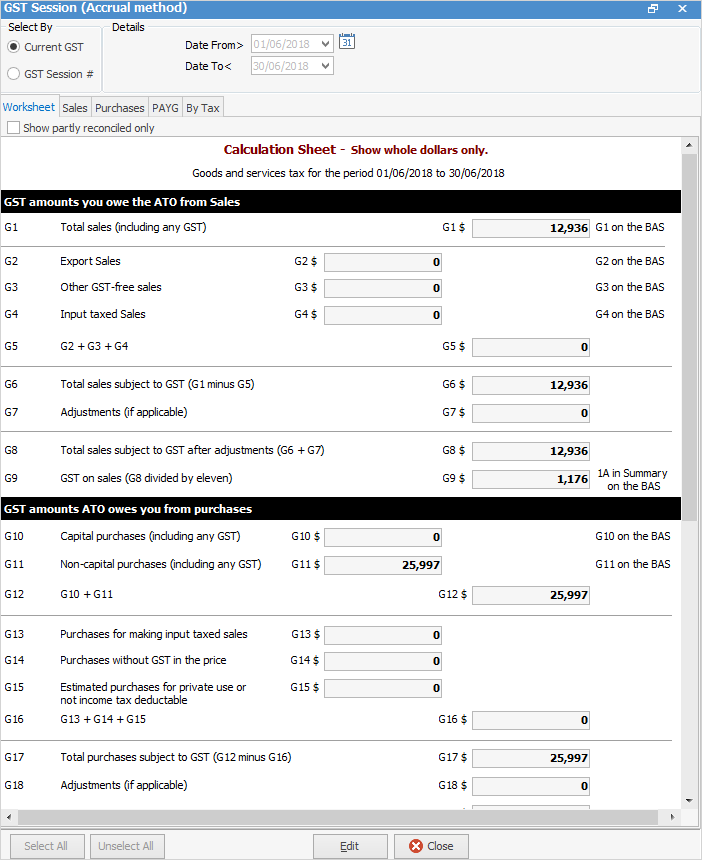

Fuel Tax Credits Calculation Worksheet - (2,000 litre for private use are not eligible.) note: There are three steps to calculate your fuel tax credits using our worksheet step 1: Leave blank for hhh to. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Work out your eligible quantities work out how much fuel. You must be registered for gst and. Amount must be converted into dollars. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement (bas).

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. You must be registered for gst and. Leave blank for hhh to. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. (2,000 litre for private use are not eligible.) note: There are three steps to calculate your fuel tax credits using our worksheet step 1: Amount must be converted into dollars. Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement (bas). Work out your eligible quantities work out how much fuel. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public.

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. There are three steps to calculate your fuel tax credits using our worksheet step 1: (2,000 litre for private use are not eligible.) note: You must be registered for gst and. Leave blank for hhh to. Work out your eligible quantities work out how much fuel. Amount must be converted into dollars. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement (bas). Use this worksheet to help you calculate your fuel tax credits and claim them on your bas.

Fuel Tax Credit Calculation Worksheet

Work out your eligible quantities work out how much fuel. Amount must be converted into dollars. Leave blank for hhh to. Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. You must be registered for gst and.

Fuel Tax Credits Calculation Worksheet

Work out your eligible quantities work out how much fuel. You must be registered for gst and. Amount must be converted into dollars. There are three steps to calculate your fuel tax credits using our worksheet step 1: (2,000 litre for private use are not eligible.) note:

