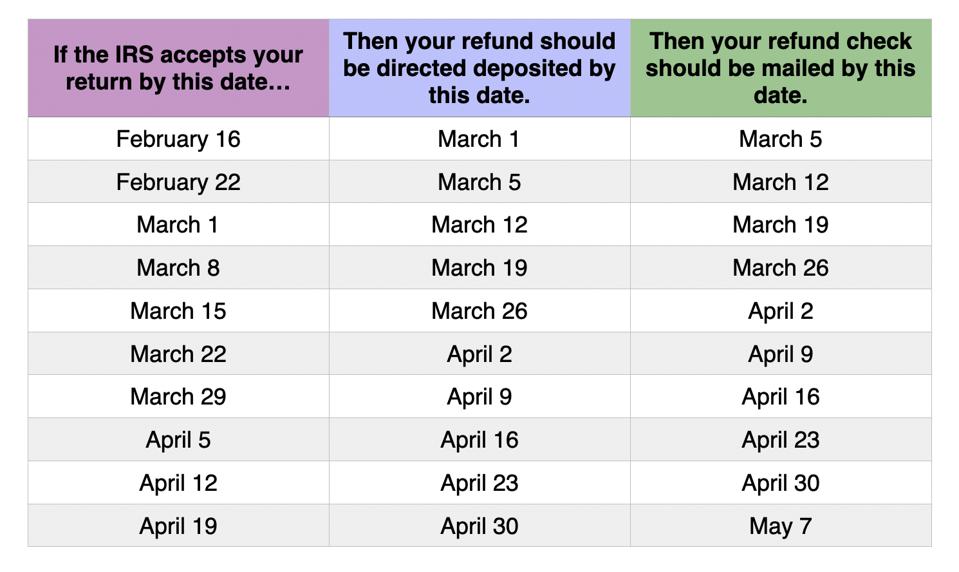

2026 Irs Tax Refund Calender - Estimate your previous year (s) income tax return now and determine your federal tax refund or if you owe taxes. If you earned income during 2025, you’ll actually file your return in early 2026. The irs tax refund schedule 2026 indicates that most refunds are issued within 21 days of the irs receiving your tax return. That’s what the irs calls the 2025 tax filing season it’s named after. Need a tax amendment for an accepted irs and/or state tax return? It is essential to understand when refunds. Find tax calculators, tools, and forms for back taxes. See your personalized refund date as soon as the irs processes your tax return and approves your refund. File as soon as possible if you. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling.

Find tax calculators, tools, and forms for back taxes. See your personalized refund date as soon as the irs processes your tax return and approves your refund. One of the most anticipated dates for taxpayers is the irs tax refund schedule for 2026. Estimate your previous year (s) income tax return now and determine your federal tax refund or if you owe taxes. File as soon as possible if you. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling. That’s what the irs calls the 2025 tax filing season it’s named after. If you earned income during 2025, you’ll actually file your return in early 2026. Need a tax amendment for an accepted irs and/or state tax return? It is essential to understand when refunds.

See your personalized refund date as soon as the irs processes your tax return and approves your refund. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. Need a tax amendment for an accepted irs and/or state tax return? If you earned income during 2025, you’ll actually file your return in early 2026. Estimate your previous year (s) income tax return now and determine your federal tax refund or if you owe taxes. File as soon as possible if you. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling. Find tax calculators, tools, and forms for back taxes. It is essential to understand when refunds. The irs tax refund schedule 2026 indicates that most refunds are issued within 21 days of the irs receiving your tax return.

Rs Refund Schedule 2025 Eic Zane E. Lowerson

Find tax calculators, tools, and forms for back taxes. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. Need a tax amendment for an accepted irs and/or state tax return? Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool.

Unlocking the IRS Refund Schedule 2026 What You Need to Know

Need a tax amendment for an accepted irs and/or state tax return? If you earned income during 2025, you’ll actually file your return in early 2026. See your personalized refund date as soon as the irs processes your tax return and approves your refund. Find tax calculators, tools, and forms for back taxes. File as soon as possible if you.

Navigating The Federal Pay Calendar For 2026 A Comprehensive Guide

Find tax calculators, tools, and forms for back taxes. See your personalized refund date as soon as the irs processes your tax return and approves your refund. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. Estimate your previous year (s) income tax return now and determine your.

