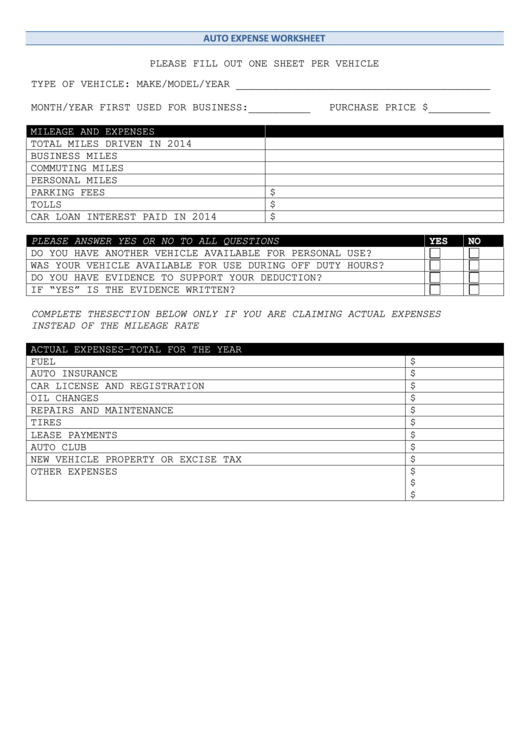

Auto Expense Worksheet - Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. If you want to use the “easy” but. Fill out below only if claiming actual expenses. License plate taxes (car tabs) paid. There are two versions of. Cost of your vehicle (please provide invoice). To claim actual expenses and depreciation or lease payments, we need the following info: * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns.

* please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. There are two versions of. Fill out below only if claiming actual expenses. To claim actual expenses and depreciation or lease payments, we need the following info: If you want to use the “easy” but. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns.

There are two versions of. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. If you want to use the “easy” but. Cost of your vehicle (please provide invoice). Fill out below only if claiming actual expenses. Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. License plate taxes (car tabs) paid. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses.

Auto Expense Worksheet printable pdf download

* please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses..

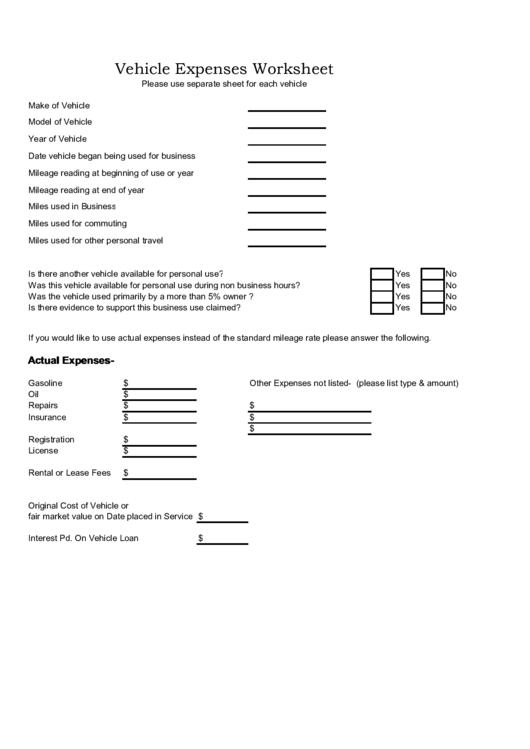

Vehicle Expense Tracker Manage Your Car Expenses Easily

Cost of your vehicle (please provide invoice). There are two versions of. License plate taxes (car tabs) paid. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. To claim actual expenses and depreciation or lease payments, we need the following info:

Car and Truck Expenses Worksheet 4 Free Worksheets Worksheets Library

Fill out below only if claiming actual expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Cost of your vehicle (please provide invoice). Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Auto expense worksheet fill out for both.

Auto Expense Worksheet 2023

Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. There are two versions of. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make.

Vehicle Expense Tracker Manage Your Car Expenses Easily Worksheets

* please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. If you want to use the “easy” but. Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. Please complete this worksheet so that we can calculate the correct.

Auto Expense Worksheet Printable Word Searches

License plate taxes (car tabs) paid. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. There are two versions of. If you want to use the “easy” but. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses.

Vehicle Expenses Worksheet printable pdf download

Fill out below only if claiming actual expenses. License plate taxes (car tabs) paid. Cost of your vehicle (please provide invoice). Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. To claim actual expenses and depreciation or lease payments, we need the following info:

Auto Expense Worksheet Vehicle Expense Spreadsheet Excel Template

Fill out below only if claiming actual expenses. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. If you want to use the “easy” but. To claim actual expenses and depreciation or lease payments, we need the following info: License plate taxes (car tabs) paid.

Car Expenses Excel Spreadsheet Google Spreadshee car expenses excel

Cost of your vehicle (please provide invoice). License plate taxes (car tabs) paid. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. Fill out below only if claiming actual expenses.

13 Free Sample Auto Expense Report Templates Printable Samples

Auto expense worksheet fill out for both mileage & actual expense methods vehicle 1 vehicle 2 year and make of vehicle date. License plate taxes (car tabs) paid. To claim actual expenses and depreciation or lease payments, we need the following info: * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle.

To Claim Actual Expenses And Depreciation Or Lease Payments, We Need The Following Info:

If you want to use the “easy” but. Please complete this worksheet so that we can calculate the correct amount of your auto expense deduction. Please use this worksheet to give us your vehicle expenses and mileage information for preparation of your tax returns. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses.

There Are Two Versions Of.

License plate taxes (car tabs) paid. * please note the irs requires mileage logs to be maintained to substantiate a business deduction for vehicle expenses. Cost of your vehicle (please provide invoice). Fill out below only if claiming actual expenses.