Form 5471 Worksheet A - Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Information about form 5471, information return of u.s.

Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. Complete a separate form 5471 and all. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return.

You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s.

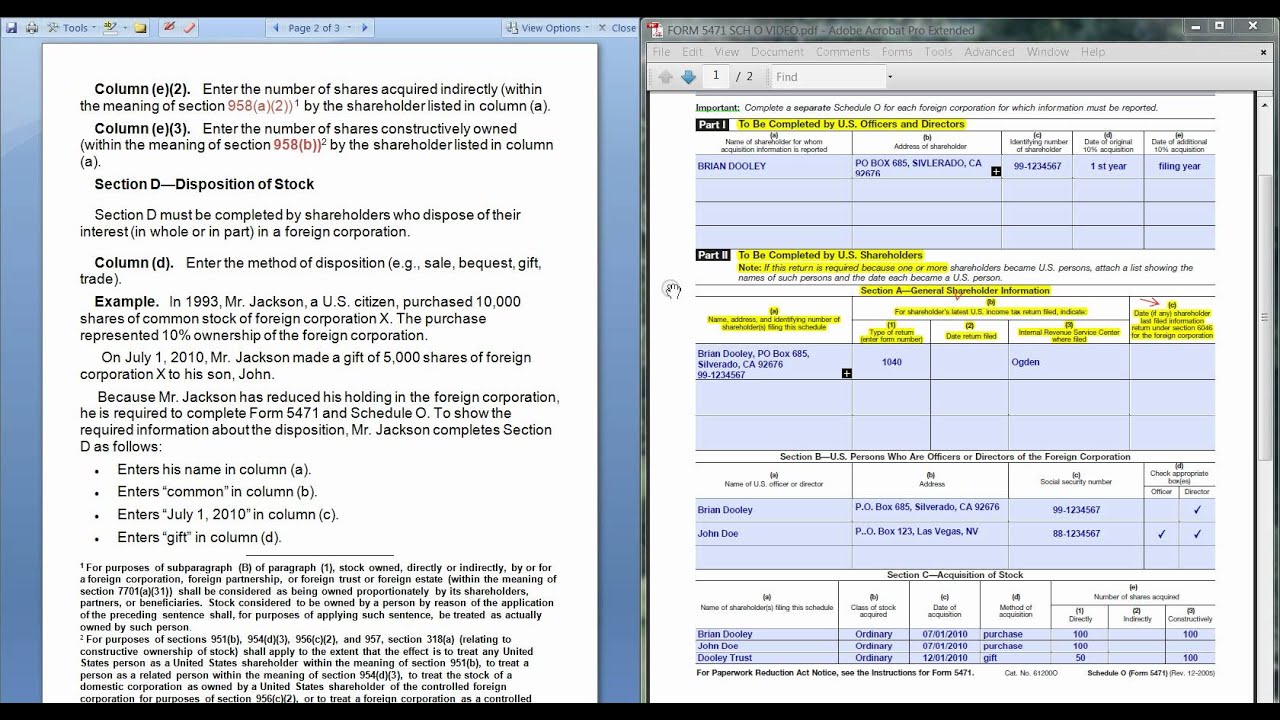

Form 5471 Schedule O Section E Instructions Form example download

You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Persons with respect to certain foreign corporations, including recent updates, related. Complete a separate form 5471 and all. Information about form 5471, information return of u.s. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of.

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. You must complete the appropriate sections in this.

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. You must complete the appropriate sections in this worksheet to generate form 5471 with a.

IRS Form 5471 Instructions CFC Tax Reporting for U.S. Persons

Information about form 5471, information return of u.s. You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Complete a separate form 5471 and all. Persons.

IRS Issues Updated New Form 5471 What's New?

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information return of u.s. You must complete the appropriate sections in this.

Substantial Compliance Form 5471 HTJ Tax

Information about form 5471, information return of u.s. You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Complete a separate form 5471 and all. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Persons.

Form 5471 Worksheet A Printable And Enjoyable Learning

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Persons with respect to certain foreign corporations, including recent updates, related. Information about form 5471, information.

5471 Worksheet A Filing Form 5471 Everything You Need To Kn

Persons with respect to certain foreign corporations, including recent updates, related. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Information about form 5471, information.

Form 5471 Fill out & sign online DocHub

Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa). Information about form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related. You must complete the appropriate sections in this worksheet to generate form 5471 with a.

Form 5471 Filing Requirements with Your Expat Taxes

Information about form 5471, information return of u.s. Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of.

Information About Form 5471, Information Return Of U.s.

You must complete the appropriate sections in this worksheet to generate form 5471 with a federal business return. Complete a separate form 5471 and all. Persons with respect to certain foreign corporations, including recent updates, related. Form 5471 questionare if you, as a us citizen or resident, own 10% or more of a foreign corporation (a corporation organized outside of the usa).