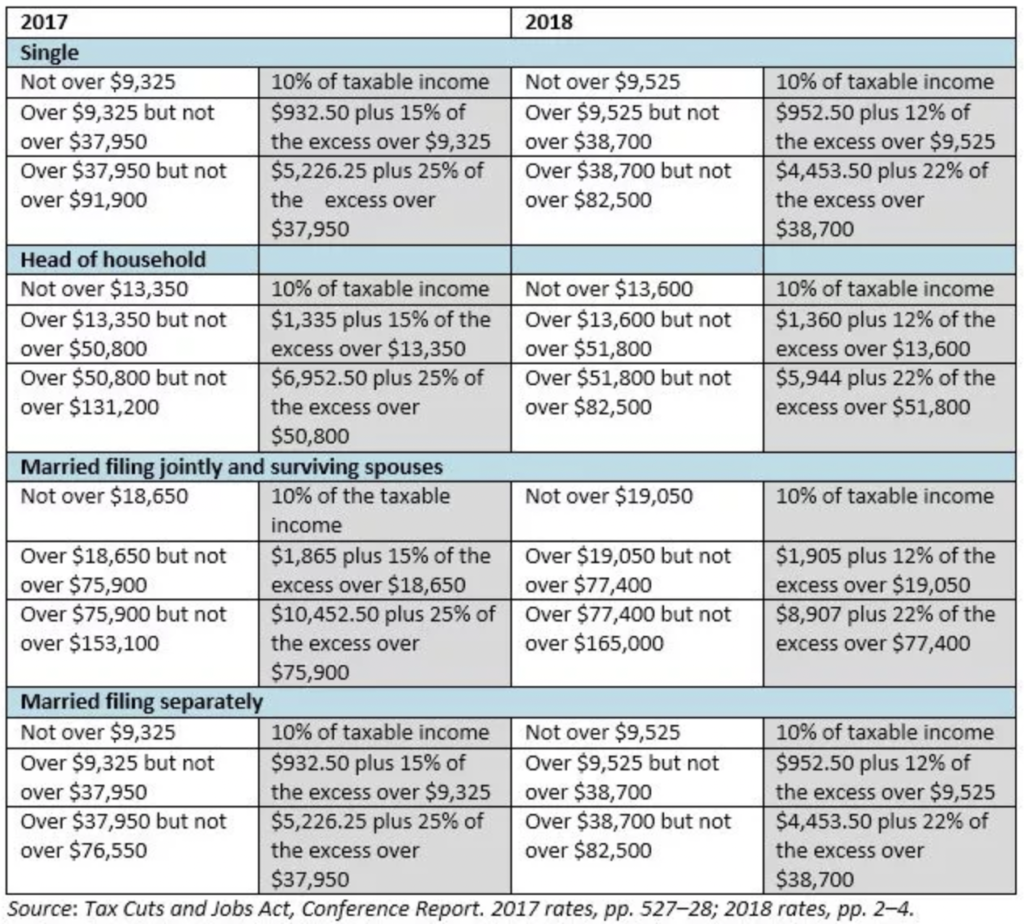

20252026 Tax Brackets A Comprehensive Overview Naja A. Nielsen

Find tax calculators, tools, and forms for back taxes. If you earned income during 2025, you’ll actually file your return in early 2026. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling. See your personalized refund date as soon as the irs processes your.

Unlocking the IRS Tax Refund Schedule 2026 What You Need to Know

File as soon as possible if you. One of the most anticipated dates for taxpayers is the irs tax refund schedule for 2026. The irs tax refund schedule 2026 indicates that most refunds are issued within 21 days of the irs receiving your tax return. Need a tax amendment for an accepted irs and/or state tax return? That’s what the.

Irs Tax Return Calendar Arturo W. Honore

Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. File as soon as possible if you. The irs tax refund schedule 2026 indicates.

20252026 Tax Brackets A Comprehensive Overview John D. Hylton

Need a tax amendment for an accepted irs and/or state tax return? The irs tax refund schedule 2026 indicates that most refunds are issued within 21 days of the irs receiving your tax return. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. If you earned income during.

IRS Tax Refund Calendar And Schedule 2025 (Updated)

File as soon as possible if you. It is essential to understand when refunds. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. One of the most anticipated dates for taxpayers is the irs tax refund schedule for 2026. Need a tax amendment for an accepted irs and/or.

Irs Tax Rebate Calendar Alice J. Molvig

See your personalized refund date as soon as the irs processes your tax return and approves your refund. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling. That’s what the irs calls the 2025 tax filing season it’s named after. Find tax calculators, tools,.

2026 Tax Refund Schedule Maximizing Child Tax Credit Benefits

That’s what the irs calls the 2025 tax filing season it’s named after. Find tax calculators, tools, and forms for back taxes. It is essential to understand when refunds. Need a tax amendment for an accepted irs and/or state tax return? One of the most anticipated dates for taxpayers is the irs tax refund schedule for 2026.

Find Tax Calculators, Tools, And Forms For Back Taxes.

The irs tax refund schedule 2026 indicates that most refunds are issued within 21 days of the irs receiving your tax return. If you earned income during 2025, you’ll actually file your return in early 2026. It is essential to understand when refunds. Need a tax amendment for an accepted irs and/or state tax return?

That’s What The Irs Calls The 2025 Tax Filing Season It’s Named After.

One of the most anticipated dates for taxpayers is the irs tax refund schedule for 2026. You can check the status of your tax refund for 2026 using the irs’s ‘where’s my refund’ tool on their website. Estimate your previous year (s) income tax return now and determine your federal tax refund or if you owe taxes. Taxpayers can check the status of their irs refund for 2026 by using the ‘where’s my refund?’ tool on the irs website or by calling.

See Your Personalized Refund Date As Soon As The Irs Processes Your Tax Return And Approves Your Refund.

File as soon as possible if you.