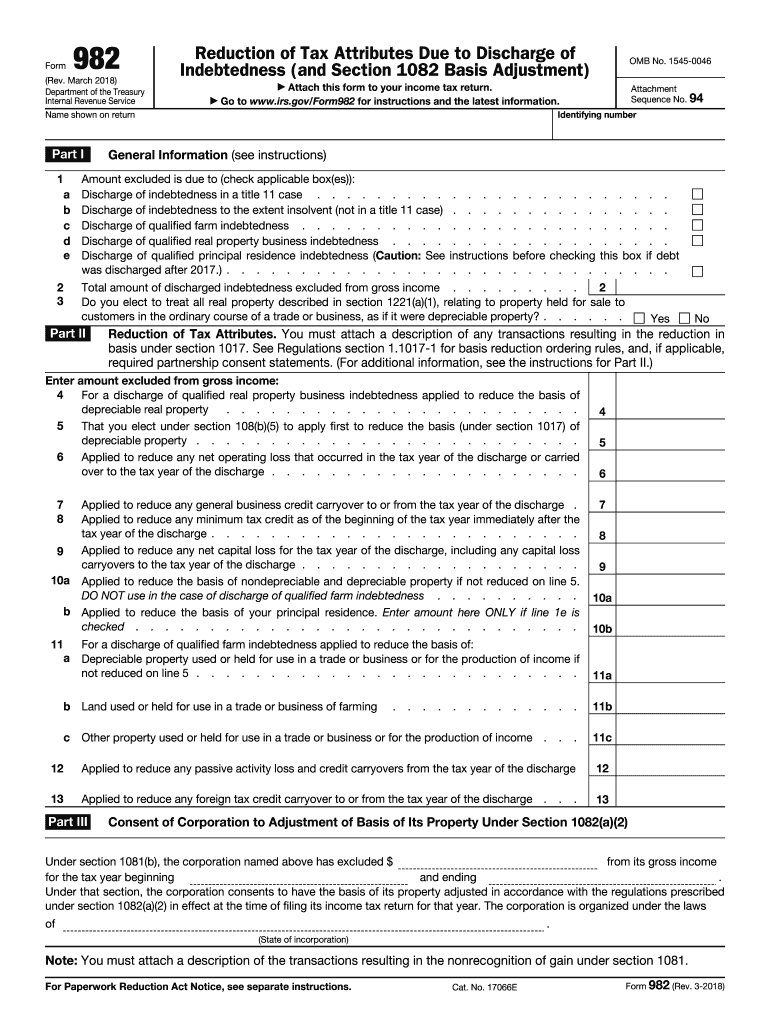

Form 982 Insolvency Worksheet - Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Include the amount of canceled. Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. It shows how to add up your assets and liabilities and. This worksheet helps you calculate your insolvency status for tax purposes. There are 4 steps to ensure that your income is excluded:

Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. This worksheet helps you calculate your insolvency status for tax purposes. It shows how to add up your assets and liabilities and. Include the amount of canceled. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. There are 4 steps to ensure that your income is excluded:

Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. It shows how to add up your assets and liabilities and. There are 4 steps to ensure that your income is excluded: Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. This worksheet helps you calculate your insolvency status for tax purposes.

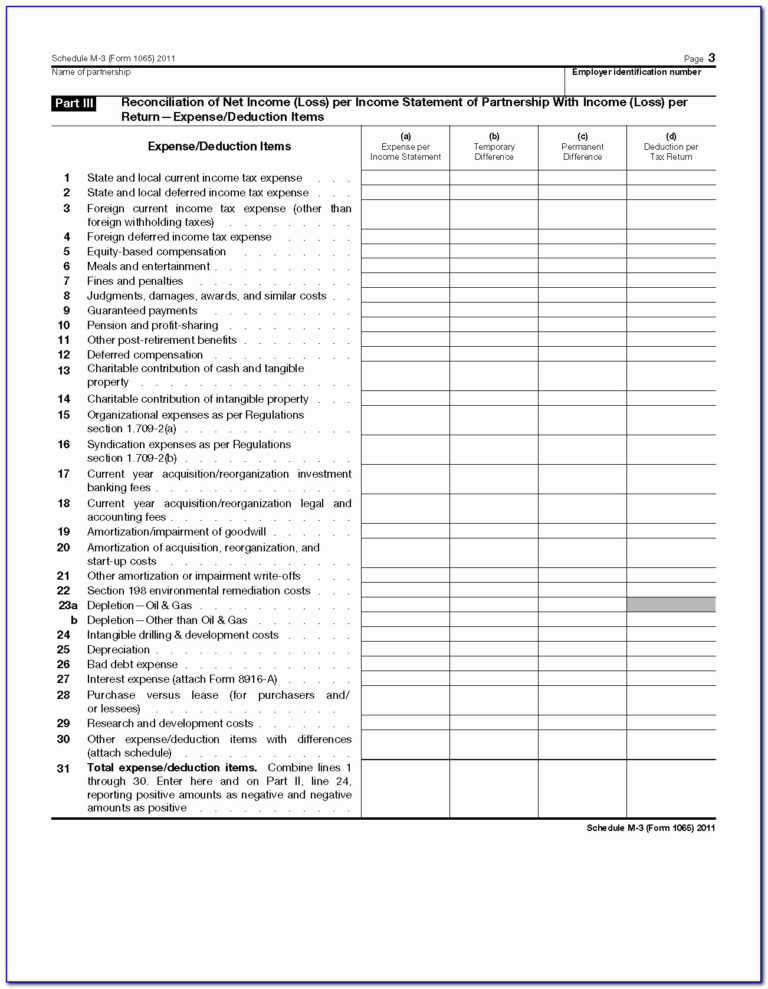

Irs Form 982 For Dummies US Legal Forms Worksheets Library

This worksheet helps you calculate your insolvency status for tax purposes. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. There are 4 steps to ensure that your income is excluded: Include the amount.

