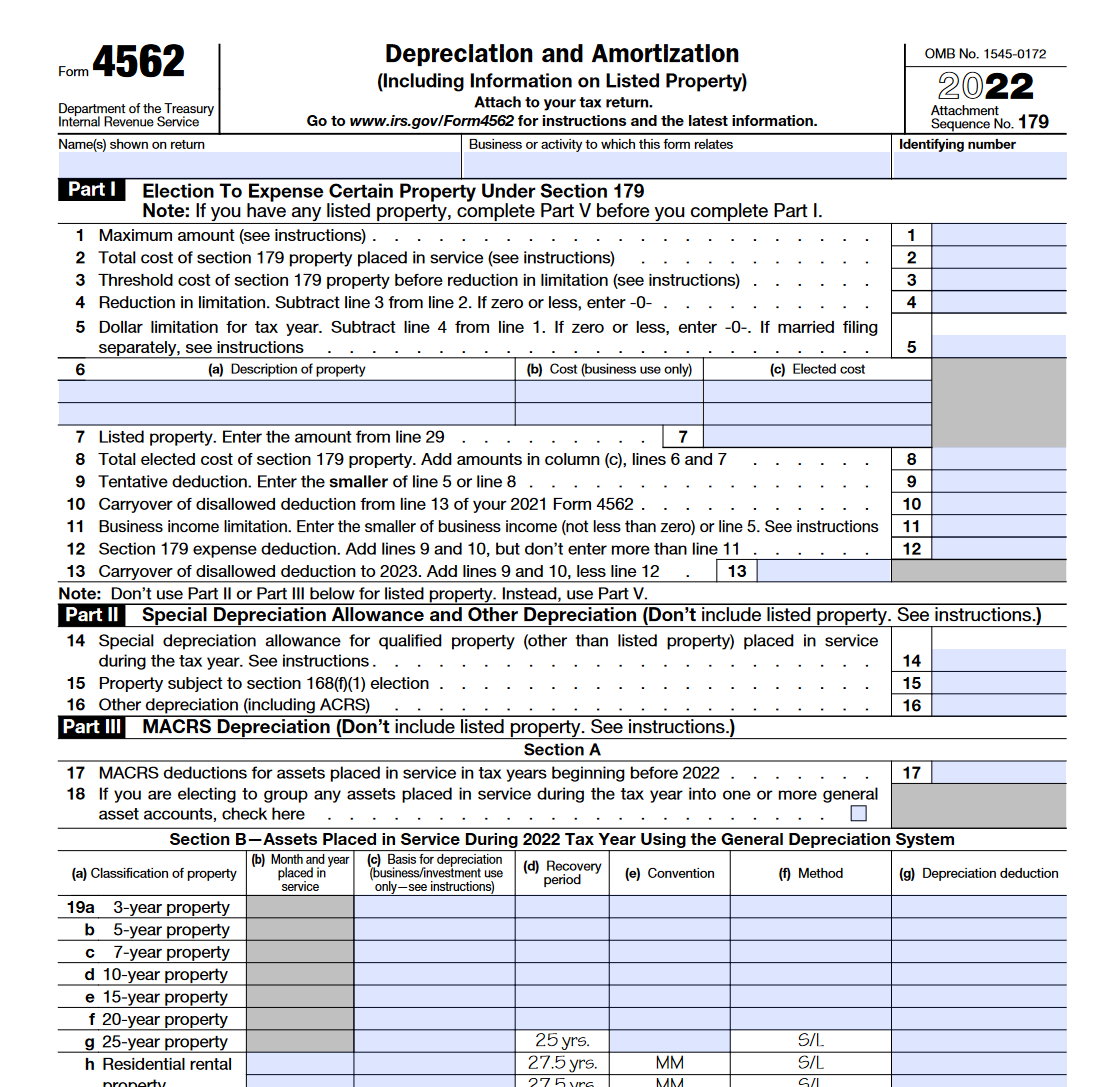

Form 4562 Depreciation And Amortization Worksheet - You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Make the election under section 179 to expense certain property.

Make the election under section 179 to expense certain property. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Claim your deduction for depreciation and amortization. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records.

Claim your deduction for depreciation and amortization. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Make the election under section 179 to expense certain property.

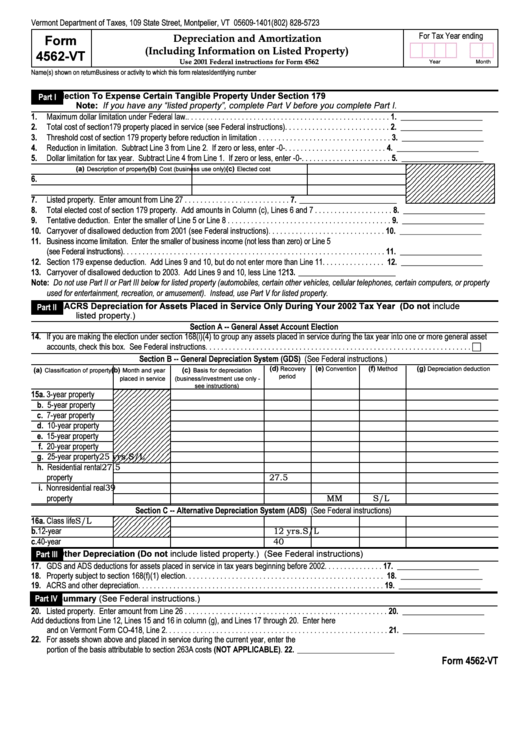

IRS Form 4562. Depreciation and Amortization Forms Docs 2023

You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf).

