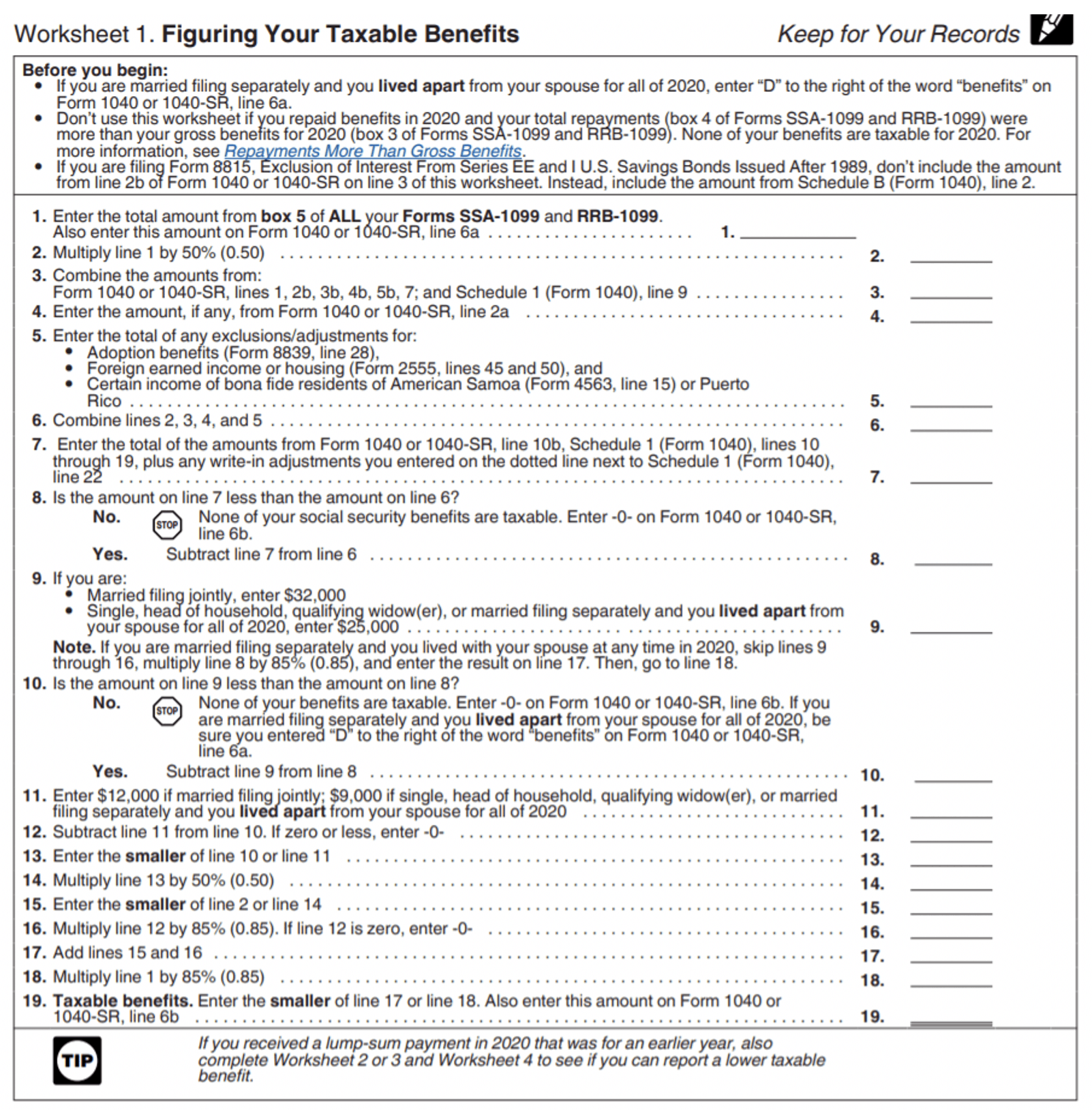

2023 Taxable Social Security Worksheet - The taxable portion can range from 50 to 85 percent of your benefits. We developed this worksheet for you to see if your benefits may be taxable for 2023. Calculating how much of your social security is taxable step 1: The taxable social security base amount ($32,000) for joint filers. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Annual social security amount (eg.$40,000) _________________ step 2:. The worksheet provided can be used to determine the exact amount. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. Fill in lines a through e. Do not use the worksheet below if.

