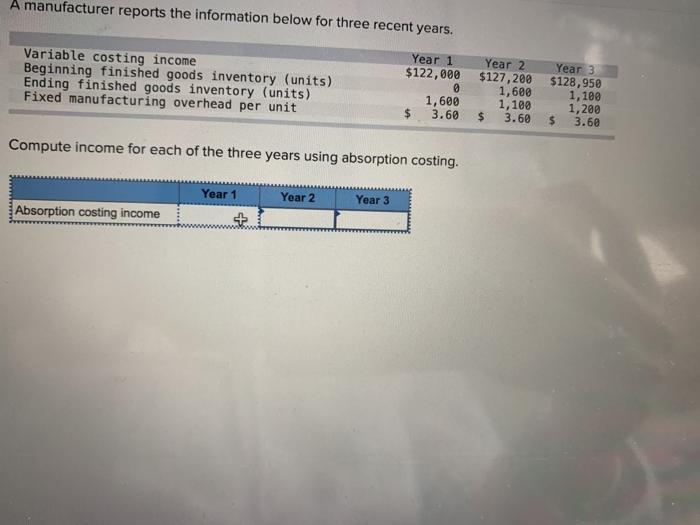

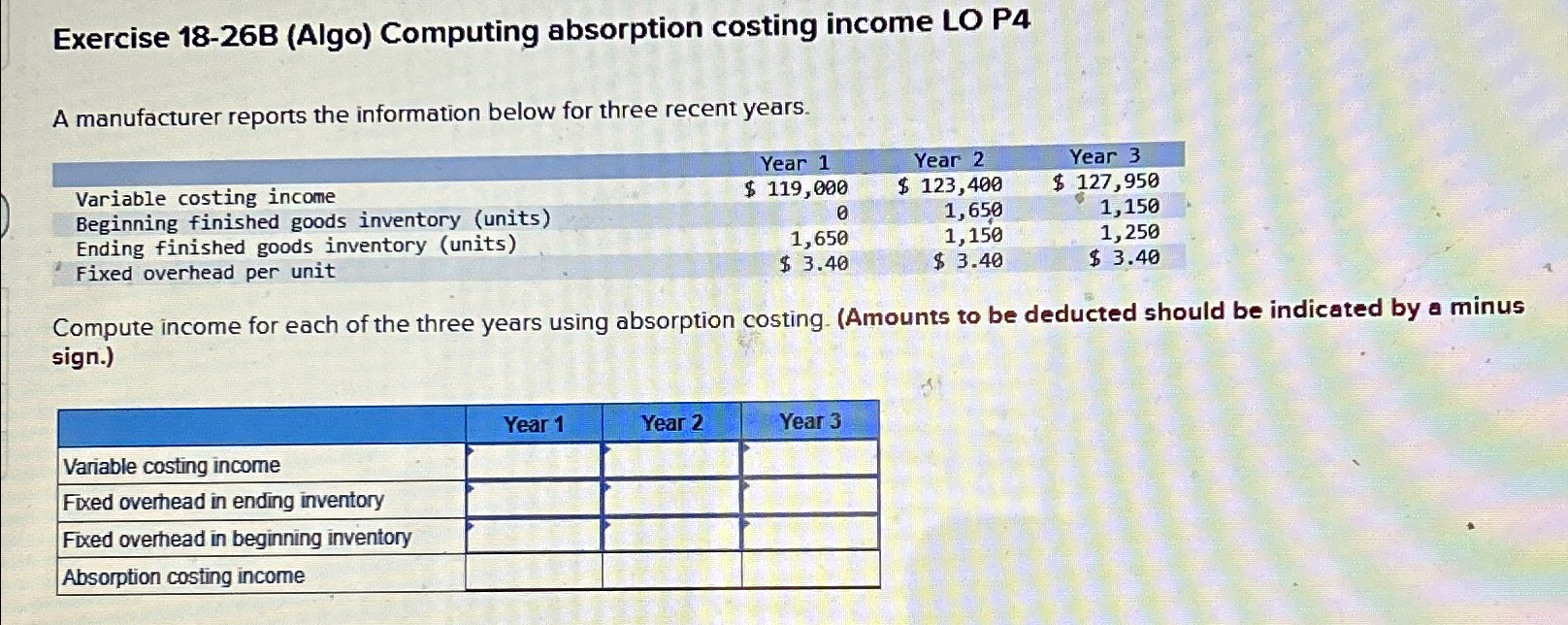

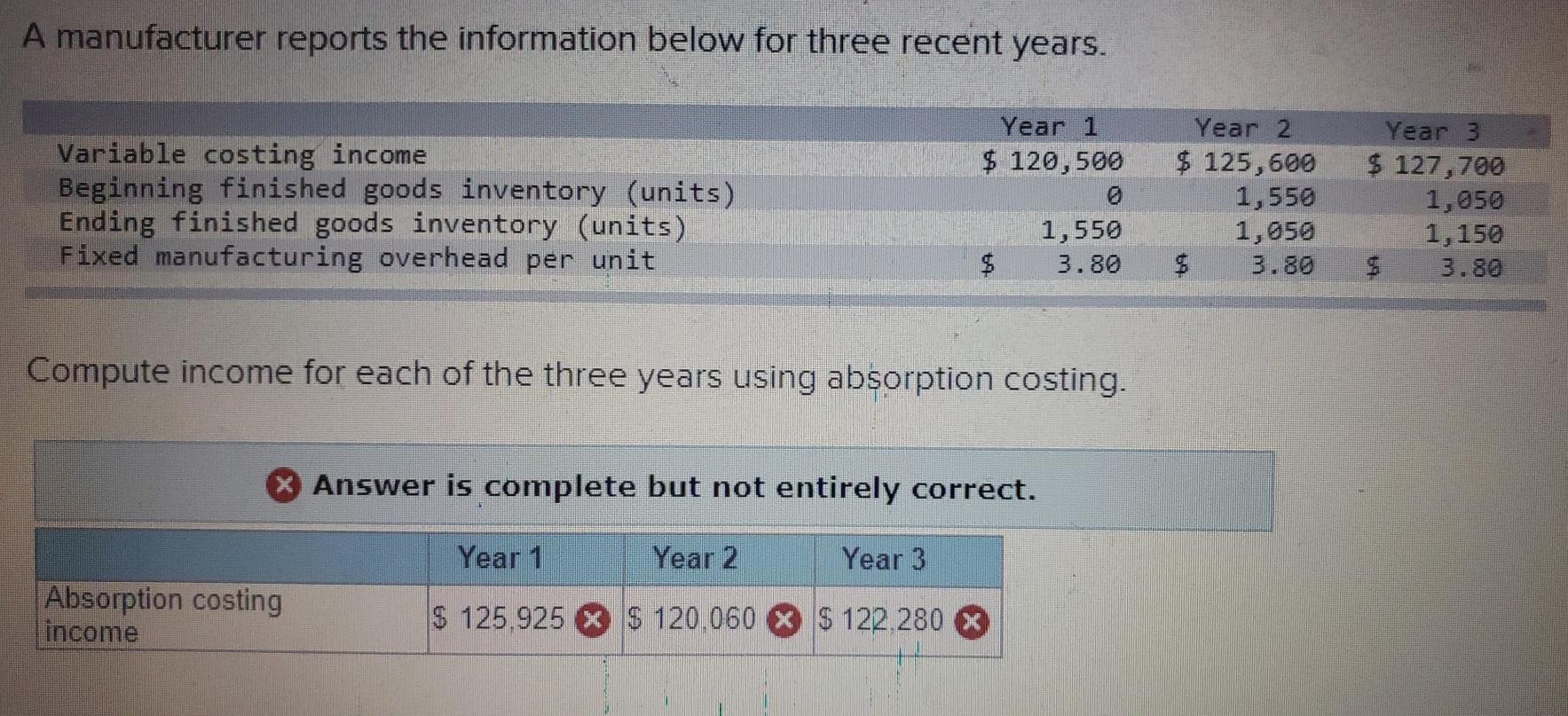

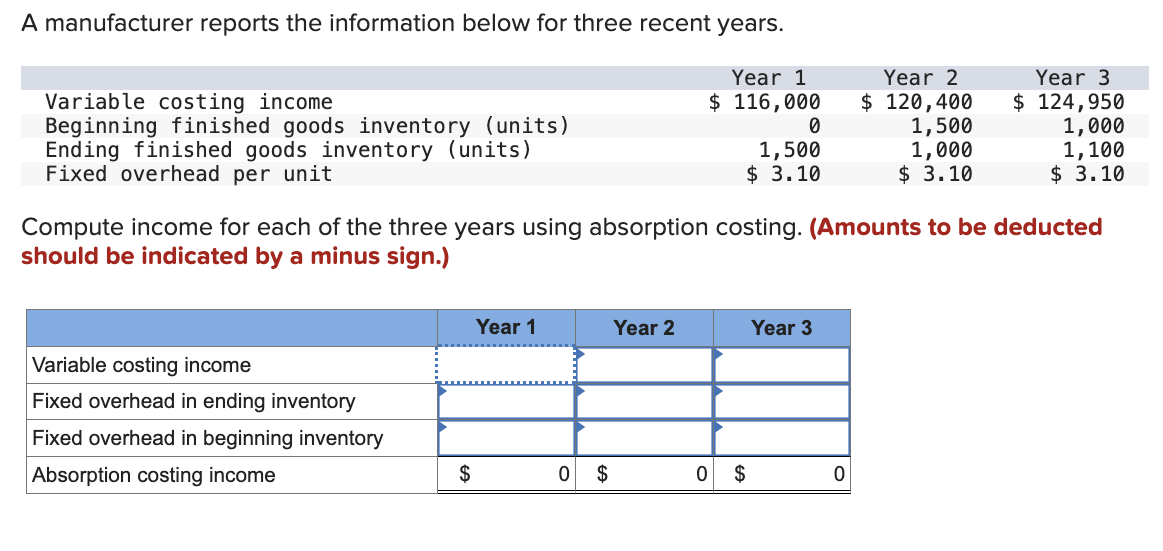

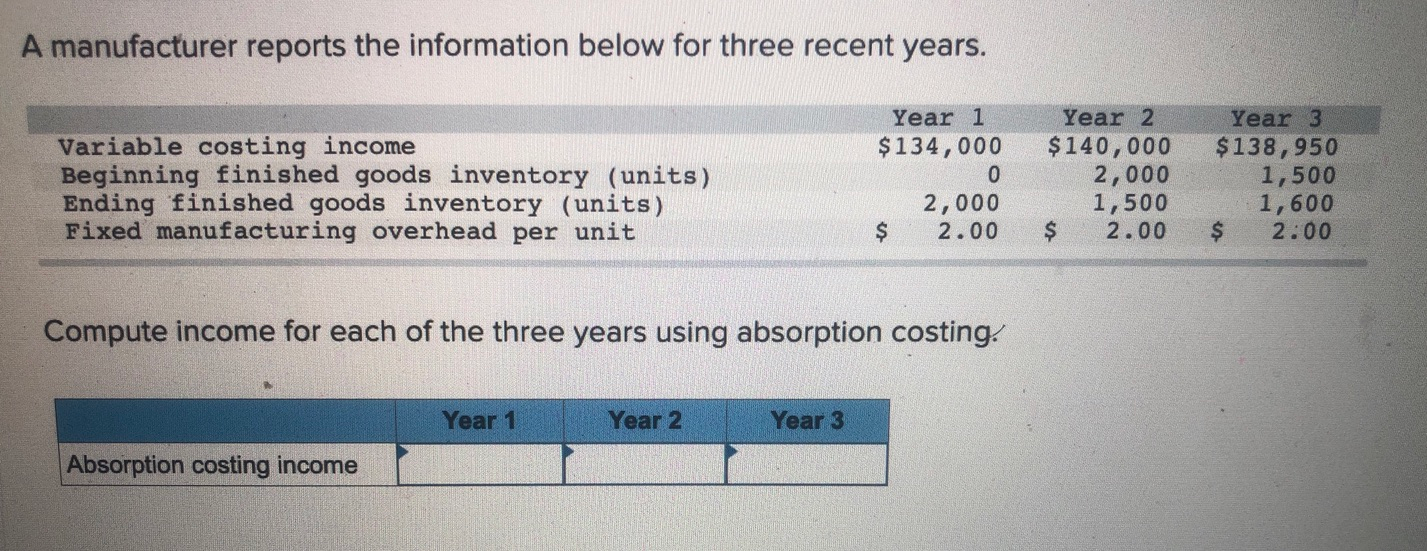

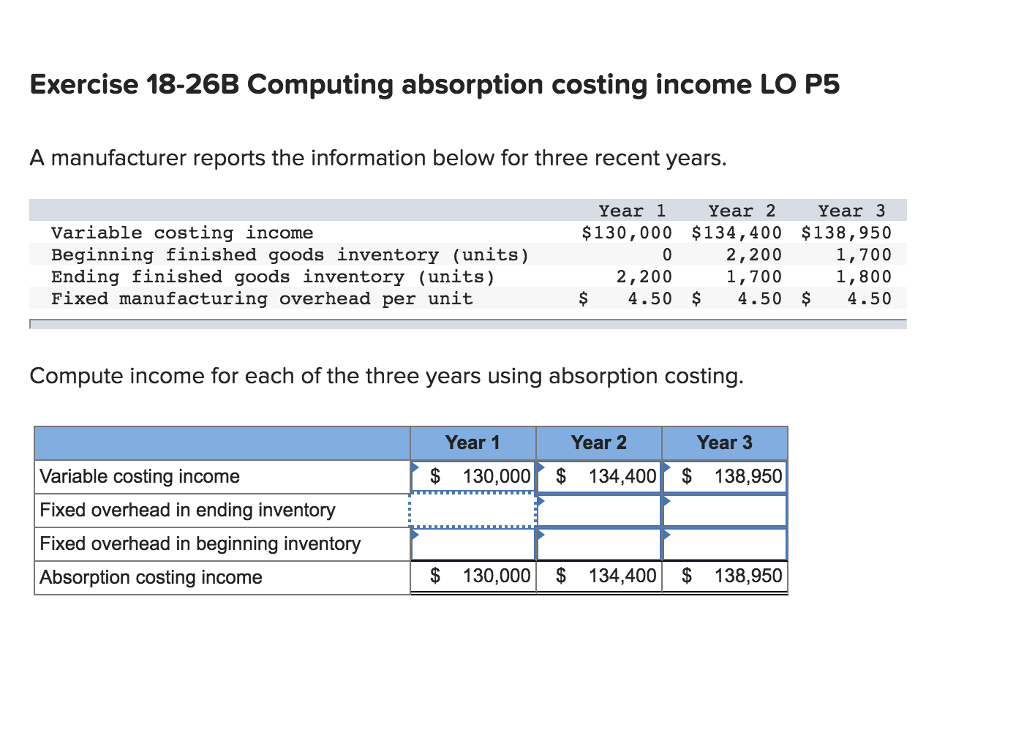

A Manufacturer Reports The Information Below For Three Recent Years - Compute income for each of the three years using absorption costing. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Solution for a manufacturer reports the information below for three recent years. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each of the three years using absorption costing. First, let's calculate the cost of goods sold (cogs) for each year. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. A manufacturer reports the information below for three recent. Multiply each year's beginning and ending. Year 3 $123,950 year 1 year 2 variable costing income.

Absorption costing income for year 1 year 2 and year 3 Compute income for each of the three years using absorption costing. Year 3 $123,950 year 1 year 2 variable costing income. Compute income for each of the three years using absorption costing. Sirhuds inc., a maker of smartwatches, reports the information below on. A manufacturer reports the information below for three recent. First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each of the three years using absorption costing. Multiply each year's beginning and ending. Solution for a manufacturer reports the information below for three recent years.

Year 3 $123,950 year 1 year 2 variable costing income. A manufacturer reports the information below for three recent. First, we need to compute for the fixed overhead of each inventory balance for each year. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Absorption costing income for year 1 year 2 and year 3 First, let's calculate the cost of goods sold (cogs) for each year. Solution for a manufacturer reports the information below for three recent years. Compute income for each of the three years using absorption costing. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Compute income for each of the three years using absorption costing.

