Form 941 X Worksheet 2 - When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs.

Form 941x Worksheet 2

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

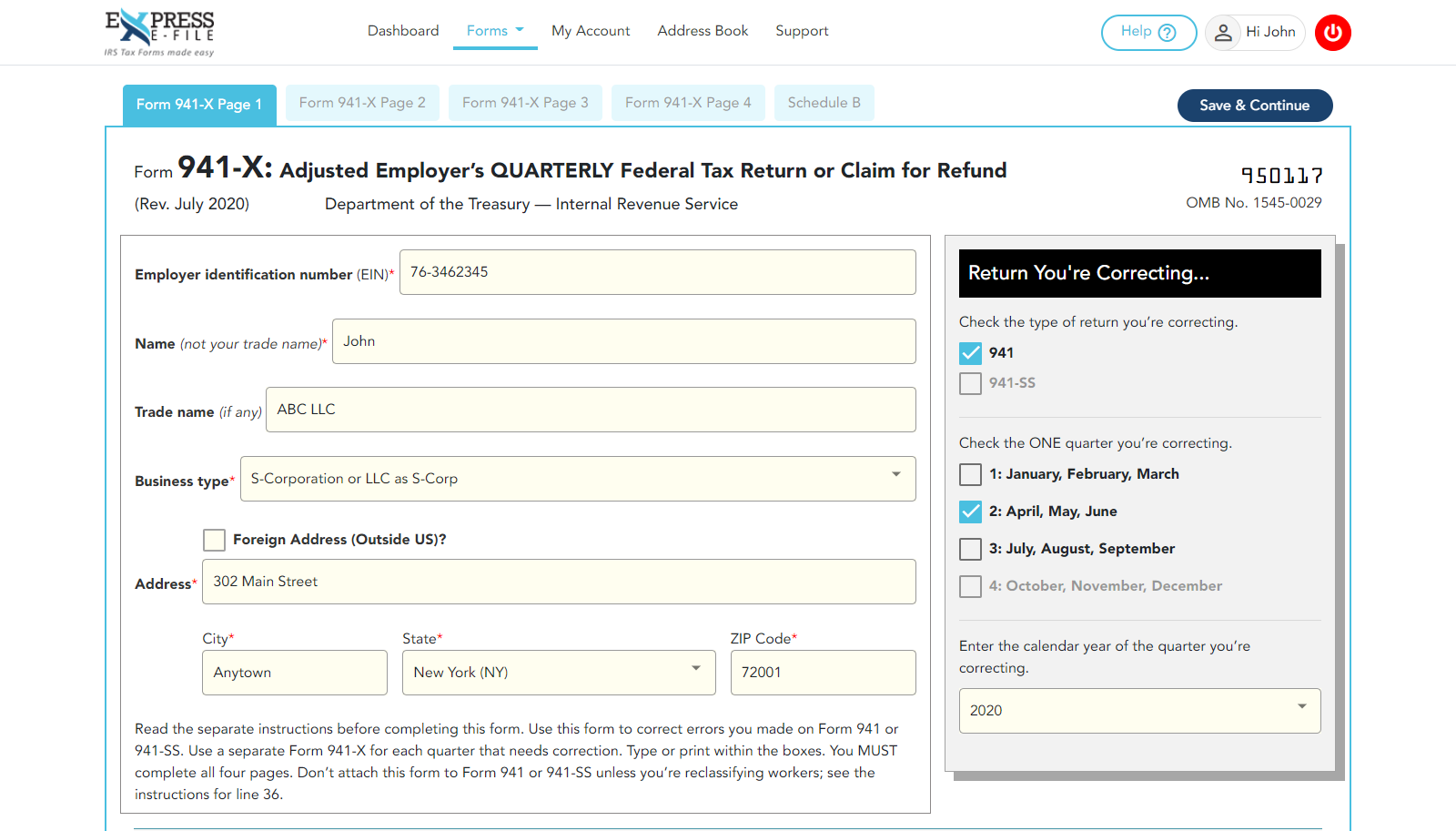

Create And Download Form 941 X Fillable And Printable

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

941 X Worksheet 2 Excel

You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs.

Form 941x Worksheet 2

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

Irs Form 941x 2020 Worksheet 2

You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs.

941 X Worksheet 2 Fillable Form Worksheets Printable Free

You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,. When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs.

IRS Form 941X Fill Out, Sign Online and Download Fillable PDF

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

941 X Worksheet 2 Instructions

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

941 X Worksheet 2 Fillable Form Fillable Form 2023

When preparing form 941 for the year 2022, you must use two worksheets to ensure accurate reporting and compliance with irs. You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.

When Preparing Form 941 For The Year 2022, You Must Use Two Worksheets To Ensure Accurate Reporting And Compliance With Irs.

You must use this worksheet if you claimed the employee retention credit for qualified wages paid after march 12, 2020, and before july 1, 2021,.