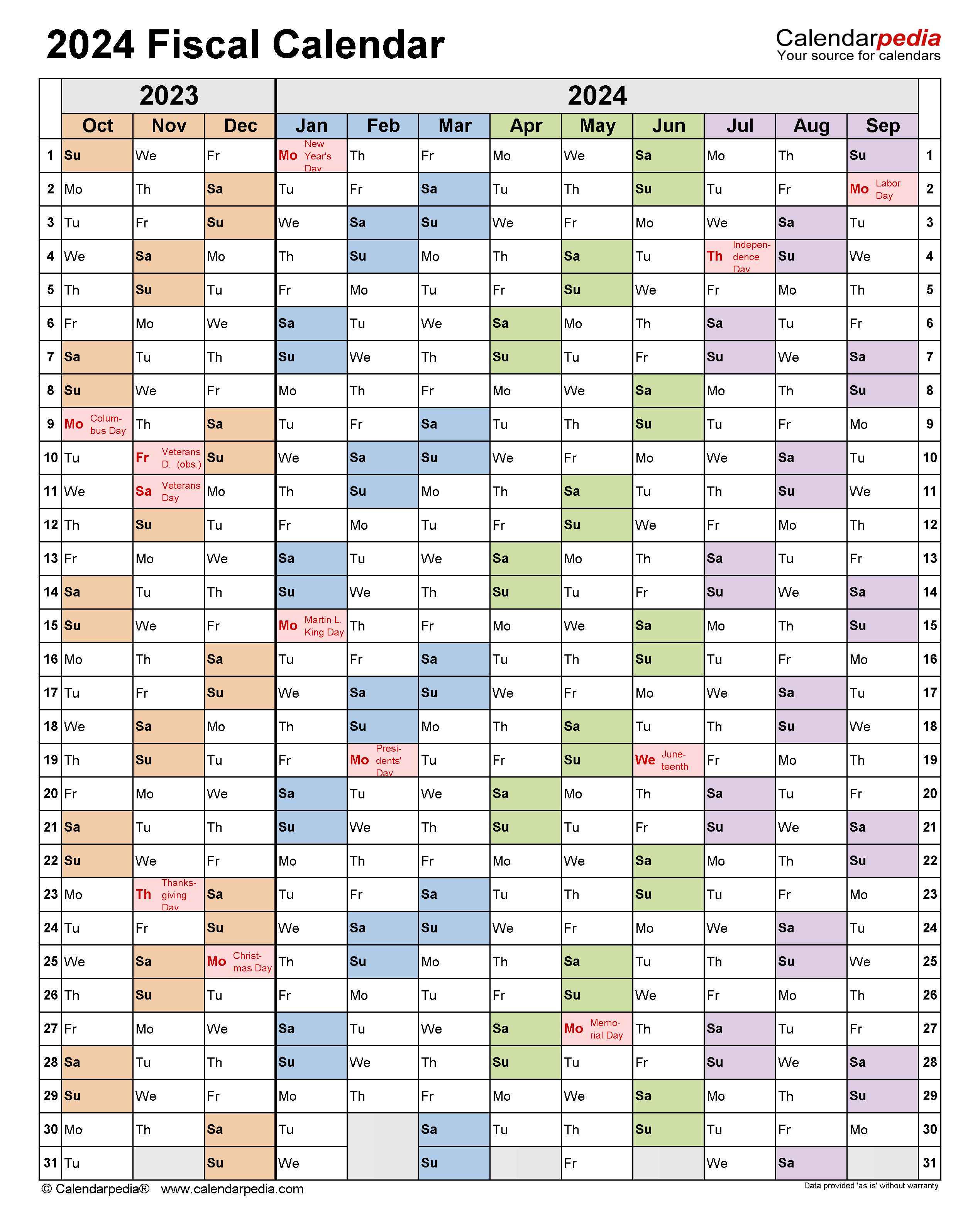

Fiscal Calendars 2024 Free Printable Word templates

File a 2023 calendar year income tax return (form 1120) and pay any tax due. The effect of saturdays, sundays, and holidays has been. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you receive any income not shown in this organizer such.

The IRS Tax Refund Schedule 2024 Where's My Refund?

The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? Did you receive any income not shown in this organizer such as gambling. The effect of saturdays, sundays, and holidays has been..

August Tax Calendar 2024 CloudCFO

The effect of saturdays, sundays, and holidays has been. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any tax due. Did you receive any income not shown in this organizer such as gambling. The amounts in column (1) are to be included as.

tax calendar for September 2024 Key deadlines you should know

File a 2023 calendar year income tax return (form 1120) and pay any tax due. Did you receive any income not shown in this organizer such as gambling. The effect of saturdays, sundays, and holidays has been. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? The amounts in column (1) are to be included as.

The Effect Of Saturdays, Sundays, And Holidays Has Been.

Did you receive any income not shown in this organizer such as gambling. Did you take your first rmd in 2020, 2021, 2022, 2023 or 2024? File a 2023 calendar year income tax return (form 1120) and pay any tax due. The amounts in column (1) are to be included as dividend income on your tax return and 15.20% of these amounts are qualified dividend income.