I Recently Bought Propertyfor $1 How Much Expenses Is That - Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Additional minor updates and repairs cost about $3,000. “in total, our investment was $75,500. For example, on a $400,000 home, closing costs. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion.

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Additional minor updates and repairs cost about $3,000. We ended up selling this property. “in total, our investment was $75,500. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. For example, on a $400,000 home, closing costs. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it.

Additional minor updates and repairs cost about $3,000. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. For example, on a $400,000 home, closing costs. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. We ended up selling this property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. “in total, our investment was $75,500.

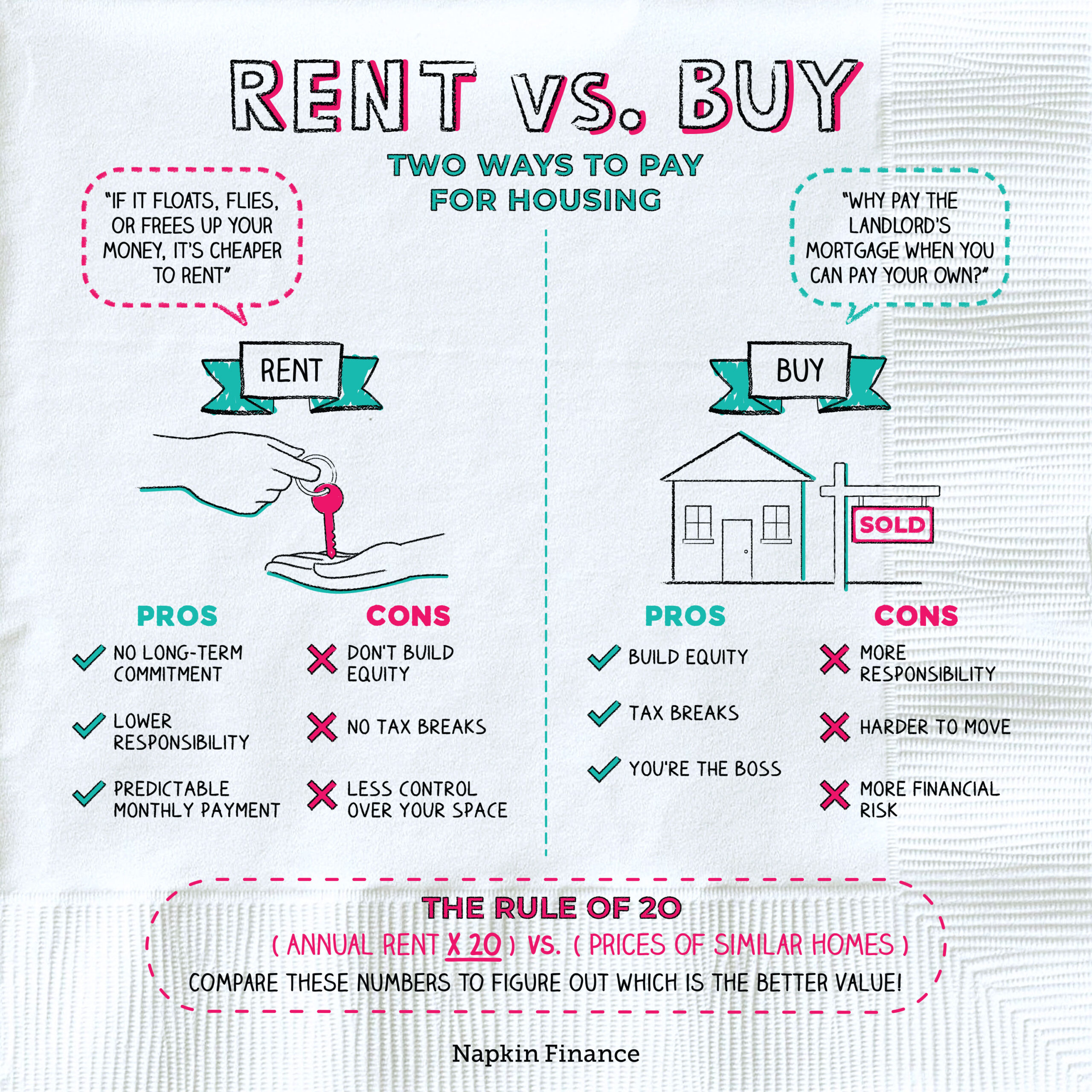

Should I Buy a House Rent vs. Buy Real Estate Buying vs Renting

