California Itemized Deduction Worksheet - If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or. Itemized deductions are expenses that you can claim on your tax return. To figure your standard deduction, use the california standard deduction worksheet for dependents. They can decrease your taxable income. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Please ask if you are unsure or have any. If you do not plan to itemize your.

Please ask if you are unsure or have any. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Itemized deductions are expenses that you can claim on your tax return. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. If you do not plan to itemize your. To figure your standard deduction, use the california standard deduction worksheet for dependents. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. They can decrease your taxable income.

Please ask if you are unsure or have any. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or. If you do not plan to itemize your. To figure your standard deduction, use the california standard deduction worksheet for dependents. Itemized deductions are expenses that you can claim on your tax return. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. They can decrease your taxable income.

California Itemized Deductions Worksheets

If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. Please ask if you are unsure or have any. To figure your standard.

Tax And Interest Deduction Worksheet 2022

If you do not plan to itemize your. To figure your standard deduction, use the california standard deduction worksheet for dependents. They can decrease your taxable income. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Complete the itemized deductions worksheet in the instructions for schedule ca.

California Dependent Tax Worksheets

Itemized deductions are expenses that you can claim on your tax return. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. They can decrease your taxable income. If you do not plan to itemize your. Please ask if you are unsure or have any.

California Itemized Deductions Worksheet Fill Online, Printable

Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. Please ask if you are unsure or have any. If you do, you.

Ca Itemized Deduction Worksheet Printable Word Searches

Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or. To figure your standard deduction, use the california standard deduction worksheet for dependents. If you do not plan to itemize your. If you claimed both the mortgage interest certificate on form 8396 and the.

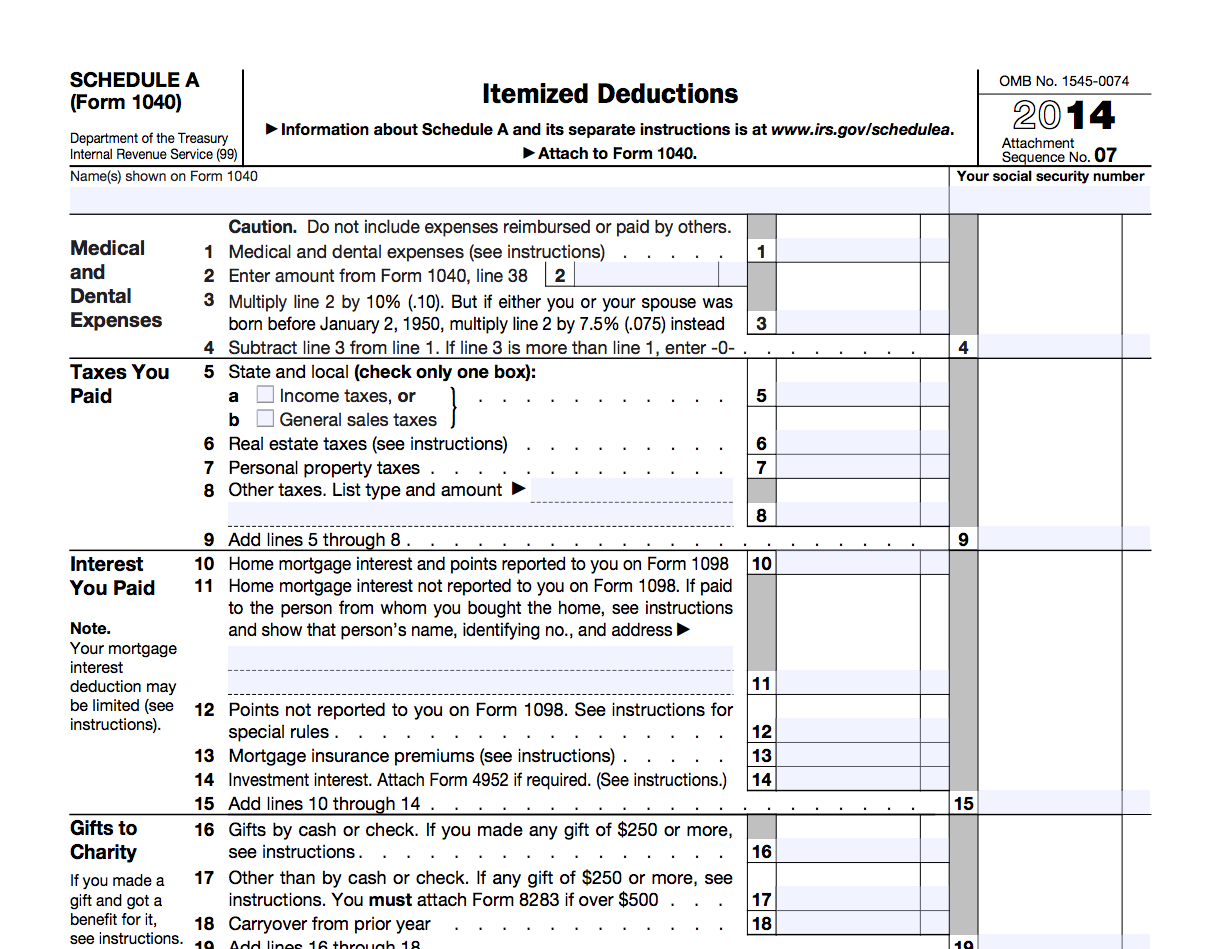

A List Of Itemized Deductions

If you do not plan to itemize your. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Please ask if you are unsure or have any. Itemized deductions are.

A List Of Itemized Deductions

Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. Itemized deductions are expenses that you can claim on your tax return. If you claimed both the mortgage interest certificate on form 8396 and the mortgage interest deduction on schedule a (decreased by the. To.

Itemized Deductions Worksheet Ca 540

To figure your standard deduction, use the california standard deduction worksheet for dependents. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or. If you do not plan to itemize your. They can decrease your taxable income. Please ask if you are unsure or.

California Standard Deduction 2025 Tax Year Kaden Jade

To figure your standard deduction, use the california standard deduction worksheet for dependents. Itemized deductions are expenses that you can claim on your tax return. If you do not plan to itemize your. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Complete the itemized deductions worksheet in the instructions for.

Ca Itemized Deduction Worksheet

They can decrease your taxable income. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. Itemized deductions are expenses that you can claim on your tax return. Please ask if you are unsure or have any. If you do not plan to itemize your.

If You Do Not Plan To Itemize Your.

Please ask if you are unsure or have any. Enter an estimate of your itemized deductions for california taxes for this tax year as listed in the schedules in the ftb form 540 1. If you do, you can use worksheet b to determine whether you are eligible for other withholding allowances. They can decrease your taxable income.

If You Claimed Both The Mortgage Interest Certificate On Form 8396 And The Mortgage Interest Deduction On Schedule A (Decreased By The.

Itemized deductions are expenses that you can claim on your tax return. To figure your standard deduction, use the california standard deduction worksheet for dependents. Complete the itemized deductions worksheet in the instructions for schedule ca (540), line 29 29 30 enter the larger of the amount on line 29 or.