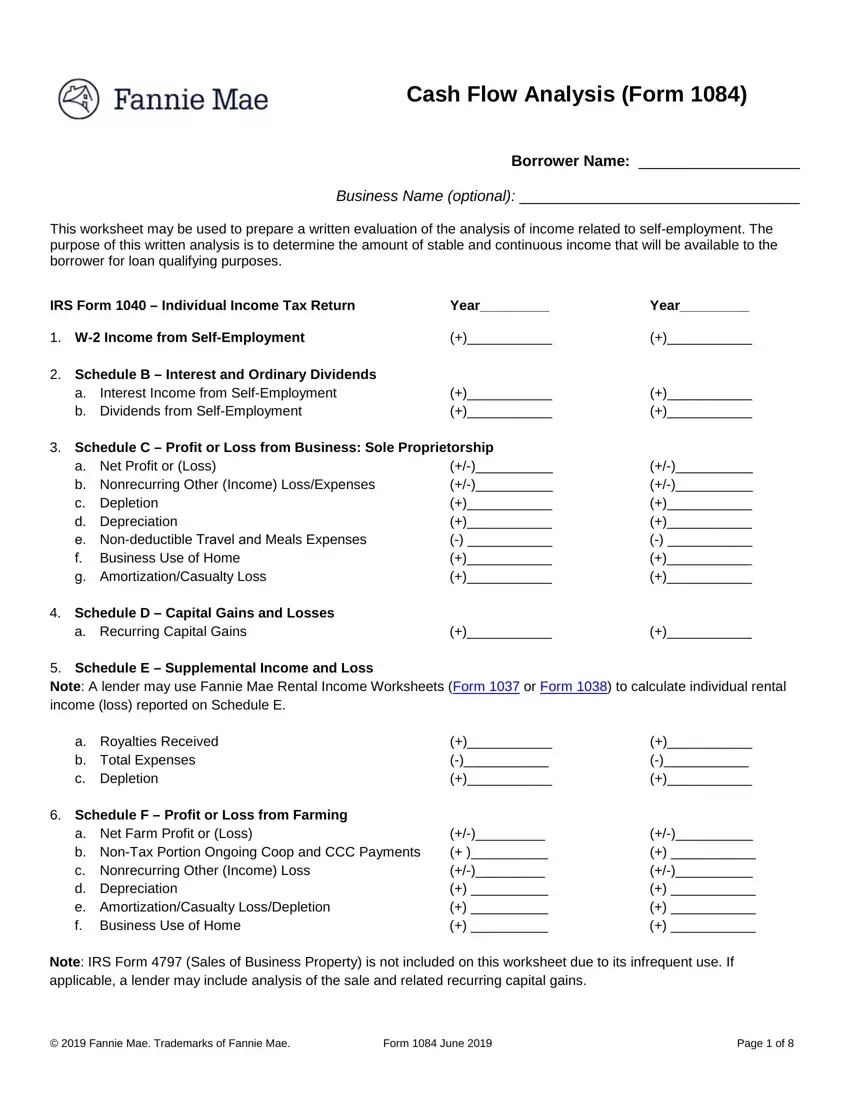

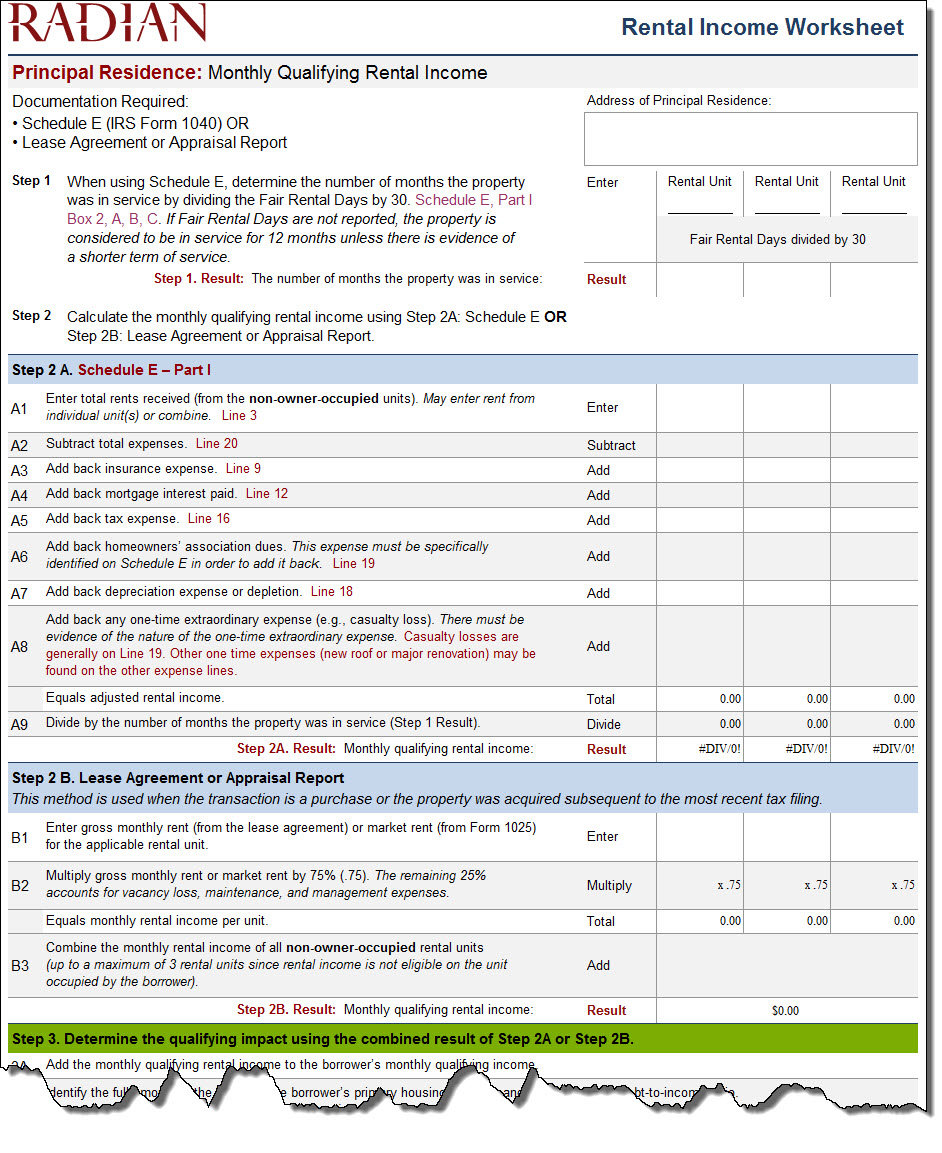

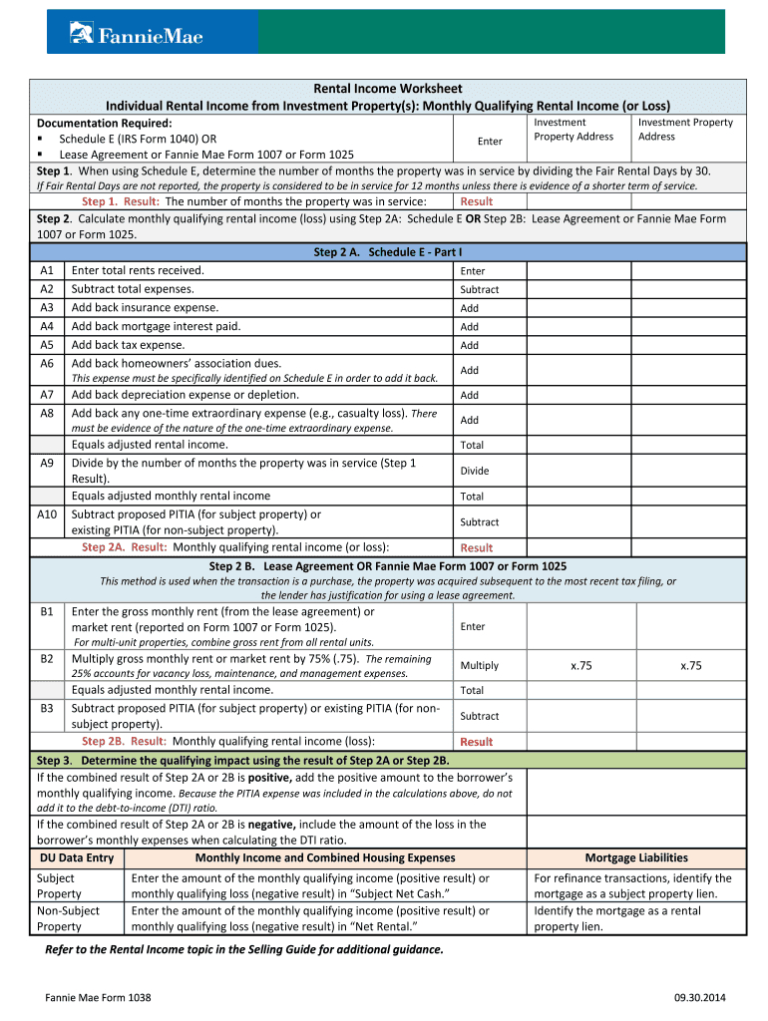

Fannie Mae Income Worksheet - Fannie mae publishes four worksheets that lenders may use to calculate rental income. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the. Calculate the monthly qualifying income for a borrower who is a sole proprietor. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. The purpose of this written. Our income analysis tools, job aids and worksheets are. Use of these worksheets is optional. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up.

Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up. Calculate the monthly qualifying income for a borrower who is a sole proprietor. The purpose of this written. Our income analysis tools, job aids and worksheets are. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Fannie mae publishes four worksheets that lenders may use to calculate rental income. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the. Use of these worksheets is optional.

Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Fannie mae publishes four worksheets that lenders may use to calculate rental income. Calculate the monthly qualifying income for a borrower who is a sole proprietor. The purpose of this written. Use of these worksheets is optional. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up. Our income analysis tools, job aids and worksheets are. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the.