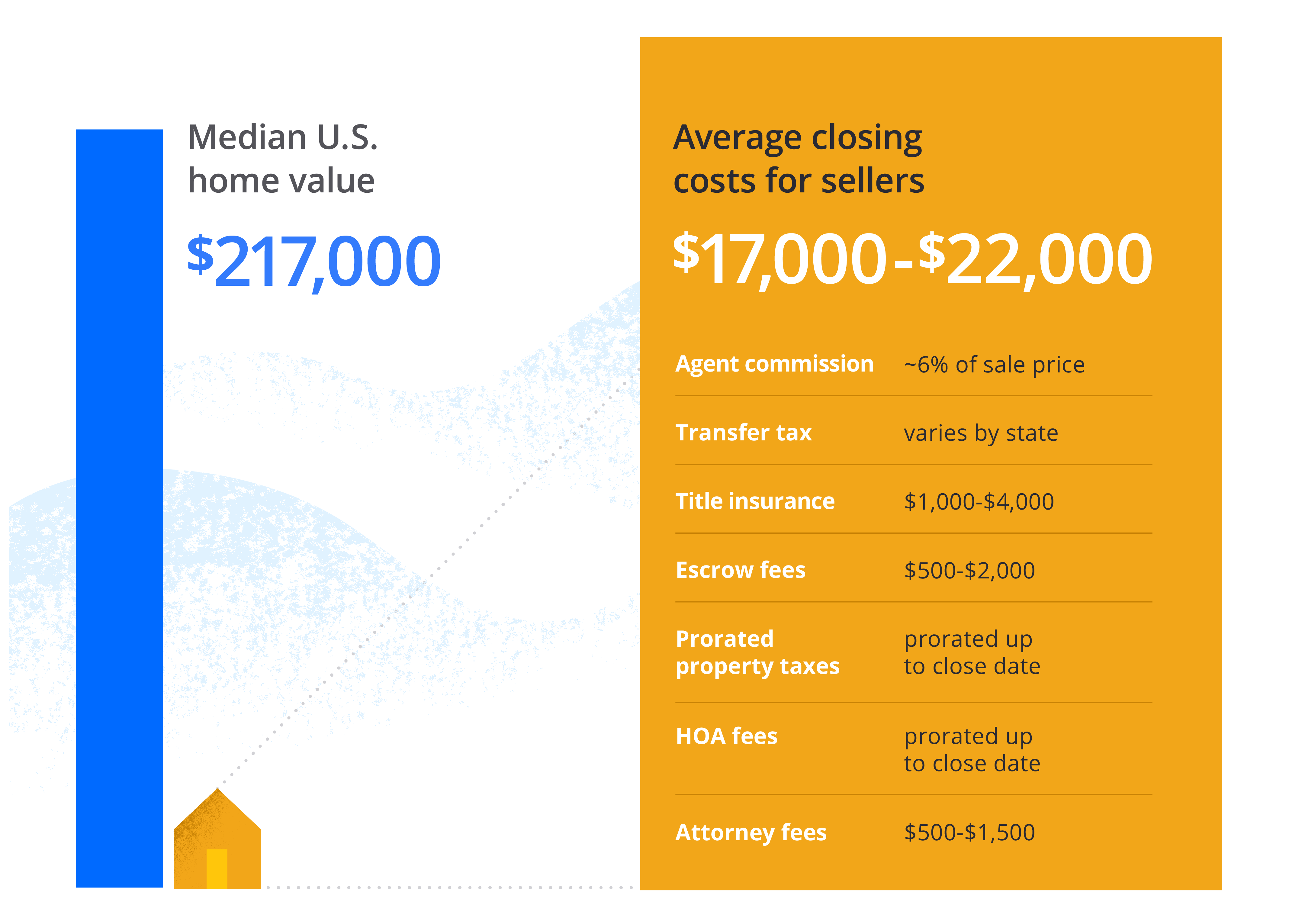

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. For example, on a $400,000 home, closing costs. Additional minor updates and.

Post by Andy Buchanan Commonstock How Much Real Estate Could you

For example, on a $400,000 home, closing costs. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known.

How Much Money do you Need to Buy a Rental Property?

As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. We ended up selling this property. “in total, our investment was $75,500. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. The original owner.

[Solved] Last year, Eleanor and Felix Knight bought a home with a

For example, on a $400,000 home, closing costs. Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The answer could make a big difference in.

How Much Does It Cost To Buy A House Scotland at Katherine James blog

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. “in total, our investment was $75,500. For example, on a $400,000 home, closing costs. The answer could make.

