Double Calendar Spreads - Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series; What strikes, expiration's and vol spreads work best. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously.

What strikes, expiration's and vol spreads work best. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series; A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously.

A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series; What strikes, expiration's and vol spreads work best.

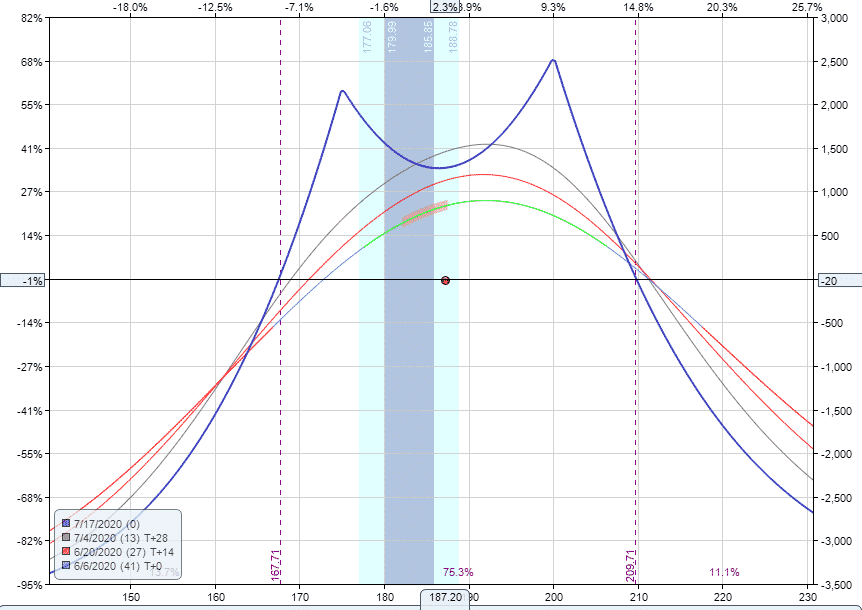

Double Calendar Spreads Ultimate Guide With Examples

A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. What strikes, expiration's and vol spreads work best. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series;

Double Calendar Spread Strategy Printable Word Searches

A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series; What strikes, expiration's and vol spreads work best.

Double Calendar Spreads Ultimate Guide With Examples

A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. What strikes, expiration's and vol spreads work best. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series;

Double Calendar Spreads Ultimate Guide With Examples

What strikes, expiration's and vol spreads work best. Learn how to effectively trade double calendars with my instructional video series; Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously.

Double Calendar Spread Options Infographic Poster

What strikes, expiration's and vol spreads work best. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series;

Double Calendar Spreads Ultimate Guide With Examples

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. What strikes, expiration's and vol spreads work best. Learn how to effectively trade double calendars with my instructional video series; A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously.

Double Calendar Spreads Ultimate Guide With Examples

Learn how to effectively trade double calendars with my instructional video series; Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. What strikes, expiration's and vol spreads work best.

Double Calendar Spread Adjustment videos link in Description

What strikes, expiration's and vol spreads work best. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. Learn how to effectively trade double calendars with my instructional video series; A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously.

Double Calendar Spreads Ultimate Guide With Examples

Learn how to effectively trade double calendars with my instructional video series; Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. What strikes, expiration's and vol spreads work best.

Calendar and Double Calendar Spreads

A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. What strikes, expiration's and vol spreads work best. Learn how to effectively trade double calendars with my instructional video series;

Learn How To Effectively Trade Double Calendars With My Instructional Video Series;

Setting up a double calendar spread involves selecting underlying assets, choosing strike prices, and determining expiration dates. A double calendar spread is an options trading strategy that involves buying and selling two calendar spreads simultaneously. What strikes, expiration's and vol spreads work best.