Solved A manufacturer reports the information below for

Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Multiply each year's beginning and ending. Absorption costing income for year 1 year 2 and year 3 Compute income for each of the three years using absorption costing. Compute income for each of the three years using absorption costing.

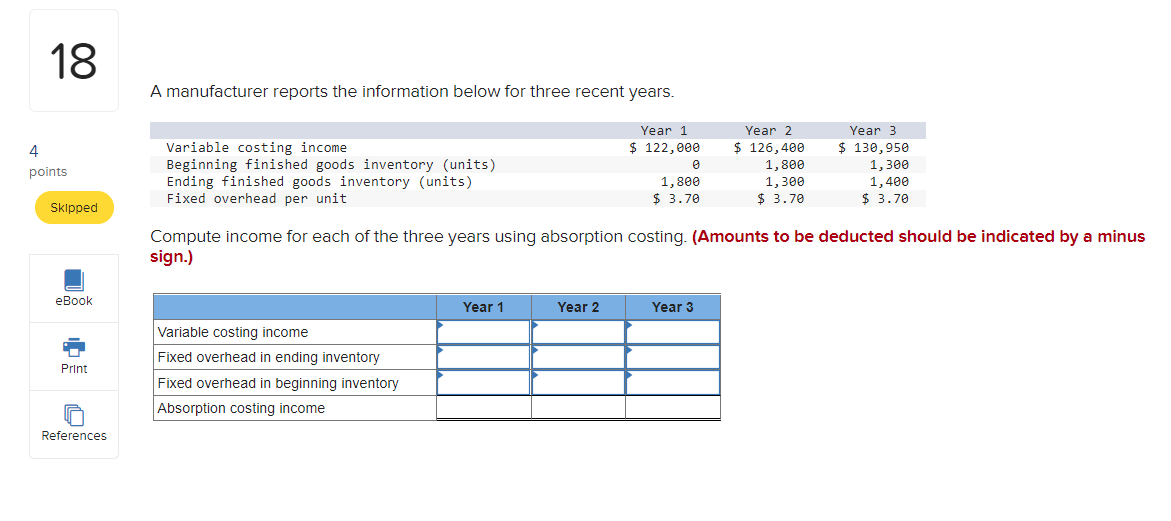

Solved 18 A manufacturer reports the information below for

Absorption costing income for year 1 year 2 and year 3 Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. First, let's calculate the cost of goods sold (cogs) for each year. A manufacturer reports the information below for three recent. Compute income for each of the three years using.

Solved A manufacturer reports the information below for

First, we need to compute for the fixed overhead of each inventory balance for each year. Compute income for each of the three years using absorption costing. Year 3 $123,950 year 1 year 2 variable costing income. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that..

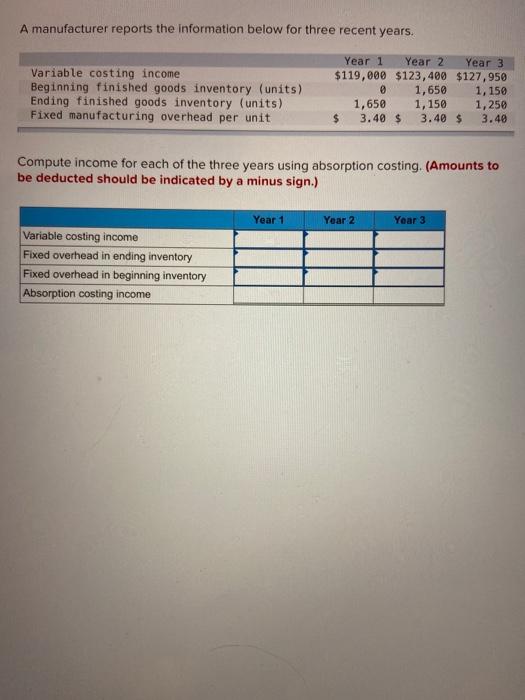

Solved A manufacturer reports the information below for

Solution for a manufacturer reports the information below for three recent years. Compute income for each of the three years using absorption costing. Multiply each year's beginning and ending. First, let's calculate the cost of goods sold (cogs) for each year. Year 3 $123,950 year 1 year 2 variable costing income.

