Calendar Call Spread - Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price.

Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. There are two types of calendar spreads:

Additionally, two variations of each type are possible using call or put options. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. There are two types of calendar spreads:

Calendar Spread Calculator Printable Computer Tools

There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Additionally, two variations of each type are possible using call or.

Trading Guide on Calendar Call Spread AALAP

There are two types of calendar spreads: Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to use a calendar spread, an options strategy that.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that.

Calendar Call Spread Options Edge

Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to use a calendar call spread to.

Calendar Call Definition, Purpose, Advantages, and Disadvantages

Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Additionally, two variations of each type are possible using.

Long Call Calendar Spread Strategy Nesta Adelaide

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike.

CALENDARSPREAD Simpler Trading

Additionally, two variations of each type are possible using call or put options. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to.

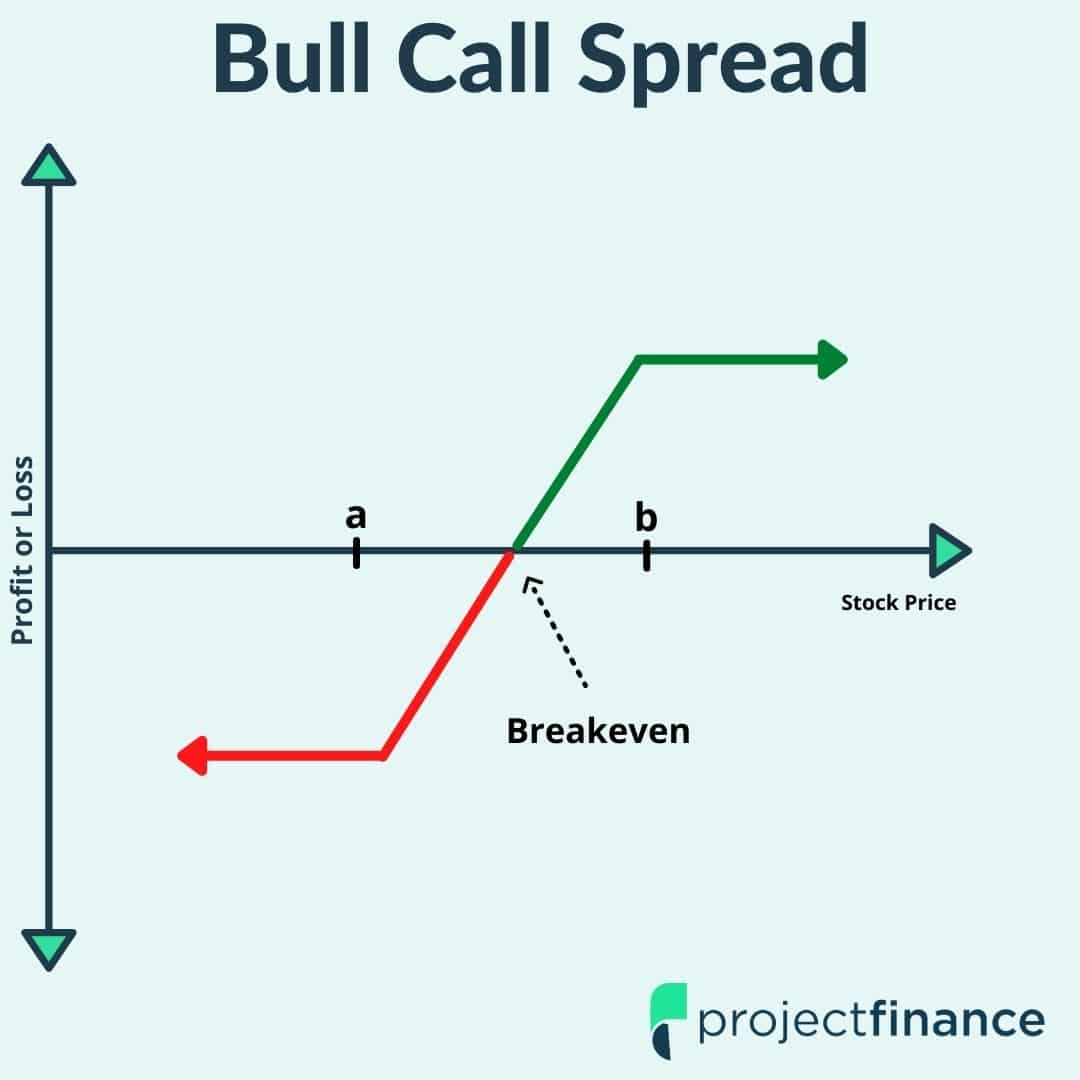

Credit Spread Options Strategies (Visuals and Examples) projectfinance

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different.

Using Calendar Trading and Spread Option Strategies

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. There are two types of calendar spreads: Additionally, two variations of each type are possible using call or.

Calendar Call Spread Mella Siobhan

Learn how to use a calendar call spread to generate a profit when a security doesn't move much in price. Additionally, two variations of each type are possible using call or put options. There are two types of calendar spreads: Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike.

Learn How To Use A Calendar Call Spread To Generate A Profit When A Security Doesn't Move Much In Price.

There are two types of calendar spreads: Additionally, two variations of each type are possible using call or put options. Learn how to use a calendar spread, an options strategy that involves buying and selling contracts at the same strike price but. Learn how to run a calendar spread with calls, selling and buying options with the same strike price but different expiration dates.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Calendar_Trading_and_Spread_Option_Strategies_Nov_2020-01-b1d47a55f4684e1b9d37580d219dc778.jpg)