We developed this worksheet for you to see if your benefits may be taxable for 2023. Do not use the worksheet below if. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Fill in lines a through e. None of their social security benefits are taxable. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. The worksheet provided can be used to determine the exact amount. The taxable social security base amount ($32,000) for joint filers. Annual social security amount (eg.$40,000) _________________ step 2:. The taxable portion can range from 50 to 85 percent of your benefits.

Do not use the worksheet below if. We developed this worksheet for you to see if your benefits may be taxable for 2023. Calculating how much of your social security is taxable step 1: The worksheet provided can be used to determine the exact amount. None of their social security benefits are taxable. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. The taxable social security base amount ($32,000) for joint filers. Fill in lines a through e. Annual social security amount (eg.$40,000) _________________ step 2:. Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023.

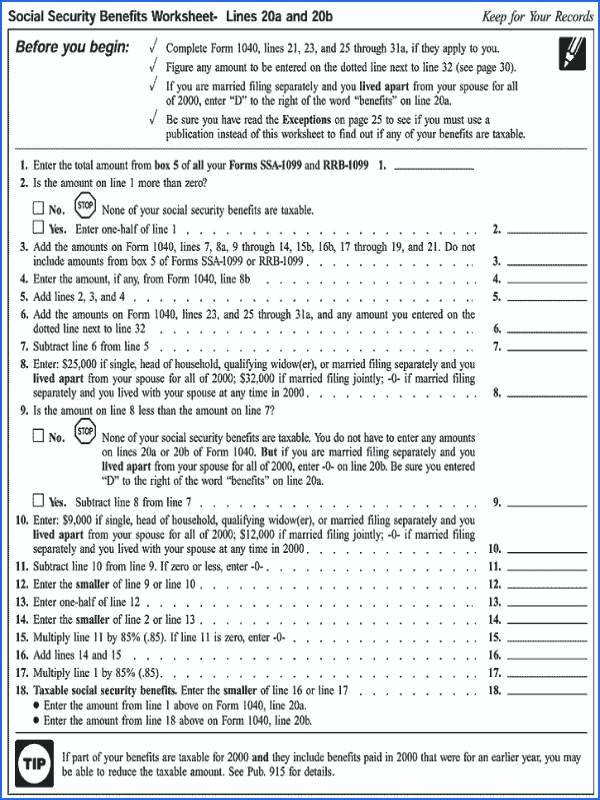

Calculating Taxes on Social Security Benefits Kiplinger Worksheets

Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. None of their social security benefits are taxable. Calculating how much of your social security is taxable step 1: The taxable portion can range from 50 to 85 percent of your benefits. Do not use the worksheet below if.

Form 1040 Social Security Worksheet 2023

Use this worksheet to determine if your social security and/or ssi benefits are taxable for the year 2023. Calculating how much of your social security is taxable step 1: None of their social security benefits are taxable. Fill in lines a through e. We developed this worksheet for you to see if your benefits may be taxable for 2023.

Publication 915 2023 Worksheet 1

Annual social security amount (eg.$40,000) _________________ step 2:. The taxable social security base amount ($32,000) for joint filers. Do not use the worksheet below if. We developed this worksheet for you to see if your benefits may be taxable for 2023. Calculating how much of your social security is taxable step 1:

Social Security Worksheet For 2023 Tax Return

Do not use the worksheet below if. We developed this worksheet for you to see if your benefits may be taxable for 2023. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits. The taxable social security base amount ($32,000) for joint filers.

2020 Social Security Benefits Worksheets

As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Annual social security amount (eg.$40,000) _________________ step 2:. None of their social security benefits are taxable. Do not use the worksheet below if. The worksheet provided can be used to determine the exact amount.