Solved Exercise 1826B (Algo) absorption costing

Year 3 $123,950 year 1 year 2 variable costing income. Multiply each year's beginning and ending. Sirhuds inc., a maker of smartwatches, reports the information below on. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Absorption costing income for year 1 year 2 and year 3

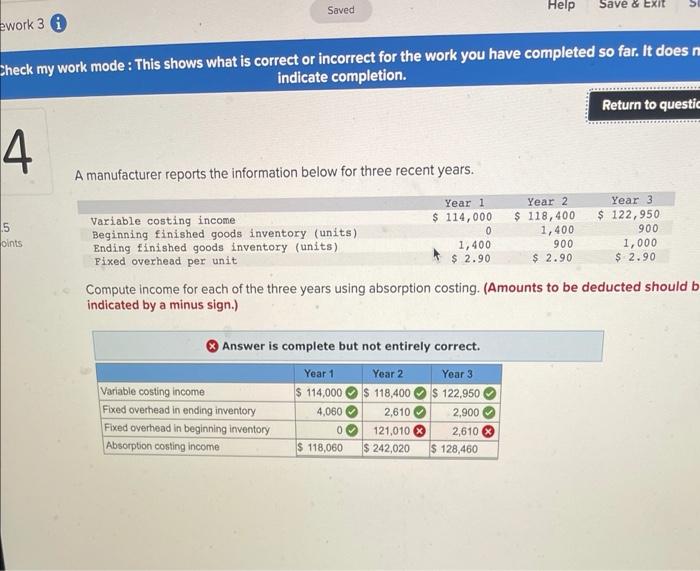

Solved A manufacturer reports the information below for

Compute income for each of the three years using absorption costing. First, let's calculate the cost of goods sold (cogs) for each year. Compute income for each of the three years using absorption costing. Year 3 $123,950 year 1 year 2 variable costing income. Sirhuds inc., a maker of smartwatches, reports the information below on.

Solved A manufacturer reports the information below for

Compute income for each of the three years using absorption costing. First, we need to compute for the fixed overhead of each inventory balance for each year. A manufacturer reports the information below for three recent. Sirhuds inc., a maker of smartwatches, reports the information below on. Absorption costing income for year 1 year 2 and year 3

Solved A manufacturer reports the information below for

Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Compute income for each of the three years using absorption costing. Absorption costing income for year 1 year 2 and year 3 Compute income for each of the three years using absorption costing. A manufacturer reports the information below for three.

Solved Exercise 1826B Computing absorption costing

First, let's calculate the cost of goods sold (cogs) for each year. To find the total fixed manufacturing overhead for each year, we multiply this by the number of units in ending inventory for that. Multiply each year's beginning and ending. Sirhuds inc., a maker of smartwatches, reports the information below on. Compute income for each of the three years.

(Solved) A Manufacturer Reports The Information Below For Three

Multiply each year's beginning and ending. Compute income for each of the three years using absorption costing. A manufacturer reports the information below for three recent. Absorption costing income for year 1 year 2 and year 3 Compute income for each of the three years using absorption costing.

First, We Need To Compute For The Fixed Overhead Of Each Inventory Balance For Each Year.

Absorption costing income for year 1 year 2 and year 3 Year 3 $123,950 year 1 year 2 variable costing income. Compute income for each of the three years using absorption costing. Solution for a manufacturer reports the information below for three recent years.

Multiply Each Year's Beginning And Ending.

Sirhuds inc., a maker of smartwatches, reports the information below on. A manufacturer reports the information below for three recent. Using absorption costing, the incomes for year 1, year 2, and year 3 are $122,160, $118,600, and $124,390 respectively. Compute income for each of the three years using absorption costing.

To Find The Total Fixed Manufacturing Overhead For Each Year, We Multiply This By The Number Of Units In Ending Inventory For That.

First, let's calculate the cost of goods sold (cogs) for each year. Compute income for each of the three years using absorption costing.