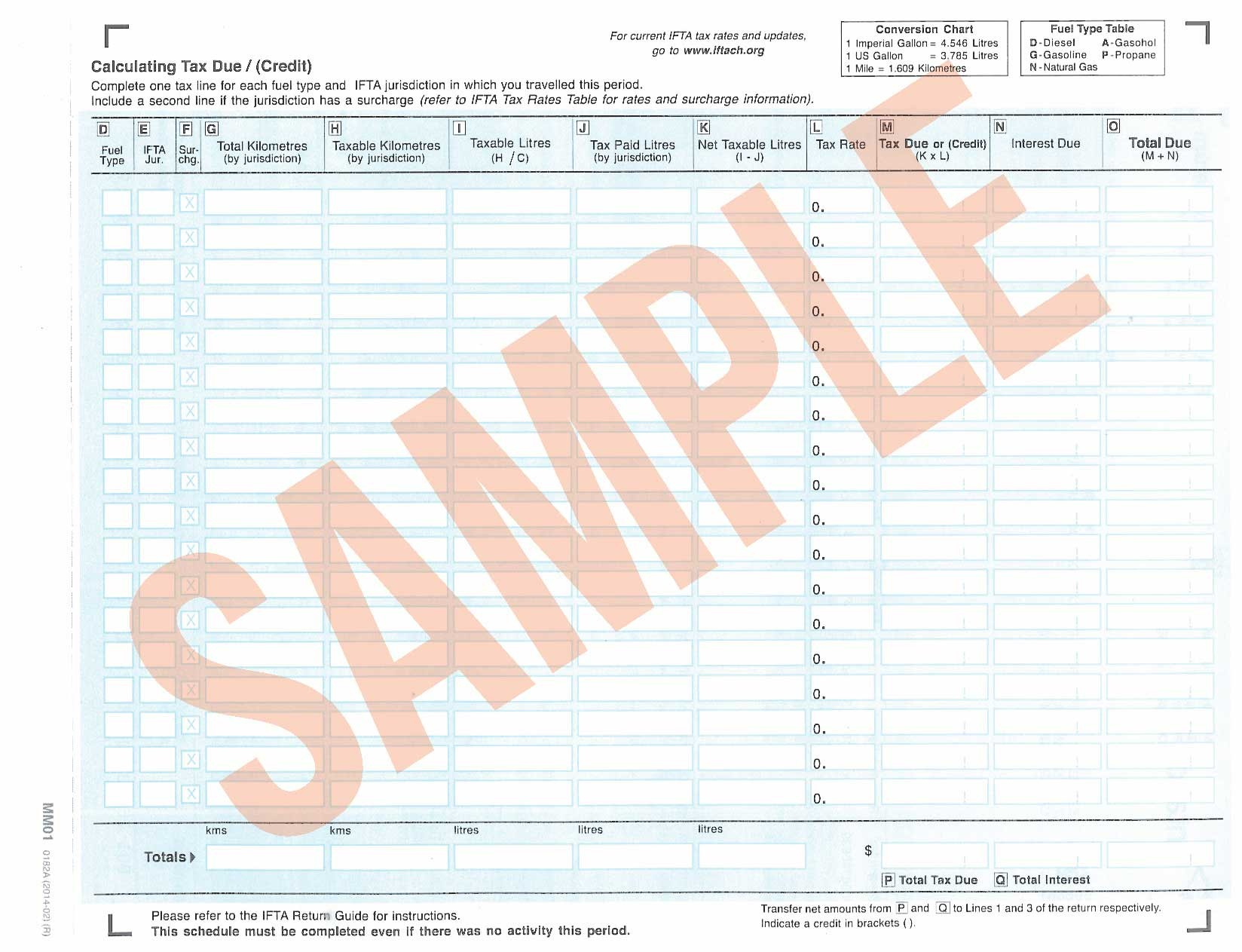

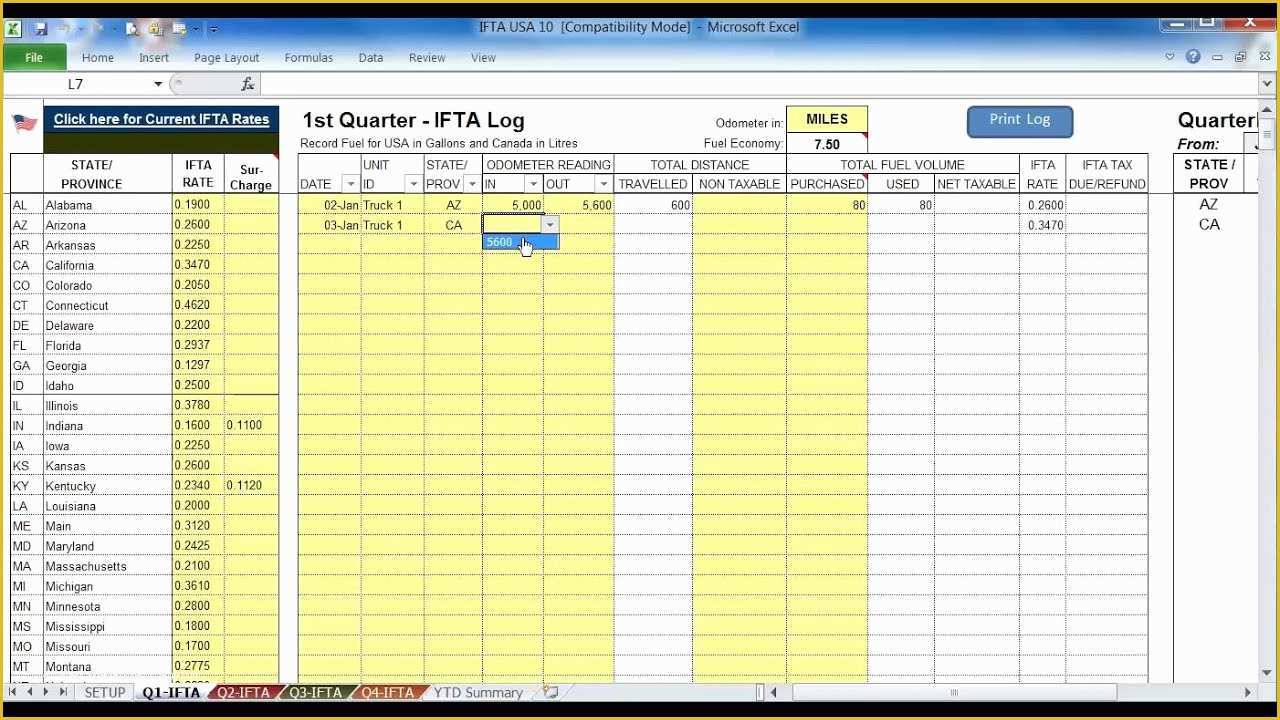

Ifta Fuel Tax Spreadsheet for Tax Worksheet Excel New Fuel Tax

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out your eligible quantities work out how much fuel. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity.

Fuel Tax Credit Calculation Worksheet

You must be registered for gst and. (2,000 litre for private use are not eligible.) note: ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this.

Fuel Tax Credits Calculation Worksheet

There are three steps to calculate your fuel tax credits using our worksheet step 1: Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. (2,000 litre for private use are not eligible.) note: You must be registered for gst and. ** this rate accounts for the road user charge (which is subject.

Fuel Tax Credit Calculation Sheet

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out your eligible quantities work out how much fuel. Leave blank for hhh to. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. (2,000.

Fuel Tax Credit Calculation Worksheet

Use this worksheet to help you calculate your fuel tax credits and claim them on your bas. Work out your eligible quantities work out how much fuel. ** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Amount must be converted into dollars..

Fuel Tax Credits 2024 Pdf Vonni Susana

Amount must be converted into dollars. (2,000 litre for private use are not eligible.) note: There are three steps to calculate your fuel tax credits using our worksheet step 1: Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Leave blank for hhh to.

Fuel Tax Credits Calculation Worksheet

Work out your eligible quantities work out how much fuel. Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement (bas). You must be registered for gst and. (2,000 litre for private use are not eligible.) note: ** this rate accounts for the road user charge (which is subject to change).

Fuel Tax Credits 2024 Jacqui Nissie

There are three steps to calculate your fuel tax credits using our worksheet step 1: Work out your eligible quantities work out how much fuel. Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. (2,000 litre for private use are not eligible.) note: Amount must be converted into dollars.

(2,000 Litre For Private Use Are Not Eligible.) Note:

Learn how to calculate and claim fuel tax credits for your business activity statement using this worksheet. Work out your eligible quantities work out how much fuel. There are three steps to calculate your fuel tax credits using our worksheet step 1: Use this worksheet to help you calculate your fuel tax credits and claim them on your bas.

Leave Blank For Hhh To.

** this rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public. Amount must be converted into dollars. You must be registered for gst and. Use this worksheet to help you calculate your fuel tax credits and claim them on your business activity statement (bas).