Energy Efficient Home Improvement Credit Limit Worksheet - Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

How Energy Efficient Is Your Home? Worksheet

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

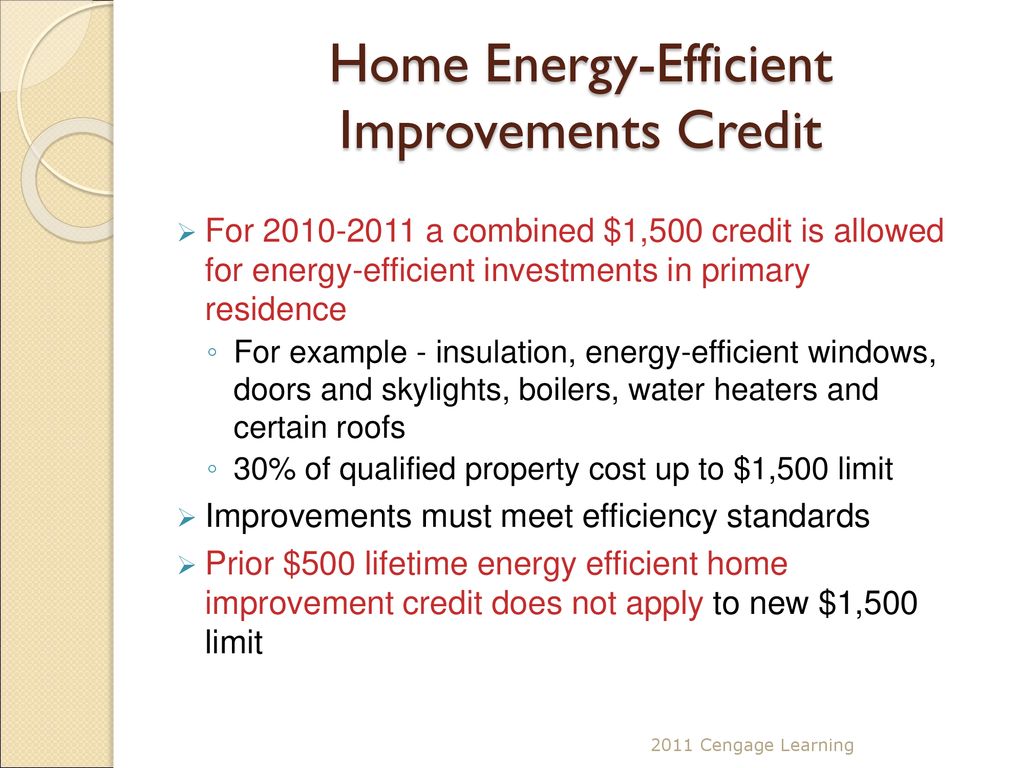

CHAPTER 6 Credits & Special Taxes ppt download

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

2024 Federal Tax Credits For Energy Efficient Home Improvements Aleen

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

Household Worksheet Form Energy Assistance

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

Lifetime Limitation Worksheet Instructions

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

Energy Efficient Home Improvement Credit Calculator 2023

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

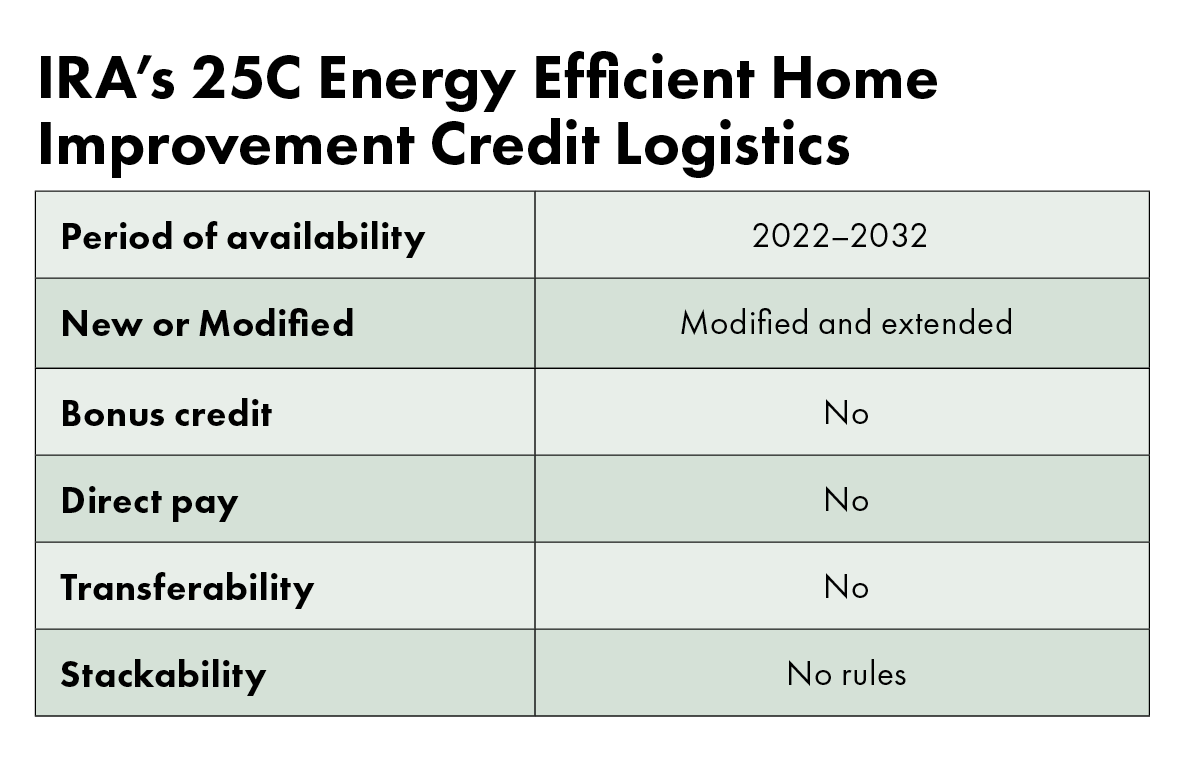

IRA’s 25C Energy Efficient Home Improvement Credit Just the Basics

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

2023 Schedule 8812 Credit Limit Worksheet A

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

Residential Energy Efficient Property Credit Limit Worksheet

Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax. Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.

Energy Efficient Home Improvement Credit Limit Worksheet

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property. Residential energy credits as a stand alone tax form calculator to quickly calculate specific amounts for your 2025 tax.

Residential Energy Credits As A Stand Alone Tax Form Calculator To Quickly Calculate Specific Amounts For Your 2025 Tax.

Learn how to claim the energy efficient home improvement credit for qualified energy efficiency improvements and residential energy property.