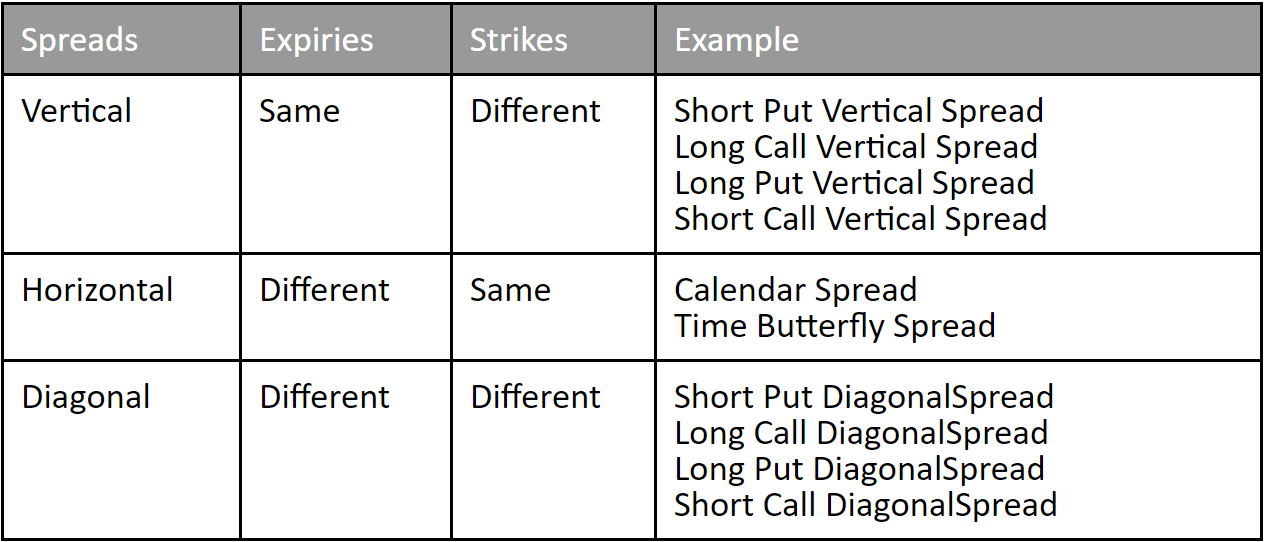

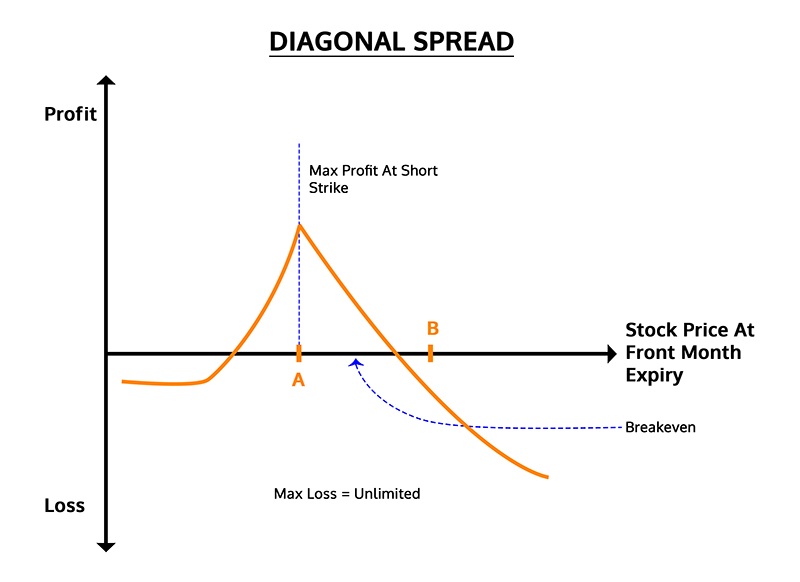

Diagonal Calendar Spread - A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Diagonal Spreads Unofficed

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Trading Calendar and Diagonal Spreads l Options Trading YouTube

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

DIAGONAL WEEKLY CALENDAR WITH ADJUSTMENTS WEEKLY CALENDAR SPREAD

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Calendar Spread & Diagonal Spread Strategy, Pros & Cons, Real Examples

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

DOUBLE DIAGONAL CALENDAR SPREAD STRATEGY TRADING PLUS YouTube

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

The Ultimate Guide to Options Trading Strategies IMS Proschool

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Diagonal Spread Options Trading Strategy In Python

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Diagonal Calendar Spread Option Strategy Printable Word Searches

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price. Both a diagonal spread & calendar spread allow option traders to collect premium and time decay.