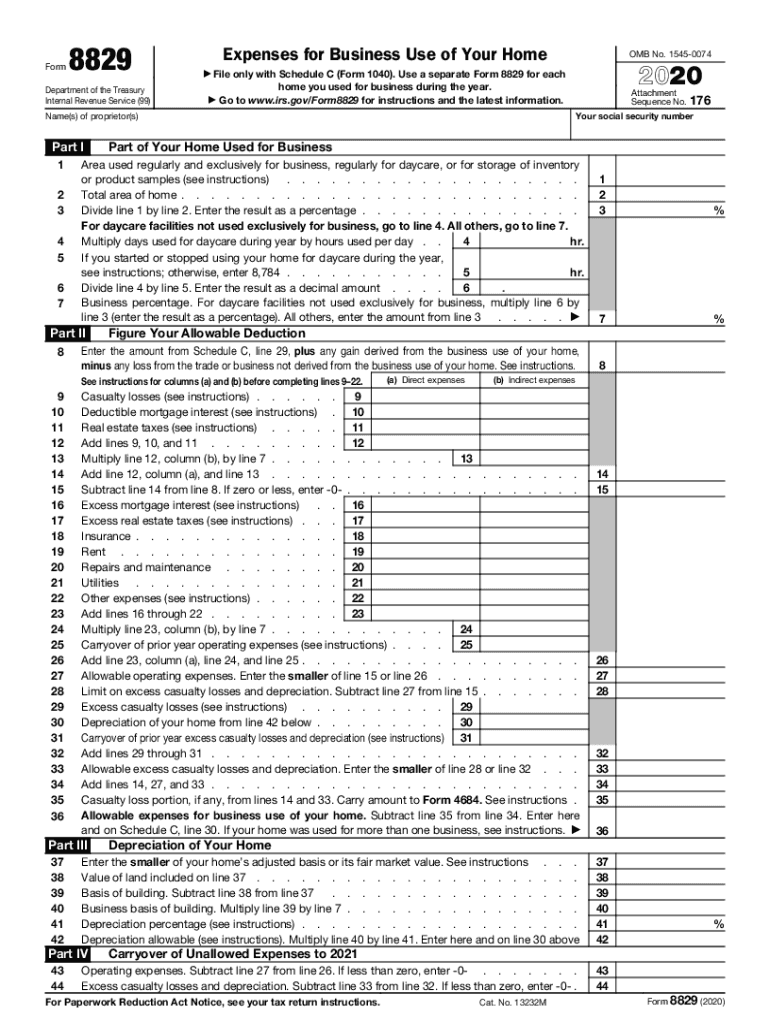

Free social security benefits worksheet, Download Free social security

Calculating how much of your social security is taxable step 1: The worksheet provided can be used to determine the exact amount. None of their social security benefits are taxable. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Do not use the worksheet below if.

Social Security Tax Worksheet 2023 Social Security Taxable B

The taxable social security base amount ($32,000) for joint filers. The worksheet provided can be used to determine the exact amount. Fill in lines a through e. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. Use this worksheet to determine if your social security and/or ssi.

1040 Social Security Worksheet 2023 Ssi Worksheet Printable

Do not use the worksheet below if. The taxable social security base amount ($32,000) for joint filers. We developed this worksheet for you to see if your benefits may be taxable for 2023. The worksheet provided can be used to determine the exact amount. Fill in lines a through e.

Worksheet To Calculate Taxable Social Security Printable Word Searches

The taxable social security base amount ($32,000) for joint filers. Calculating how much of your social security is taxable step 1: Annual social security amount (eg.$40,000) _________________ step 2:. The worksheet provided can be used to determine the exact amount. The taxable portion can range from 50 to 85 percent of your benefits.

2023 Social Security Benefits Worksheet Disability Ss

Annual social security amount (eg.$40,000) _________________ step 2:. As your gross income increases, a higher percentage of your social security benefits become taxable, up to a maximum of 85% of. We developed this worksheet for you to see if your benefits may be taxable for 2023. Calculating how much of your social security is taxable step 1: Fill in lines.

As Your Gross Income Increases, A Higher Percentage Of Your Social Security Benefits Become Taxable, Up To A Maximum Of 85% Of.

Calculating how much of your social security is taxable step 1: We developed this worksheet for you to see if your benefits may be taxable for 2023. None of their social security benefits are taxable. The taxable portion can range from 50 to 85 percent of your benefits.

Use This Worksheet To Determine If Your Social Security And/Or Ssi Benefits Are Taxable For The Year 2023.

Fill in lines a through e. The worksheet provided can be used to determine the exact amount. The taxable social security base amount ($32,000) for joint filers. Do not use the worksheet below if.