Fnma Rental Worksheets

A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the.

Fannie Mae Calculation Worksheets

Use of these worksheets is optional. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up. The purpose of this written. Our income analysis tools, job aids and worksheets are. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to.

Fannie Mae Rental Worksheet 2023

Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the. Use of these worksheets is optional. Calculate the monthly qualifying income for a borrower who is a sole.

Fannie Mae Rental Calc Worksheet

Calculate the monthly qualifying income for a borrower who is a sole proprietor. Fannie mae publishes four worksheets that lenders may use to calculate rental income. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Use of these worksheets is optional. Fannie mae’s income calculator provides a.

Fannie Mae Self Employed Worksheet Fill and Sign

Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Use of these worksheets is optional. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Our income analysis tools, job aids and worksheets are. The.

Fannie Mae Schedule C Guidelines

Our income analysis tools, job aids and worksheets are. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Calculate the monthly qualifying income for a.

Calculation Worksheets Fannie Mae

A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. The purpose of this written. Use this worksheet to calculate qualifying rental income for fannie mae.

Fannie Mae Rental Calc Worksheet

Our income analysis tools, job aids and worksheets are. Fannie mae publishes four worksheets that lenders may use to calculate rental income. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income.

Fannie Mae Calculation Worksheet

Calculate the monthly qualifying income for a borrower who is a sole proprietor. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Our income analysis tools, job aids and worksheets are. Use of these worksheets is optional. Fannie mae’s income calculator provides a more efficient and accurate.

Fannie Mae Rental Worksheets

Calculate the monthly qualifying income for a borrower who is a sole proprietor. Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up. A lender may use fannie mae.

Calculate The Monthly Qualifying Income For A Borrower Who Is A Sole Proprietor.

The purpose of this written. Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be. Use of these worksheets is optional. Use this worksheet to calculate qualifying rental income for fannie mae form 1038 (individual rental income from investment property (s) (up.

Our Income Analysis Tools, Job Aids And Worksheets Are.

Fannie mae’s income calculator provides a more efficient and accurate way to calculate income while increasing the certainty of the. A lender may use fannie mae rental income worksheets (form 1037 or form 1038) or a comparable form to calculate individual rental. Fannie mae publishes four worksheets that lenders may use to calculate rental income.