IRS Form 4562 Download Fillable PDF or Fill Online Depreciation and

You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Make the election under section 179 to expense certain property. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Claim your deduction for depreciation and amortization.

Form 4562 depreciation and amortization worksheet Fill online

You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf).

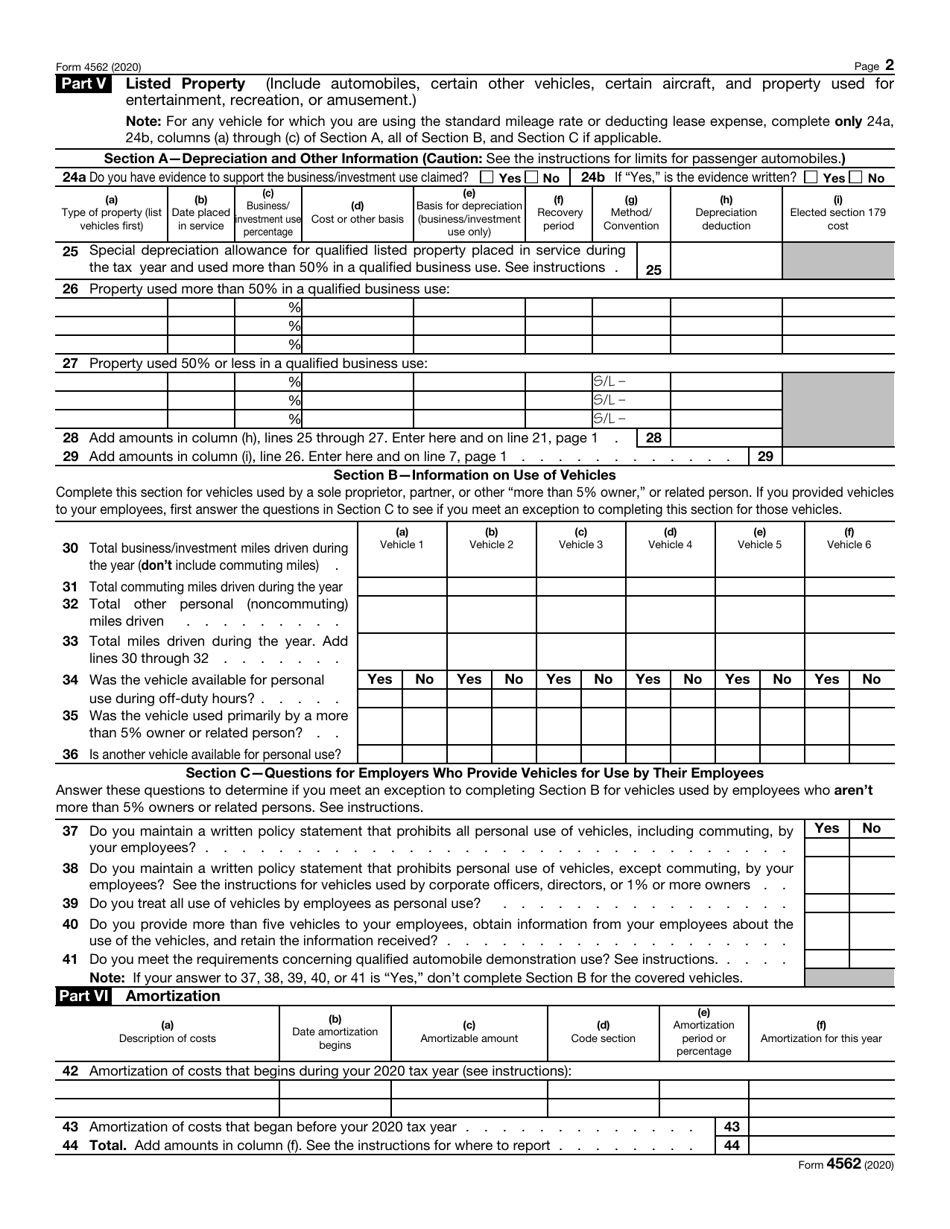

Irs Form 4562 Depreciation Worksheet Worksheets For Kindergarten

Make the election under section 179 to expense certain property. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Claim your deduction for depreciation and amortization. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf).

IRS Form 4562 Instructions Depreciation & Amortization

Claim your deduction for depreciation and amortization. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Make the election under section 179 to expense certain property. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf).