Option Basics Strategy Ultimate Guide to Calendar & Diagonal

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

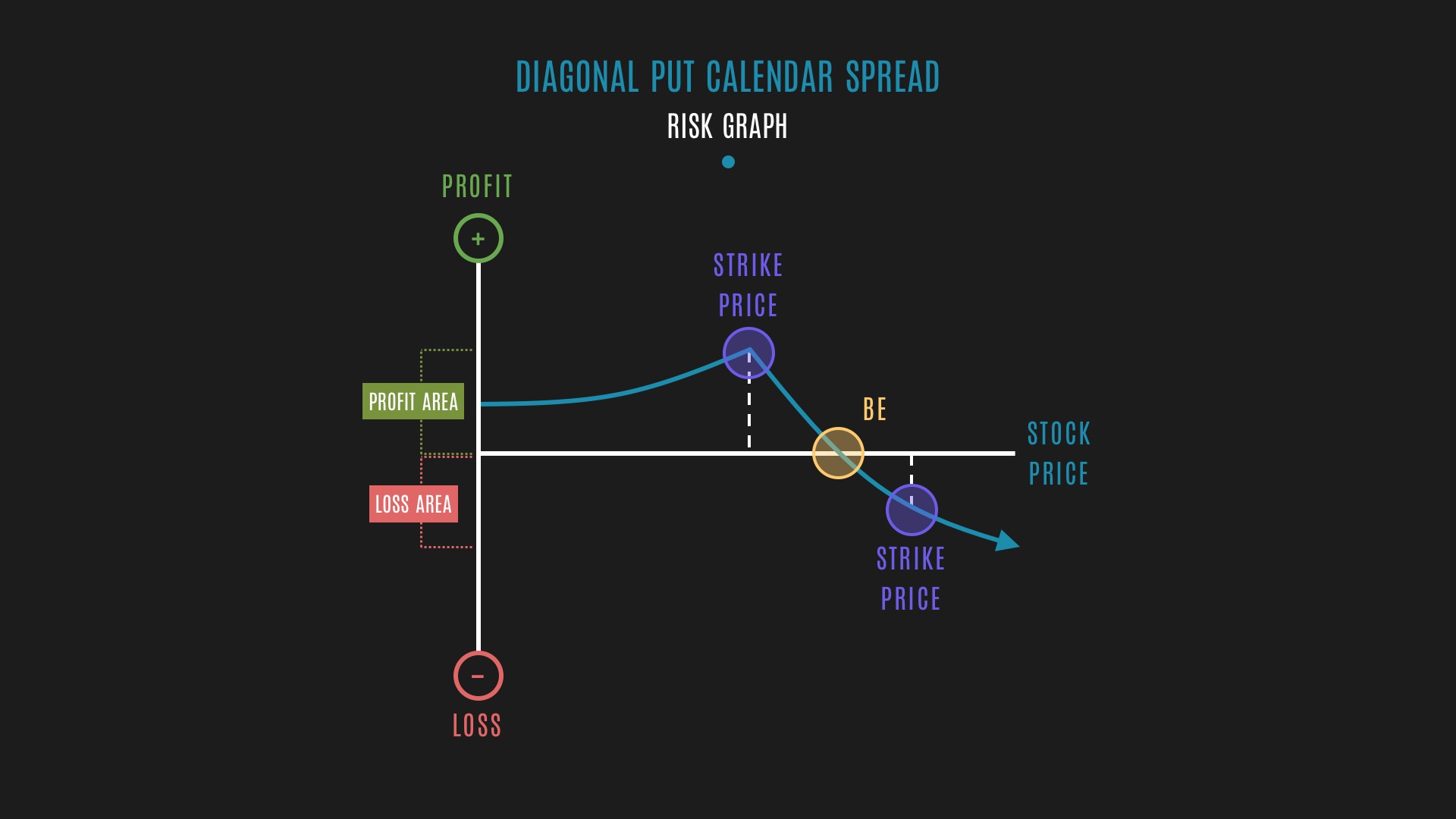

Glossary Diagonal Put Calendar Spread example Tackle Trading

Both a diagonal spread & calendar spread allow option traders to collect premium and time decay. A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.

Both A Diagonal Spread & Calendar Spread Allow Option Traders To Collect Premium And Time Decay.

A diagonal spread, also called a calendar spread, involves holding an options position with different expiration dates but the same strike price.