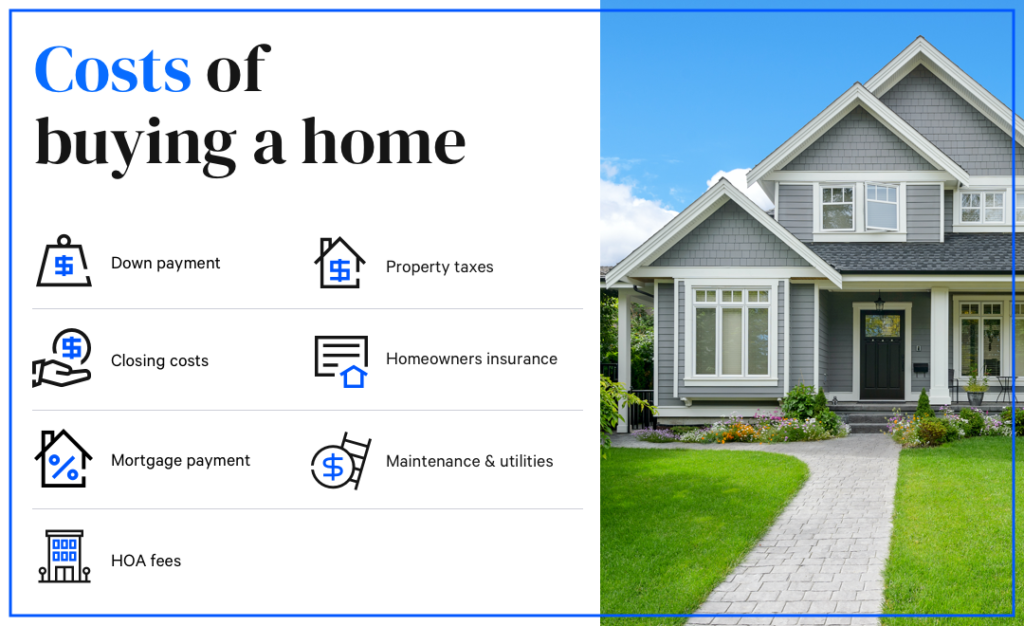

How Much Money Do You Need To Buy A House? Bankrate

For example, on a $400,000 home, closing costs. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Additional minor updates and repairs cost about $3,000.

How to Easily Track Your Rental Property Expenses

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Additional minor updates and repairs cost about $3,000. We ended up selling this property. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. Closing costs typically range between 2% to 5% of the home’s purchase price for.

How Much Does it Cost to Sell a House? Zillow

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. For example, on a $400,000 home, closing costs. As a supplemental fee to the realty transfer tax.

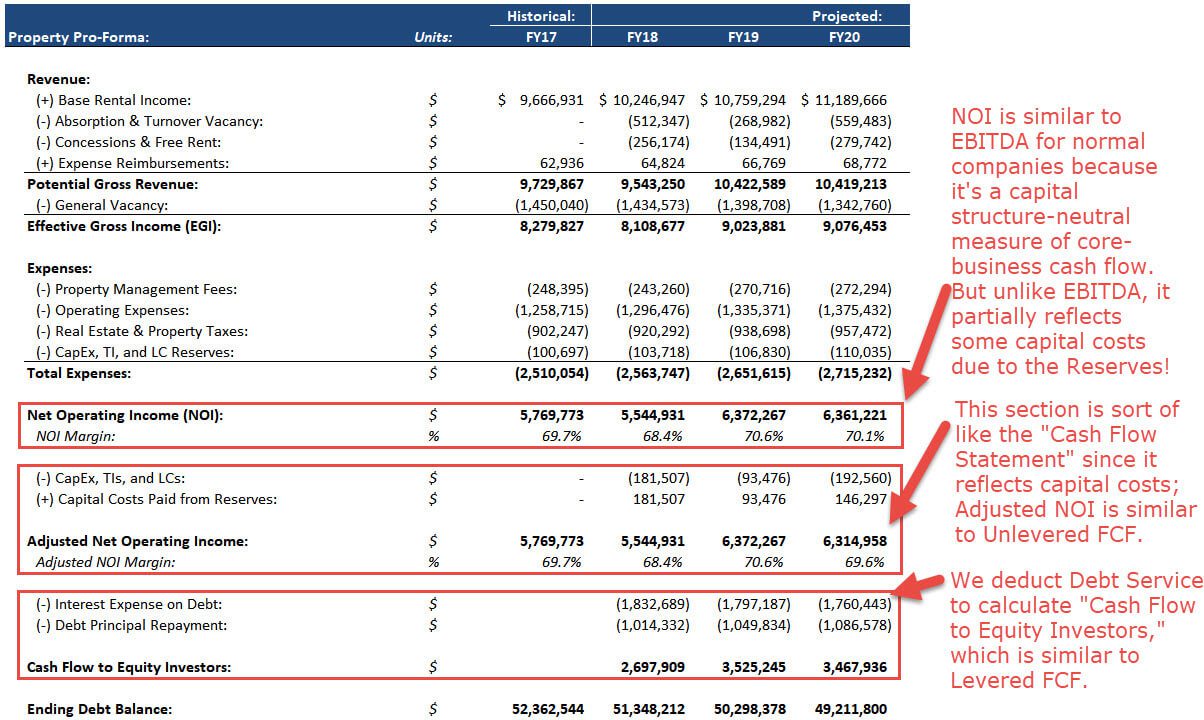

Real Estate ProForma Calculations, Examples, and Scenarios (Video)

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. For example, on a $400,000 home, closing costs. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion. Additional minor updates and repairs cost about $3,000. Janelle buys.

How much does it cost to build a house after buying land kobo building

The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. We ended up selling this property. “in total, our investment was $75,500. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it.

“In Total, Our Investment Was $75,500.

Closing costs vary depending on the location, property price, and loan terms, but buyers can typically expect to pay between 3% and 6%. The original owner sells their $200,000 home for $1 and no longer uses or occupies the property. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. As a supplemental fee to the realty transfer tax paid by a property's seller, homebuyers are required to pay what is known as a mansion.

For Example, On A $400,000 Home, Closing Costs.

Janelle buys her home for $60,000 cash and assumes a mortgage of $240,000 on it. We ended up selling this property. The answer could make a big difference in how much you save—and it largely depends on your specific expenses, especially. Additional minor updates and repairs cost about $3,000.