Irs Form 982 For Dummies US Legal Forms Worksheets Library

Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. This worksheet helps you calculate your insolvency status for tax purposes. Include the amount of canceled. It shows how to add up your assets and liabilities and. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting.

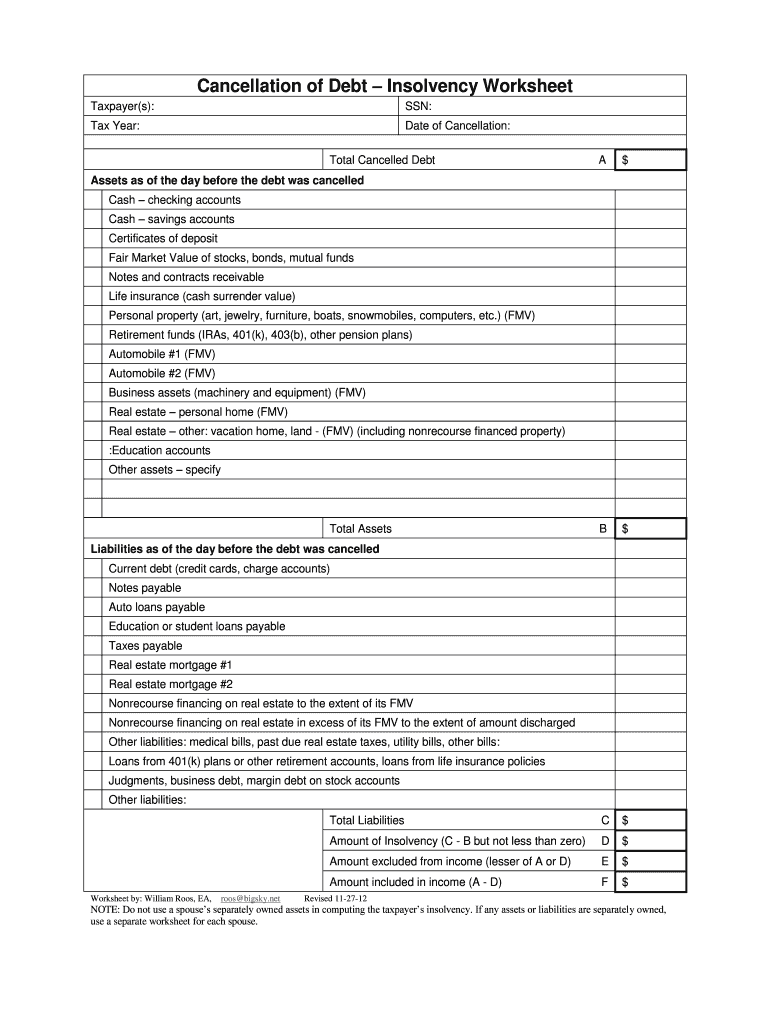

Fillable Insolvency Worksheet Irs

Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. It shows how to add up your assets and liabilities and. This worksheet helps you calculate your insolvency status for tax.

982 Form Insolvency Worksheet Worksheets Library

It shows how to add up your assets and liabilities and. This worksheet helps you calculate your insolvency status for tax purposes. Include the amount of canceled. Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Form 982 is used to find the discharged indebtedness amount that can be excluded from.

Fillable Insolvency Irs ≡ Fill Out Printable PDF Forms Online

It shows how to add up your assets and liabilities and. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. Attach form 982 to your federal income tax return for 2024 and check the box on.

10++ Form 982 Insolvency Worksheet Worksheets Decoomo

There are 4 steps to ensure that your income is excluded: Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled. Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. It shows how to add up your assets and.

Insolvency Worksheet Form 982

There are 4 steps to ensure that your income is excluded: Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Include the amount of canceled. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled. It shows how to add up your assets and liabilities and.

Insolvency worksheet Fill out & sign online DocHub Worksheets Library

Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled. This worksheet helps you calculate your insolvency status for tax purposes. There are 4 steps to ensure that your income is excluded: Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting.

Fillable Online Cancellation of Debt Insolvency Worksheet Fax Email

Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled. There are 4 steps to ensure that your income is excluded: This worksheet helps you calculate your insolvency status for tax purposes. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting.

Insolvency Worksheet Form 982

There are 4 steps to ensure that your income is excluded: This worksheet helps you calculate your insolvency status for tax purposes. It shows how to add up your assets and liabilities and. Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Include the amount of canceled.

It Shows How To Add Up Your Assets And Liabilities And.

There are 4 steps to ensure that your income is excluded: Include the amount of canceled. Attach form 982 to your federal income tax return for 2024 and check the box on line 1d. Learn how to accurately complete form 982 with insights on documentation, calculating insolvency, and reporting canceled.

This Worksheet Helps You Calculate Your Insolvency Status For Tax Purposes.

Form 982 is used to find the discharged indebtedness amount that can be excluded from gross income.