Instructions for Form 4562 (2024) Internal Revenue Service

Make the election under section 179 to expense certain property. Claim your deduction for depreciation and amortization. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). You may use the depreciation worksheet, later, to assist you in maintaining depreciation records.

Fill Free fillable Form 4562 2019 Depreciation and Amortization PDF form

Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Claim your deduction for depreciation and amortization. Make the election under section 179 to expense certain property. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records.

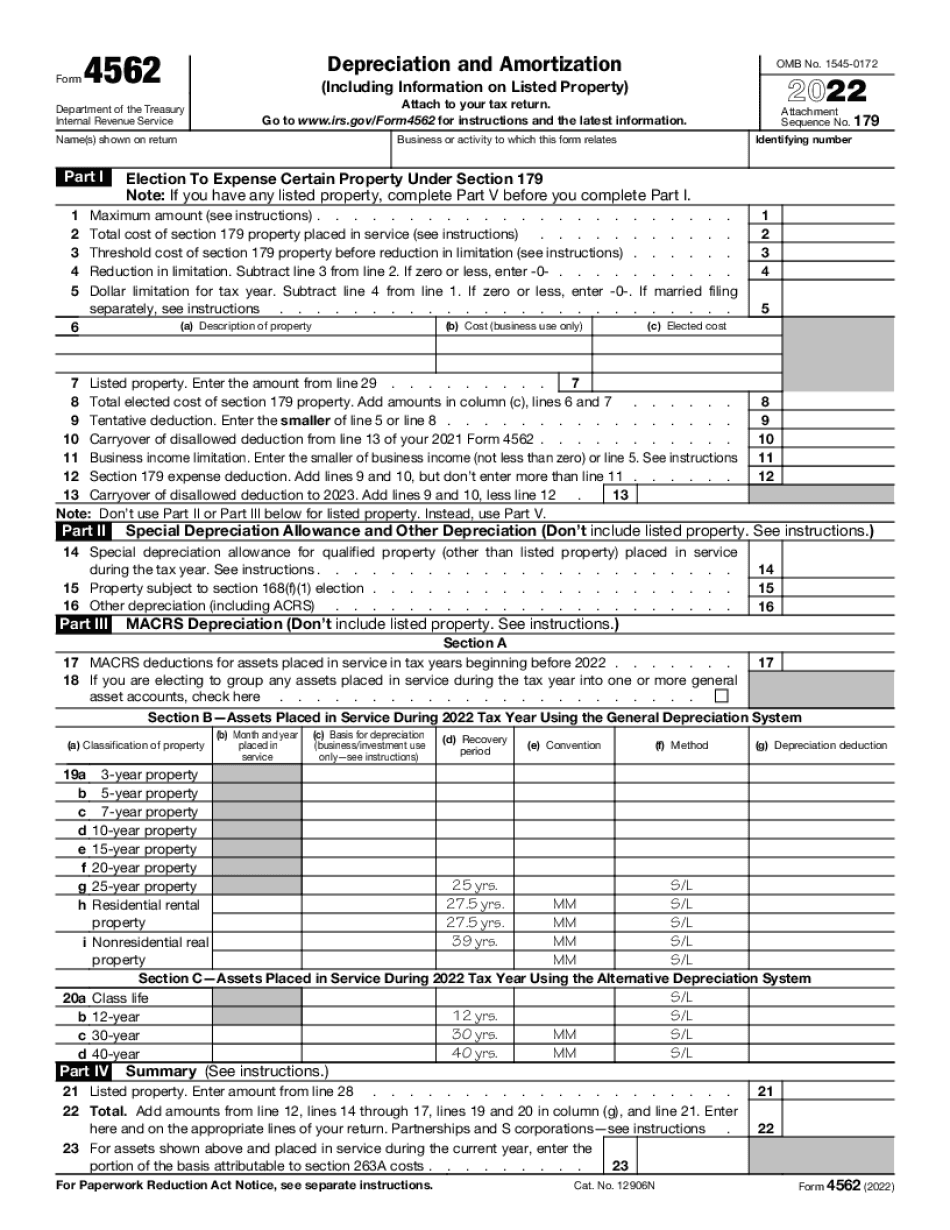

Form 4562 depreciation and amortization worksheet Fill online

Make the election under section 179 to expense certain property. Claim your deduction for depreciation and amortization. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf).

Form 4562 Depreciation And Amortization Worksheet

Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Claim your deduction for depreciation and amortization. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Make the election under section 179 to expense certain property.

Form 4562 Depreciation And Amortization Worksheet

Make the election under section 179 to expense certain property. Claim your deduction for depreciation and amortization. Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). You may use the depreciation worksheet, later, to assist you in maintaining depreciation records.

Make The Election Under Section 179 To Expense Certain Property.

Yes, if you filed your tax return with turbotax last year, you will find this report as part of your complete tax return (pdf). Claim your deduction for depreciation and amortization. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records.